The "Western Fleet" is the largest (90% of the global tanker fleet) with the most transparent with links to Western insurance and finance. The Western Fleet’s oil and product tankers of 45,000 dwt size and above, mandatorily have P&I (“Protection and Indemnity") maritime insurance cover underwritten by one of 13 P&I Clubs. Maritime policies cover large transnational marine liability risks including the property or interest (the ship including hull and machinery of the ship, the cargo, and the freight (the charterer fee for transporting goods)) insured against perils of the sea such as bad weather, stranding, collision, fire seizure and the like based on an assumed estimated maximum loss (EML) factor with or without Demurrage protection regardless of where the cargo is moving. The high-risk environment produced by ongoing security challenges in the Black and Red Seas has complicated the premium rates and issuance of war risk insurance to the detriment of oil shipping. The cost of insuring a ship through the Red Sea has more than doubled since the start of 4Q2024 and some underwriters undertaking to make good the loss of an interest in the carriage venture are pausing cover as the risk of attack from Yemen's Houthis on commercial vessels increases.

The "Shadow fleet" comprises of more than 360-odd ships, typically more than two decades old relying on sovereign insurance and financing from the Russian state as they may be used to circumvent international sanctions. These “Shadow fleets”, equivalent to 16% of the global crude tanker inventory, keep Russia’s crude exports flowing dodging the “Russia oil price cap” being less transparent than the Western fleet, avoiding disclosures on charterers and undertaking longer journeys than they have ever done before to undisclosed destinations with middlemen only paying for the cargo once they have collected the proceeds.

"Dark fleets" consist of around 100 battered tankers as much as half a century old which actively try to hide activity by turning off satellite transponders or sending spoof signals. These "dark fleets" engage in covert trade in crude from Iran and Venezuela to clandestine customers, but similar activities are starting to emerge in Russia. They are renamed and repainted, sometimes several times a journey. They often transit via busy terminals where their crude is blended with others, making it hard to detect. Were they to cause an accident, the insurers may be unwilling or unable to cover the damage.

A blog focused on educating global physical energy commodities participants on evolving financial, regulatory and marketing developments in the Asian commodities markets including use of cryptocurrencies in physical commodities trading. This blog seeks to educate market participants only and does not constitute financial advice.

Tuesday, 30 December 2025

Tuesday, 8 April 2025

How India is following in China's footsteps as the future driver of global energy demand

The extensive growth and energy consumption seen in China through the 2000s and 2010s hint at the magnitude of changes and energy use increase expected in India over the 2030s and 2040s.

- India’s Real GDP per capita at PPP had risen to $7,100 in 2022, a rate China first reached in 2007/08 (“World development indicators”, World Bank, 2023). Real incomes are still less than half the level in China and a sixth of the average for the OECD), so there is enormous catch-up potential.

- Median population age is low at 27.9 years, which China reached in 1998. Massive Population growth averaged 1.1% per year over the 10 years from 2012 to 2022, similar to China’s over the ten years from 1988 to 1998 (“World population prospects”, United Nations Population Division, 2022).

- The share of the population living in urban areas is estimated to have reached 35% in 2022, a level reached in China around 2000 (“World urbanization prospects”, United Nations Population Division, 2018).

- Energy consumption reached 26 gigajoules per person in 2022, a rate China reached in the early 1990s. India’s primary energy consumption per person is less than a quarter of China’s and one-sixth of the average in the OECD economies, again implying an enormous potential to increase as the gap narrows. Total oil consumption climbed to 237 million metric tons in 2022, which China first reached in 2001 (“Statistical review of world energy”, Energy Institute, 2023).

Location:

Czechia

How Indian refineries purchased Russian crude through Dubai in 2022 and 2023

Throughout 2022 and early 2023, Indian refineries purchased Russian crude through Dubai-based intermediaries such as Hinera Trading, Black Pearl Energy Trading, Starex Trading, and Pontus Trading, as well as Dubai-based proxies for Russian NOCs Everest Energy, DMCC and Lukoil Litasco.

Indian rupees were utilized to bypass SWIFT for Russian oil payments, resulting in Russia accumulating surplus rupees in vostro accounts within India. By mid-2023, Russia ceased accepting rupees for energy trade, leading private Indian refiners to pay for Russian oil in Chinese Yuan while state-owned refiners paid in UAE Dirhams.

In 2024, the threat of U.S. sanctions complicated UAE Dirham transactions, consolidating the dominance of only three middlemen—Lukoil Litasco Middle East, Hinera Trading, and Black Pearl Energy Trading—as primary sellers of Russian crude to India.

Indian rupees were utilized to bypass SWIFT for Russian oil payments, resulting in Russia accumulating surplus rupees in vostro accounts within India. By mid-2023, Russia ceased accepting rupees for energy trade, leading private Indian refiners to pay for Russian oil in Chinese Yuan while state-owned refiners paid in UAE Dirhams.

In 2024, the threat of U.S. sanctions complicated UAE Dirham transactions, consolidating the dominance of only three middlemen—Lukoil Litasco Middle East, Hinera Trading, and Black Pearl Energy Trading—as primary sellers of Russian crude to India.

Monday, 19 December 2022

How Commodity Traders and Commodity Trading Companies stay out of the public eye

The physical commodities world is very oligopolistic and self-sustaining in that, all Commodities Trading Companies sell the same products (commodities) and have no distinct business advantages such as the possession of patents or proprietary technology, and there are high barriers to entry. These commodity houses mainly sell commodities to each other, or offer to take on risk from commodity producers through the use of financial derivatives. This creates a closed-end supply chain from supermarkets to commodity houses to raw producers fostering a culture of privacy and secrecy, not only from competitors but also the general public.

As physical commodity traders depend on superior trading/pricing information gleaned from proprietary IT trading platforms they get an added advantage if they are able to control critical assets through sourcing or origination requiring agile, entrepreneurial traders and trading teams to make secretive dealings with commodities producers.

Many of the big commodity houses (especially in agricultural commodities) also collectively lobby and support one another to ensure that their business thrives in the face of impending regulations and bills. They often make up the key constituents or backers of powerful organisations and unions that represent the collective interests of the producers of commodities, such as the Alliance for Abundant Food and Energy. By lobbying correctly, a commodity house can ensure that its' business remains out of the spotlight of public interest.

As physical commodity traders depend on superior trading/pricing information gleaned from proprietary IT trading platforms they get an added advantage if they are able to control critical assets through sourcing or origination requiring agile, entrepreneurial traders and trading teams to make secretive dealings with commodities producers.

Many of the big commodity houses (especially in agricultural commodities) also collectively lobby and support one another to ensure that their business thrives in the face of impending regulations and bills. They often make up the key constituents or backers of powerful organisations and unions that represent the collective interests of the producers of commodities, such as the Alliance for Abundant Food and Energy. By lobbying correctly, a commodity house can ensure that its' business remains out of the spotlight of public interest.

Location:

Czechia

Why bitcoin is very different from all other altcoin "cryptocurrencies" - Part 3 - Bitcoin vs CBDCs - a detailed side by side comparison

Part 1 of this 3 part series introduced the high level of cyber crime taking place in the world of altocoin "cryptocurrencies". Part 2 of this 3 part series comparied Bitcoin and all other altcoin "crytocurrencies" to emphasize how bitcoin is indeed truly unique. While CBDCs are still in their infancy, this post compares in detail, the similarities and differences between Bitcoin and CBDCs:

| Criterion | Bitcoin | CBDCs |

| Architecture/Issuer | Bitcoin has no central issuer. A peer-to-peer blockchain based network regulates bitcoins, transactions and issuance according to consensus in the network. | Reserve currency CBDCs such as the digital dollar or digital euro, non-reserve currency CBDCs such as the digital Singapore Dollar as well CBDCs of restricted currencies such as the digital Yuan have a two-tier architecture, where the central bank (Federal Reserve, ECB, MAS or PBOC) issues digital CBDC tokens to commercial banks (tier 1). Commercial banks maintain the digital wallets for user authentication, transaction authentication, user interface and define the smart contract languages to support the innovation and customization (tier 2) |

| Regulatory classification | Bitcoin is not a security according to the SEC as it was started by an unknown person or persons going by the pseudonym Satoshi Nakamoto and does not exist as a way to raise money for a specific project for profit thereby failing the Howey test. SEC chairman Gary Gensler classifies bitcoin as a commodity to be regulated by the CFTC. | CBDCs are by their very nature a security and considered equivalent to cash as an asset class. |

| Purpose/ Use Cases | Originally intended as an electronic peer-to-peer payment system that is based on cryptographic proof, instead of trust that would operate free of central control. Now used more as store of value or digital gold. | Intended as an electronic peer-to-peer payment system substituting person to person or person to business cash payments. |

| Regulatory oversight and Compliance | Bitcoin’s decentralized Blockchain architecture is specifically designed not to be controlled by a state, a central bank or any other central authority for regulatory oversight and compliance. | The two-tier CBDC architecture aligns closely with existing banking system customer service delivery models, compliance mechanisms for anti-money-laundering, countering the funding of terrorism (AML/CFT) laws. CBDCs avoid disruptive disintermediation through enforcement of regulatory and compliance rules ensuring financial stability. |

| Account Management and Identity Checking | Bitcoin miners delegate this task implicitly to Bitcoin exchanges which maintain a traditional account and business relationship with each individual customer to address the gap between cryptographic keys in Bitcoin and human identity-checking tasks required to ensure compliance. | In CBDCs, Central banks delegate the task of account management and identity checking to commercial banks. |

| System Operators/Miners | In the Bitcoin architecture, system operators (miners) receive rewards to incentivize them to follow the Bitcoin protocol. | In the CBDC architecture, Central banks do not choose the system operators (miners) in the open system but determine the inflation rate. |

| Cross Border Payments | Cross-border payments with Bitcoin do not require currency conversions, as it takes place outside the Bitcoin system where counterparties convert from/into domestic currencies. The absence of intermediaries brings cost benefits and efficiency with no risks from operational or financial failures of intermediaries. | For Cross-border payments with CBDCs of reserve currencies such as the digital dollar or digital euro, participants from partnering jurisdictions are allowed access to the digital dollar or the digital euro which becomes available to counterparties inside and outside of that jurisdiction enabling cross-border payments.For Cross-border payments with CBDCs of non-reserve currencies, access and settlement arrangements aiming to facilitate cross-border interoperability are established among multiple CBDCs from different jurisdictions (mCBDC), built on strong technological, market structure and legal frameworks between central banks |

| Smart Contract capabilities | A Turing-incomplete script language allows the creation of custom smart contracts on top of Bitcoin like multisignature accounts, payment channels, escrows, timelocks, atomic cross-chain trading, oracles, or multiparty lottery with no operator | It is not necessary for a CBDC to provide smart contracts in order to fulfill its primary role as a digital currency, and some CBDCs such as the digital yuan are unlikely to do so. |

Labels:

Bitcoin,

CBDCs,

Digital Dollar,

Digital Euro,

ECB,

Federal Reserve,

Regulation

Location:

Czechia

Friday, 9 September 2022

Energy Security vs Energy Sovereignty

Energy Security is all about ensuring a more equitable, diverse, and independent energy matrix that can withstand any uncertainties in global oil markets. India’s Ministry of Petroleum is seeking to bring all national refiners – public sector as well as private players – together to scour the global market for the most affordable physical oil grades to safeguard its energy security from future disruptions by diversifying its oil import sources at lower costs. India is already increasing the share of renewables and clean energy and increasing its SPRs. Indian companies have invested over US$ 16 billion in Russia’s oil and gas sector and handle the export of oil from Russia to India. Now, with the threat of US secondary sanctions looming on the horizon, a consortium of buyers can go a long way in working out the logistics to bolster energy security.

On May 16th, 2022 the Czech Ministry of Industry announced plans to launch a new state energy trader to purchase gas through foreign gas upstream producers at better prices as Russia's invasion of Ukraine prompted a re-think on energy security and a drive to cut dependence on Russian supplies and increase the state's influence on gas storage in the country. Utility bills for households and companies have also soared, worsened by the war which has caused energy commodity prices to spike.

Energy Sovereignty on the other hand is substituting fossil fuels imports from problematic countries with other fossil fuels imports from less problematic countries as well as independence from energy imports by boosting domestic energy production including an acceleration of renewable and nuclear developments. Poland, a coal-producing powerhouse, mining 55 million tons of hard coal and 52 million tons of lignite in 2021, rejected cheaper imported Russian and Ukrainian coal which previously accounted for a significant proportion of heating for households. Since Russian imports were banned by Poland in March 2022 shortages led to rising prices forcing the government to subsidize coal for households. The ability to meet most of the domestic demand with Polish coal leaves the country free to push for a cessation of the Russian gas imports achieving a coal-based national energy sovereignty.

On May 16th, 2022 the Czech Ministry of Industry announced plans to launch a new state energy trader to purchase gas through foreign gas upstream producers at better prices as Russia's invasion of Ukraine prompted a re-think on energy security and a drive to cut dependence on Russian supplies and increase the state's influence on gas storage in the country. Utility bills for households and companies have also soared, worsened by the war which has caused energy commodity prices to spike.

Energy Sovereignty on the other hand is substituting fossil fuels imports from problematic countries with other fossil fuels imports from less problematic countries as well as independence from energy imports by boosting domestic energy production including an acceleration of renewable and nuclear developments. Poland, a coal-producing powerhouse, mining 55 million tons of hard coal and 52 million tons of lignite in 2021, rejected cheaper imported Russian and Ukrainian coal which previously accounted for a significant proportion of heating for households. Since Russian imports were banned by Poland in March 2022 shortages led to rising prices forcing the government to subsidize coal for households. The ability to meet most of the domestic demand with Polish coal leaves the country free to push for a cessation of the Russian gas imports achieving a coal-based national energy sovereignty.

Labels:

Coal,

Energy Security,

Energy Sovereignty,

Gas,

Oil

Location:

Czechia

Tuesday, 6 September 2022

State Oil vs. Big Oil

According to data from the Economist, State-owned oil companies (State Oil) such as UAE’s ADNOC, Saudi Aramco, pdvsa of Venezuela and Qatar Energy have roughly two-thirds of the remaining reserves of discovered oil and gas globally and produce three-fifths of the world’s crude and half its natural gas. Large international oil majors (Big Oil) such as BP and its rivals Royal Dutch Shell Plc and Total SE on the other hand produce one tenth of the world’s crude and natural gas (the rest is pumped by smaller independent companies) but they’re also some of the world’s largest commodity futures traders and see it as the heart of their business. Together the three companies trade almost 30 million barrels a day of oil and other petroleum products, equal to the daily production of the entire OPEC cartel. Shell alone trades about 12 million barrels a day. That’s physical trading. The paper volumes in financial trading are much larger. Trading also gives them an edge over their U.S. rivals, Exxon Mobil Corp. and Chevron Corp., which for historical and cultural reasons have eschewed trading.

While Big Oil does trade in physical energy markets, buying tankers of crude, gasoline, diesel, natural gas and power markets via pipelines and electricity grids, they also speculate in financial markets, buying and selling futures, options and closing deals with hedge funds, private equity firms, and investment banks. Shell is by far the world’s largest oil trader, ahead of Commodity Trading Companies such as Vitol Group and Glencore Plc and makes as much as $4 billion in pretax profit from trading oil and gas; BP between $2 billion to $3 billion annually roughly half of the company’s upstream business of producing oil and gas; the French major Total not much less, according to people familiar with the three companies. In years of low oil prices, like 2016 or 2020, trading profits can far exceed those of the production business.

While Big Oil does trade in physical energy markets, buying tankers of crude, gasoline, diesel, natural gas and power markets via pipelines and electricity grids, they also speculate in financial markets, buying and selling futures, options and closing deals with hedge funds, private equity firms, and investment banks. Shell is by far the world’s largest oil trader, ahead of Commodity Trading Companies such as Vitol Group and Glencore Plc and makes as much as $4 billion in pretax profit from trading oil and gas; BP between $2 billion to $3 billion annually roughly half of the company’s upstream business of producing oil and gas; the French major Total not much less, according to people familiar with the three companies. In years of low oil prices, like 2016 or 2020, trading profits can far exceed those of the production business.

Labels:

ADNOC,

BP,

Exxon,

Royal Dutch Shell,

Saudi Aramco,

Total

Location:

Czechia

Saturday, 3 September 2022

Why bitcoin is very different from all other altcoin "cryptocurrencies" - Part 2 - A detailed side by side comparison

Part 1 of this 3 part series introduced the high level of cyber crime taking place in the world of altocoin "cryptocurrencies". In this post, a detailed side by side comparison is provided below to illustrate how and why bitcoin is indeed very different from all other altcoin "crytocurrencies".

| Criterion | Bitcoin | Altcoin "Cryptocurrencies" |

| Legal structure/ Issuer | Bitcoin has no central issuer. A peer-to-peer network regulates bitcoins, transactions and issuance according to consensus in network software. | All other cryptocurrencies are issued via an initial coin offereing (ICO) and are linked to a central issuer such as Ethereum foundation, Ripple, Algorand foundation among others |

| Regulatory classification | Bitcoin is not a security according to the SEC as it was started by an unknown person or persons going by the pseudonym Satoshi Nakamoto and does not exist as a way to raise money for a specific project for profit thereby failing the Howey test. SEC chairman Gary Gensler classifies bitcoin as a commodity to be regulated by the CFTC. | All other cryptocurrenecies having been issued through an ICO to raise money for specific projects for profit pass the Howey test. There is a strong likelyhood of all other cryptocurrencies being classified as securities by the SEC in the near future. |

| Purpose/ Use Cases | Originally intened as an electronic peer-to-peer payment system that is based on cryptographic proof, instead of trust that would operate free of central control. Now used more as store of value or digital gold. | Altcoins are often created to resolve some of the limitations of Bitcoin but similar to bitcoin intended to provide low cost, safe, secure payment system for transactions. Now used for different use cases from meme (Dogecoin), an open-ended decentralised software platform that supports smart contracts and the creation of distributed applications (Ethereum), to create a system of direct transfers (Ripple) to IoT environment (Iota). |

| Inflationary/ Deflationary aspects | Bitcoin is architecturally deflationary as the total number of bitcoins is capped at 21 million. Each bitcoin in theory will be worth more and more as the total number of issued Bitcoins maxes out. | Some altcoin cryptocurrencies with a hard maximum cap such as Binance coin, litecoin are deflationary. Ethereum had no hard caps and until 2021 was inflationary but an update mandated to burn some ethers whenever the network activity rises to make the cryptocurrency deflationary. Others such as Dogecoin with no hard caps are inflationary |

| Security, Scalability, Decentralization | Bitcoin sacrifices scalability for the sake of security encrypted with the SHA-256 algorithm and decentralization, and can be expensive at times of high demand. This also makes an attack over the Bitcoin network too costly or too impractical due to the cryptographic strength, and high number of nodes securing it through a decentralized mining network. | Altcoins are designed to address specific bitcoin limitations such as transaction speeds but are highly centralized -e.g. out of the 100 billion XRP, 20% are owned by the founders of Ripple and the remaining 80% were initially given to Ripple Labs. They use encryption algorithms such as ETHASH (Ethereum) which are less secure than Bitcoin and moreover use the less secure Proof of Stake consensus mechanism. |

| Network Availability | Bitcoin has the largest network comprised of tens of thousands of nodes and an unknown number of miners, with an unparalleled uptime built on top of the most secure database in history. Since 2013, Bitcoin has remained active and accessible without interruption. | Altcoins such as Solana have been subjected to assaults and have consistently experienced prolonged network unavailability. |

| Consensus Mechanism | Most other Altcoins are moving to Proof of Stake,Proof of History or other mechanisms which cannot prevent double spend. Capturing control of the network is easy as it depends on staked capital leading to governance issues as users with more tokens can change the rules of the network. | |

| Smart Contract capabilities | A Turing-incomplete script language allows the creation of custom smart contracts on top of Bitcoin like multisignature accounts, payment channels, escrows, timelocks, atomic cross-chain trading, oracles, or multiparty lottery with no operator | Most altcoins provide turing complete programming languages allowing full smart contract capability. |

| Adoption | Bitcoin could reach 10% adoption rate by 2030. It is already the most widely used cryptocurrency with the most number of users compared to altcoins. | The only altcoin that has a fair adoption rate is Ethereum but that too is at least 50% lower than Bitcoin's adoption. |

| Layer2 and Sidechains | Bitcoin has Layer 2 networks such as the lightning network to increase transcation throughput and lower costs as well as sidechains | Ethereum also has Layer 2 networks such as Polygon as well as sidechains but this is less common in other altcoins |

| Layer 3 applications | Chargeable events reportable on self assessment return | Any pension income taken is reportable under the foreign pension income section and as such 90% will be subject to tax at the member's marginal rate |

| Trustworthiness | The Bitcoin core layer one network with deep storage, and global root trust is very difficult or impossibly expensive to alter leading to its trustworthiness. | Depends on the local regulator e.g. In Gibraltar the Trustee is regulated by the Gibraltar Financial Services Commission |

| Antifragility | Bitcoin has survived external attacks, attempted bans from governments, and internal disputes over the direction of the protocol. Bitcoin has weathered massive price climbs and drops, and its volatility has declined over time. Bitcoin is the only cryptocurrency with over a decade of experience. The fact that Bitcoin has survived this long serves as a positive signal to many investors, developers, and former critics. Bitcoin’s protocol is enforced by the tens of thousands of decentralized nodes across the world, each verifying every transaction on the Bitcoin network. To change Bitcoin’s protocol as all nodes on the network must be simultaneously convinced to change their rules, this is simply infeasible. | Most altcoins with an identifiable issuer which are fairly centralized can be shut down by a government or regulators. |

Labels:

Bitcoin,

Block Chain,

Crypto

Location:

Czechia

Wednesday, 31 August 2022

Why bitcoin is very different from all other altcoin "cryptocurrencies" - Part 1 - Rising cyber crime in "cryptocurrencies"

On August 29th, 2022 the FBI issued a public service announcement using analysis from blockchain analytics firm Chainalysis warning that between January and March 2022, cyber criminals stole $1.3 billion in "cryptocurrencies", almost 97 percent of which was stolen from DeFi platforms. The FBI warned criminals have exploited signature verification allowing Cyber criminals to take advantage of the complexity of cross-chain functionality and open source nature of Decentralized Finance (DeFi) platforms to steal all of the platform’s investments, resulting in millions in losses. The agency has also witnessed criminals exploiting smart contracts on a blockchain that don't let funds change hands unless certain rules are met, to extract millions. Crypto bridges which allow users to transfer cryptocurrencies from one blockchain to another, such as Nomad ($190 million stolen), Harmony ($100 million stolen), Ronin ($625 million stolen), Wormhole ($326 million stolen) account for the bulk of major crypto robberies this year. Earlier, Robert Reich, former US Secretary of Labor and professor at Brandeis University, published a video (see below) denouncing all "cryptocurrencies" as a Ponzi scheme. It must be pointed out that the bitcoin blockchain and to some extent some altcoin blockchains themselves are fairly secure, the cyber crime is taking place mostly at human touch points or at the edge where bitcoin or altcoin gets converted into USD or other fiat currencies such as exchanges or crypto bridges.

In August 2022 itself, net outflows from bitcoin-related products alone totaled $29 million according to Coinshares. In the past speculation on bitcoin was around it being a new technology, anti-fiat currency and an inflation hedge. Bitcoin as of late seems to be losing its investor appeal as it has lost over 70% of its value and has given away as much as 30% of its market share since 2021 to other cryptocurrencies according to Coinmarketcap. While Professor Reich bundled all cryptocurrencies together, it can be argued that bitcoin is very different from all other cryptocurrencies which arguably could be ponzi schemes. It all boils down to regulation and decentralization, few other "cryptocurrencies" can boast bitcoin’s level of decentralization and regulatory clarity, the most important aspects of blockchain technology. The SEC is very clear that bitcoin is not a security. All other altcoins will in all likelyhood be classified as securities in the near future by the SEC.

In Part 2, I will present a detailed side by side comparison between bitcoin and all other altcoin "cryptocurrencies" to show how bitcoin is very different as it's security stems from being fully decentralized with a turing incomplete script for smartcontracts.

In August 2022 itself, net outflows from bitcoin-related products alone totaled $29 million according to Coinshares. In the past speculation on bitcoin was around it being a new technology, anti-fiat currency and an inflation hedge. Bitcoin as of late seems to be losing its investor appeal as it has lost over 70% of its value and has given away as much as 30% of its market share since 2021 to other cryptocurrencies according to Coinmarketcap. While Professor Reich bundled all cryptocurrencies together, it can be argued that bitcoin is very different from all other cryptocurrencies which arguably could be ponzi schemes. It all boils down to regulation and decentralization, few other "cryptocurrencies" can boast bitcoin’s level of decentralization and regulatory clarity, the most important aspects of blockchain technology. The SEC is very clear that bitcoin is not a security. All other altcoins will in all likelyhood be classified as securities in the near future by the SEC.

In Part 2, I will present a detailed side by side comparison between bitcoin and all other altcoin "cryptocurrencies" to show how bitcoin is very different as it's security stems from being fully decentralized with a turing incomplete script for smartcontracts.

Location:

Czechia

Thursday, 25 August 2022

Crypto friendly regulation from GCC Central Banks creates an oasis for fintech and crypto innovation from regulatory storms at home

The European Union’s Markets in Crypto-Assets Legislation is likely to effectively ban stablecoins USD Tether (USDT) and USDC by requesting stablecoins issuers to build up a sufficiently liquid reserve, with a 1/1 ratio and partly in the form of deposits which, USDT and USDC are unlikely to do. The legislations is also designed to make life tougher for crypto exchanges. In the US, regulators are trying to separate the bad actors in the crypto space — those actively committing fraud — from those who want to advance crypto and its market infrastructure, according to Dawn Stump, the former commissioner at the U.S. Commodity Futures Trading Commission (CFTC). The Central banks of GCC countries on the other hand have made huge strides in lightly regulating crypto assets.

The Central Bank of the tiny gulf emirate of Bahrain (CBB) enacted banking regulations for digital assets allowing cryptocurrencies as an official method of payment since 2019. The CBB regulation allows banks in Bahrain to work with exchanges so that customers can withdraw and deposit their money easily. CBB launched FinHub 973, a virtual platform to allow fintech companies to test their solutions through the regulatory Sandbox and connect with the hub’s global network for funding and business opportunities. FinHub 973 is all about supporting innovation in the sector and is a good example of the driving forces behind the region’s shifting fintech landscape. The Saudi Central Bank and Central Bank of the United Arab Emirates have been working together to learn how the two banks can adopt blockchain and digital payments. Saudi Arabia's Financial Sector Development Program (FSDP) launched the Fintech Strategy Implementation Plan in June 2022 to make Riyadh a global Fintech hub. In contrast to their Gulf neighbours, Qatar currently has a ban on cryptocurrency trade with the exception of security tokens in 2020. In most other countries, digital assets fall under the jurisdiction of securities regulators, not central banks.

In Saudi Arabia, the fintech sector generated approximately $157.2 million in venture capital (VC) investments in the first eight months of 2021, up staggeringly from $7.8 million in 2020 and $18 million in 2019. In 2022, the Saudi VC market witnessed a record funding of $584 million in the first half, a 244 percent increase in comparison to the same period in 2021. Saudi Aramco's Prosperity7 Ventures, a one-billion-dollar Venture Capital fund aims to build on this success by identifying ground-breaking companies with exceptional leadership in diverse industries deploying disruptive technologies with the ability to scale and transform.

The Central Bank of the tiny gulf emirate of Bahrain (CBB) enacted banking regulations for digital assets allowing cryptocurrencies as an official method of payment since 2019. The CBB regulation allows banks in Bahrain to work with exchanges so that customers can withdraw and deposit their money easily. CBB launched FinHub 973, a virtual platform to allow fintech companies to test their solutions through the regulatory Sandbox and connect with the hub’s global network for funding and business opportunities. FinHub 973 is all about supporting innovation in the sector and is a good example of the driving forces behind the region’s shifting fintech landscape. The Saudi Central Bank and Central Bank of the United Arab Emirates have been working together to learn how the two banks can adopt blockchain and digital payments. Saudi Arabia's Financial Sector Development Program (FSDP) launched the Fintech Strategy Implementation Plan in June 2022 to make Riyadh a global Fintech hub. In contrast to their Gulf neighbours, Qatar currently has a ban on cryptocurrency trade with the exception of security tokens in 2020. In most other countries, digital assets fall under the jurisdiction of securities regulators, not central banks.

In Saudi Arabia, the fintech sector generated approximately $157.2 million in venture capital (VC) investments in the first eight months of 2021, up staggeringly from $7.8 million in 2020 and $18 million in 2019. In 2022, the Saudi VC market witnessed a record funding of $584 million in the first half, a 244 percent increase in comparison to the same period in 2021. Saudi Aramco's Prosperity7 Ventures, a one-billion-dollar Venture Capital fund aims to build on this success by identifying ground-breaking companies with exceptional leadership in diverse industries deploying disruptive technologies with the ability to scale and transform.

Labels:

Bitcoin,

Crypto,

EU,

GCC,

Gulf,

Middle East,

Qatar,

Regulation,

Saudi Arabia,

UAE

Location:

Czechia

Saturday, 20 August 2022

Commodities Lectures Series - Commodity Trading Companies vs Investment Banks and hedge funds vs - a new competitor - Commodity Producers

Without price transparency in physical commodities markets with clear and accessible reference commodities prices, physical commodities traders are in a powerful position to profit as they have a virtual information monopoly. Commodities Trading Companies such as Vitol, Trafigura, Glencore, Gunvor, Louis Dreyfus among others trade physical commodities taking advantage of this price opacity, investing in the physical and human capital necessary to transform commodities while simultaneously hedging their physical trades through financial (paper) trading on exchanges thus taking positions in the futures markets and the physical markets. Commodity trading firms do not tend to speculate on the outright direction of commodity prices, but instead aim to profit on the differential between the untransformed and transformed commodity specializing in (1) the production and analysis of information, buyers and sellers active in the market, supply and demand patterns, price structures (over space, time, and form), transformation technologies, and (2) the utilization of this information to optimize transformations in terms of space, time and form. Commodities trading firms attempt to identify the most valuable of these transformations, undertake the transactions necessary to make these transformations and engage in the physical and operational actions necessary to carry them out.

On top of physical trading, Commodity Trading Companies possess prop paper-trading desks. Using market intelligence coming from physical trading desks and ‘classic’ paper trading skills, these companies make profits on swaps, options and futures. They also use these paper trading books to hedge their physical exposure, which subsequently reduce their risk.These companies develop their own strategies and models - quantitative, computer-algorithm-driven or macro-driven similar to the models used in banks or hedge funds for derivatives pricing and market forecasting. They invest in physical commodities fundamental research to get an edge over their competitors and figure out where the market is going. They have on-site associates at origin and destination (offices in exporting and importing countries) to get a flavor of the local market as well as strong middle and back office for physical trading operations. They are highly skilled at managing their risks and know how to create sustainable and win-win relationships with potential buyers and sellers. Due to rising competition and change in business trends, these companies do invest at the source in mines, Exploration and Production (oil), and also transportation infrastructure such as ports. Vitol/Trafigura physically send ships to collect the cargo from the sellers, the miners and the refineries. Some like Glencore own mines (after buying Xstrata). Glencore is now a mining and trading company besides being a Commodities Trading Company. Trafigura is trading with no mining operations. It buys ore, concentrates or even refined outputs, ships them to the buyers. Trafigura model helps even for smaller operations.

Hedge funds on the other hand rarely trade physical form of commodities or take delivery concentrating only on financial or paper trading. Macro-focused hedge funds seek a hedge against an economic slowdown priced in by the market. Unlike many of their equity fund peers, commodities macro managers of the likes of George Soros and Louis Baconare are not dependent on rising markets for their gains. Rather, they look for volatility in commodities markets through 'Asset backed Trading' - a style of commodity trading which is used to seek and exploit market volatility in order to optimise the operational assets, inventory and future produce owned by trading entities. This is their core activity. However more sophisticated funds would also get into taking proprietary positions, market making and offer structured products to their clients. Hedge funds and Investment banks are beginning to exit the financial trading of commodities making daily price swings far greater than in previous years.

Financial trading is becoming an ever more important part of Commodities producers such as International Oil Majors Shell, BP, Total driven by fears that global oil demand could drop in the next few years as climate change concerns reshape society’s—and investors’—attitudes toward fossil fuel producers. The immense scale of the commodities producers' trading units gives them outsize clout. They have massive trading floors that mirror those of Wall Street’s biggest banks. Being a commodities producer gives an inherently bigger advantage with more reliable market information in trading strategy than commodities traders suchas Vitol/Trafigura. This is also the reason why in recent years, Vitol has started looking for refining and storage assets worldwide to control a bigger chunk of the supply chain. BP controls exploration and production as well, so BP obviously has advantage over oil traders who are unable to control costs associated with these projects and an oil company like BP will make more money when the production cost remains stable while prices rise. The problem for a crude oil trader like Vitol is to anticipate the price rise and buy oil from producers at sufficiently lower price to make a profit. Sometimes, the trading strategy for Vitol is so complex that the wafer thin margins made through a trade are actually made through minimizing on transportation costs of the oil instead of the oil price itself. On one occasion in 2016, for example, Shell bought roughly 70% of the cargoes of North Sea crude available for a particular month, triggering wild price gyrations while squeezing out commodities traders who privately complained to Shell. Commodities producers are also moving into the space formerly occupied by the commodities desks of Investment Banks. Shell, for example, in 2016 became the first nonbank to help the Mexican government hedge its exposure to the price of oil. BP's customers now include banks, hedge funds and private equity firms. Exxon is also hiring experienced oil traders to start making bets with the company’s money.

On top of physical trading, Commodity Trading Companies possess prop paper-trading desks. Using market intelligence coming from physical trading desks and ‘classic’ paper trading skills, these companies make profits on swaps, options and futures. They also use these paper trading books to hedge their physical exposure, which subsequently reduce their risk.These companies develop their own strategies and models - quantitative, computer-algorithm-driven or macro-driven similar to the models used in banks or hedge funds for derivatives pricing and market forecasting. They invest in physical commodities fundamental research to get an edge over their competitors and figure out where the market is going. They have on-site associates at origin and destination (offices in exporting and importing countries) to get a flavor of the local market as well as strong middle and back office for physical trading operations. They are highly skilled at managing their risks and know how to create sustainable and win-win relationships with potential buyers and sellers. Due to rising competition and change in business trends, these companies do invest at the source in mines, Exploration and Production (oil), and also transportation infrastructure such as ports. Vitol/Trafigura physically send ships to collect the cargo from the sellers, the miners and the refineries. Some like Glencore own mines (after buying Xstrata). Glencore is now a mining and trading company besides being a Commodities Trading Company. Trafigura is trading with no mining operations. It buys ore, concentrates or even refined outputs, ships them to the buyers. Trafigura model helps even for smaller operations.

Hedge funds on the other hand rarely trade physical form of commodities or take delivery concentrating only on financial or paper trading. Macro-focused hedge funds seek a hedge against an economic slowdown priced in by the market. Unlike many of their equity fund peers, commodities macro managers of the likes of George Soros and Louis Baconare are not dependent on rising markets for their gains. Rather, they look for volatility in commodities markets through 'Asset backed Trading' - a style of commodity trading which is used to seek and exploit market volatility in order to optimise the operational assets, inventory and future produce owned by trading entities. This is their core activity. However more sophisticated funds would also get into taking proprietary positions, market making and offer structured products to their clients. Hedge funds and Investment banks are beginning to exit the financial trading of commodities making daily price swings far greater than in previous years.

Financial trading is becoming an ever more important part of Commodities producers such as International Oil Majors Shell, BP, Total driven by fears that global oil demand could drop in the next few years as climate change concerns reshape society’s—and investors’—attitudes toward fossil fuel producers. The immense scale of the commodities producers' trading units gives them outsize clout. They have massive trading floors that mirror those of Wall Street’s biggest banks. Being a commodities producer gives an inherently bigger advantage with more reliable market information in trading strategy than commodities traders suchas Vitol/Trafigura. This is also the reason why in recent years, Vitol has started looking for refining and storage assets worldwide to control a bigger chunk of the supply chain. BP controls exploration and production as well, so BP obviously has advantage over oil traders who are unable to control costs associated with these projects and an oil company like BP will make more money when the production cost remains stable while prices rise. The problem for a crude oil trader like Vitol is to anticipate the price rise and buy oil from producers at sufficiently lower price to make a profit. Sometimes, the trading strategy for Vitol is so complex that the wafer thin margins made through a trade are actually made through minimizing on transportation costs of the oil instead of the oil price itself. On one occasion in 2016, for example, Shell bought roughly 70% of the cargoes of North Sea crude available for a particular month, triggering wild price gyrations while squeezing out commodities traders who privately complained to Shell. Commodities producers are also moving into the space formerly occupied by the commodities desks of Investment Banks. Shell, for example, in 2016 became the first nonbank to help the Mexican government hedge its exposure to the price of oil. BP's customers now include banks, hedge funds and private equity firms. Exxon is also hiring experienced oil traders to start making bets with the company’s money.

Labels:

BP,

Commodities Producers,

Commodities Trading Companies,

Glencore,

Gunvor,

Hedge Funds,

Louis Dreyfus,

Oil,

Oil trading,

Physical commodities,

Shell,

Trafigura,

Vitol

Location:

Czechia

Thursday, 18 August 2022

Central Bank Digital Currencies - the Digital Euro and the Digital Dollar

In July 2022, the European Central Bank published a blog on the "key objectives of the digital euro". The blog co-authored by none other than Christine Lagarde, President of the ECB argued that a digital payment ecosystem such as the digital Euro without a strong monetary anchor would create confusion leading to financial instability as "it is crucial that we all still have easy access to central bank money, which is the foundation of our currency".

In January 2022, the Federal Reserve came out with a highly anticipated paper on a digital dollar, taking a step in a process that could lead to Congressional action. This was followed in March 2022 by an Executive Order from the Biden administration placing the “highest urgency” on exploring a US CBDC and asks for an interagency report on all aspects of the future of money in the next 180 days. The Executive Order also advances US participation in cross-border experimentation of wholesale CBDCs.

The ECB is analyzing how financial intermediaries could provide front-end services that build on a digital euro. The analysis expected to completed by October 2023 followed by the development of integrated services as well as carry out testing and possible live experimentation of a digital euro in a phase that could take around three years. Extrapolating this timeline guidance from the ECB, it would be safe to assume that a digital Euro will not be available before 2028 at the very earliest. The ECB is likely to drive large scale adoption of the digital euro once adopted and likely to increase the proposed amount of digital euros in circulation to 1.5 trillion euros to control the negative effects on financial stability.

The Fed also sees commercial banks and nonbank financial companies acting as intermediaries. Banks would issue and manage the digital wallets that people would use for payments and deposits. The US is the furthest behind when it comes to developing CBDCs among the G7 economies, according to the Atlantic Council.

Central bank digital currencies like the digital dollar and the digital euro are expected to be used for payment settlement. CBDCs pose tough competition to cryptocurrencies used for cross-border payment settlements such as Ripple (XRP) and to a limited extent Bitcoin (BTC). The underlying technology for both the digital dollar and the digital euro is based on concepts in cryptography and distributed or decentralized solutions such as DLT.

The Fed also sees commercial banks and nonbank financial companies acting as intermediaries. Banks would issue and manage the digital wallets that people would use for payments and deposits. The US is the furthest behind when it comes to developing CBDCs among the G7 economies, according to the Atlantic Council.

Central bank digital currencies like the digital dollar and the digital euro are expected to be used for payment settlement. CBDCs pose tough competition to cryptocurrencies used for cross-border payment settlements such as Ripple (XRP) and to a limited extent Bitcoin (BTC). The underlying technology for both the digital dollar and the digital euro is based on concepts in cryptography and distributed or decentralized solutions such as DLT.

Labels:

Bitcoin,

BTC,

Central Banks,

Cross-border,

ECB,

Euro,

Federal Reserve,

Ripple,

US dollar,

XRP

Location:

Czechia

Wednesday, 17 August 2022

Commodities Lectures Series - Physical commodities trading vs. Exchange based commodities futures trading

Physical commodities trading is buying commodities from producers, transforming the purchased commodities to maximize their value and selling it to consumers getting maximum margin out of these structured trades. How the trade settles and how the quality of a commodity is assessed relies on the physical commodity itself as they are extraordinarily diverse in terms of location (of both producers and consumers) and physical characteristics. For instance, energy, including crude oil is traded with constant demand and refineries are optimized to process particular types of crude oil - light, heavy, sweet sour, and different refineries are optimized differently for derivative products such as Diesel, Petrochemicals. Purchase of energy commodities is a complex process which involves negotiations of contract floating of tenders, shipping arrangements, unloading at ports, transporting to refineries, refinery complexity and most importantly the discounts offered by the sellers. Given the complexity of the possible transformations, and the ever-changing conditions that affect the efficient set of transformations, physical commodities trading is an inherently dynamic, complex, and highly information-intensive task involving information gathering, analysis and the operational capabilities necessary to respond efficiently to this information.

Physical commodities trading requires matching numerous diverse producers and consumers with heterogeneous and highly idiosyncratic preferences directing resources to their highest value uses in response to price signals requiring strong relationships with market players (buyers and sellers of commodities). Physical commodities markets are mostly cyclic, have a seasonal trend and a convenience yield (the consumer wants it now and is willing to pay a higher price for it). Physical commodities traders search producer side and consumer side of the market to find sellers and buyers (bilateral “search” markets), and match them by buying from the former and selling to the latter in bilateral transactions in between adding value by transforming the commodities. Commodities producers are usually not end users and commodities need to be transported from source to destinations creating bottlenecks and an opportunity to make significant margins for traders. Physical traders can also profit through shipping, warehousing, and trade finance of the commodities. Physical commodities trading is also known as the “spot” or “cash” market.

Physical commodities trading is a human-driven business - Humans and relationships are predominant from the very beginning until the end of the trade. Humans will extract coal and assess the quality of it. Humans will test the quality of coal at loading port and discharging port. Human will negotiate premiums and discounts. Human will react against market movements and sometimes refuse to deliver or receive the commodity if prices go against market direction based on market intelligence.

Electronic Exchanges trading commodities futures are not suited to this matching process. They may be an efficient way to transact highly standardized instruments such as plain-vanilla front month contracts in large quantity, but are not well-adapted to predict the downward or upward price movement on commodities such as natural gas resulting from a pipeline explosion or the reaction of oil prices to a news events about an outbreak of war or comments from a Saudi oil minister. Little physical commodities actually change hands with futures trades, which take place on two main exchanges in the US, CME Group and the Intercontinental Exchange. In some commodities such as oil, futures trading has come to dwarf the physical trade, with as much as 13 times the physical amount of oil traded via these purely financial contracts which determines the price of oil. According to data provided by the CME Group, the amount of crude oil futures contracts traded daily on its platform rose in 2022 over 2021 and is nearly double that of a decade ago. For example, Total Energies, the French Oil supermajor may trade 7 million barrels of physical oil a day, but on the same day will electronically trade the equivalent of 31 million barrels of oil futures and options on an electronic exchange.

Physical commodities trading requires matching numerous diverse producers and consumers with heterogeneous and highly idiosyncratic preferences directing resources to their highest value uses in response to price signals requiring strong relationships with market players (buyers and sellers of commodities). Physical commodities markets are mostly cyclic, have a seasonal trend and a convenience yield (the consumer wants it now and is willing to pay a higher price for it). Physical commodities traders search producer side and consumer side of the market to find sellers and buyers (bilateral “search” markets), and match them by buying from the former and selling to the latter in bilateral transactions in between adding value by transforming the commodities. Commodities producers are usually not end users and commodities need to be transported from source to destinations creating bottlenecks and an opportunity to make significant margins for traders. Physical traders can also profit through shipping, warehousing, and trade finance of the commodities. Physical commodities trading is also known as the “spot” or “cash” market.

Physical commodities trading is a human-driven business - Humans and relationships are predominant from the very beginning until the end of the trade. Humans will extract coal and assess the quality of it. Humans will test the quality of coal at loading port and discharging port. Human will negotiate premiums and discounts. Human will react against market movements and sometimes refuse to deliver or receive the commodity if prices go against market direction based on market intelligence.

Electronic Exchanges trading commodities futures are not suited to this matching process. They may be an efficient way to transact highly standardized instruments such as plain-vanilla front month contracts in large quantity, but are not well-adapted to predict the downward or upward price movement on commodities such as natural gas resulting from a pipeline explosion or the reaction of oil prices to a news events about an outbreak of war or comments from a Saudi oil minister. Little physical commodities actually change hands with futures trades, which take place on two main exchanges in the US, CME Group and the Intercontinental Exchange. In some commodities such as oil, futures trading has come to dwarf the physical trade, with as much as 13 times the physical amount of oil traded via these purely financial contracts which determines the price of oil. According to data provided by the CME Group, the amount of crude oil futures contracts traded daily on its platform rose in 2022 over 2021 and is nearly double that of a decade ago. For example, Total Energies, the French Oil supermajor may trade 7 million barrels of physical oil a day, but on the same day will electronically trade the equivalent of 31 million barrels of oil futures and options on an electronic exchange.

Labels:

Futures,

Oil,

Oil trading,

Physical commodities,

Trading

Location:

New Jersey, USA

Monday, 15 August 2022

New paradigm shift in India’s energy trade - evidence in charts

An unprecedented paradigm shift is evolving in the energy commodities trade of India, the world’s third-largest oil consumer after the US and China, and second largest oil importer after China importing over 85 percent of its crude needs. Despite being the second largest coal producer in the world, India is also the world’s second largest coal importer as new power plants designed to use only high grade imported coal (17.6 GW or 8.6% of the 204.9 GW installed power generation capacity) while older power plants import the fuel for blending with domestic coal according to S&P Global. Indian Ministry of Commerce’s Export & Import Data Bank (EIDB) points to crude oil imports worth US$ 122.45 billion and around 173.32 million tons of coal imports worth US$ 30.6 billion in the year 2021-22.

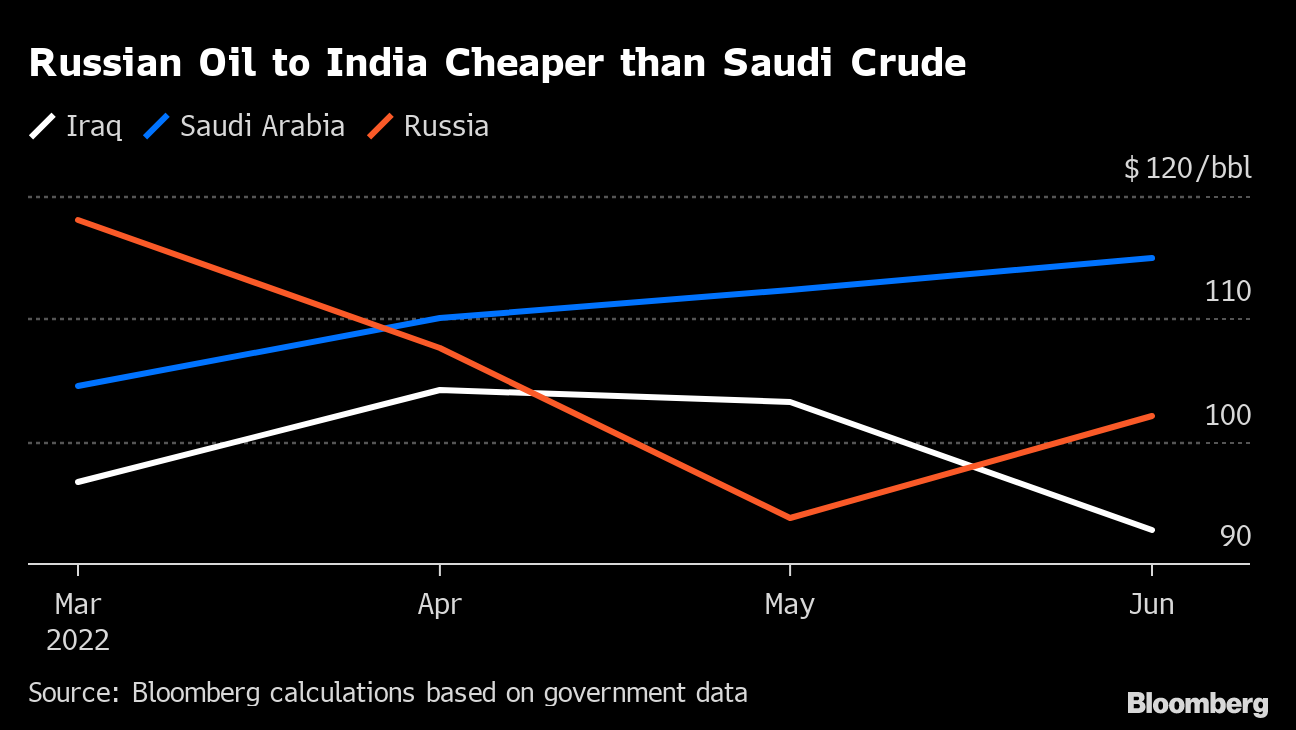

In a new paradigm shift, according to analysis by Bloomberg, Russia surpassed Saudi Arabia as the second-biggest supplier of crude to India in June 2022, ranked just behind Iraq.

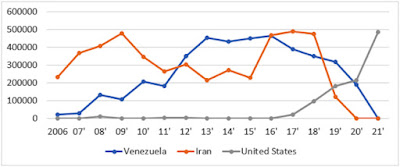

In comparison, India’s imports of U.S. oil and gas commodities which grew from $4.1 billion in 2018 to $5.5 billion in 2020 roughly halved by July 2021 and the US is no longer among India’s top oil suppliers according to the oil ministry’s Petroleum Planning & Analysis Cell.

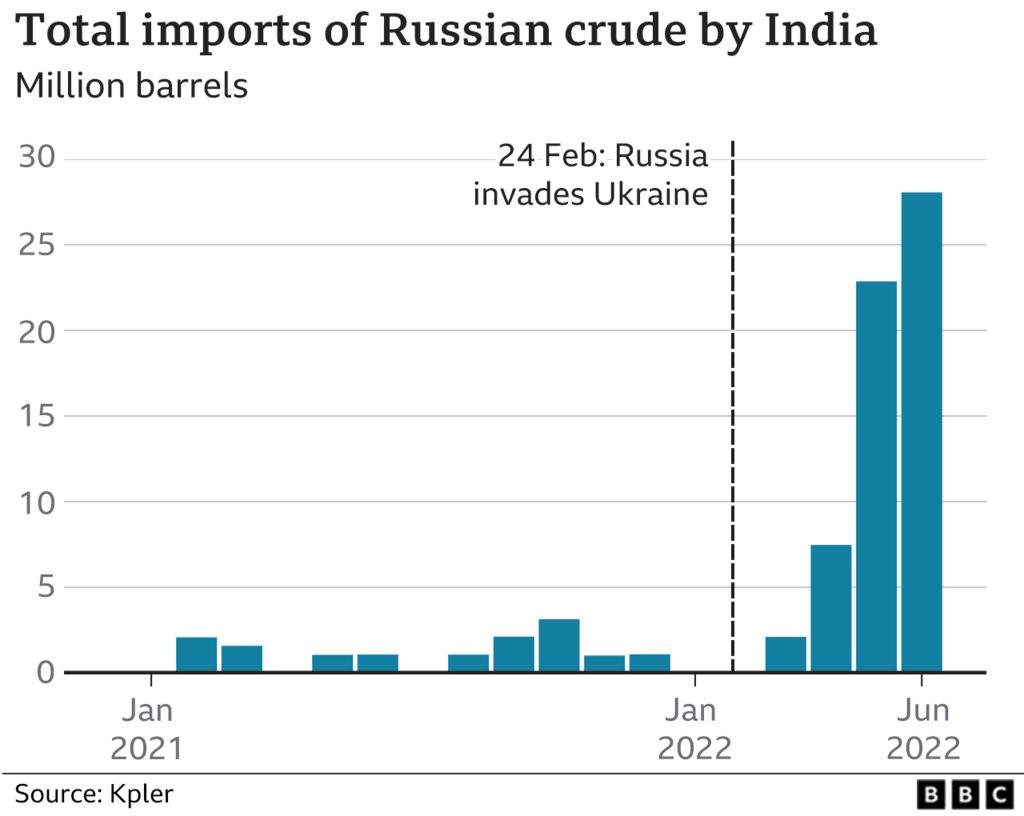

With economic growth expected to rise to 8% this year, Indian state refiners which dominate fuel retailing are in the market for the lowest priced crude that works with their refinery and product configurations via open tenders. The discount of Russian Urals crude to Brent crude was around $30 per barrel with bigger discounts to other medium-sour grades typically sold to India such as Oman and Upper Zakum reflecting the huge risk premium the market requires to transact on Russian cargoes according to Kpler. In 2021, only around 2% of India’s total oil imports (12 million barrels or 33,000 barrels a day on average of Urals crude) came from Russia, according to Kpler.

Urals oil contracts for India rose from nothing in January 2022 to 300,000 barrels a day in March to 700,000 a day in April totaling around 26 million barrels ending June 2022 according to Kpler. The India-bound Russian tankers head into Jamnagar, in the western state of Gujarat, where Reliance Industries has the world’s largest refinery complex, and into the Vadinar refinery of Nayara Energy an affiliate of Rosneft, the Russian state company which alone imports crude oil worth about $1bn every month or 400,000 barrels per day on average.

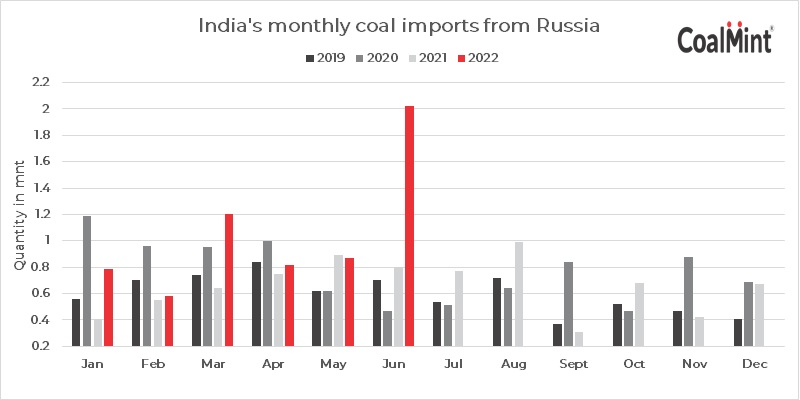

This paradigm shift in India’s energy trade is not limited to oil. Russia became India's third-largest coal supplier in July 2022 after Indonesia and Australia, with imports from Russia jumping 70.3% to a new record of 2.06 million mt, per Coalmint data. In comparison, thermal coal imports from the US fell 52% on the year to 3.4 million mt over the same time. Russian imports to India are expected to rise even higher due to a wider coal shortage during the third quarter of 2022 exacerbated by higher electricity demand. Steep discounts offered by Russian suppliers for thermal coal and Urals crude as global prices trade at near-record highs due to western sanctions are not the only reason for this paradigm shift. India is also exploring alternative payment channels for trade with Russia including allowing payments for energy commodities in the Indian rupee or settling the trade in other Asian currencies furthering this new paradigm.

This paradigm shift in India’s energy trade is not limited to oil. Russia became India's third-largest coal supplier in July 2022 after Indonesia and Australia, with imports from Russia jumping 70.3% to a new record of 2.06 million mt, per Coalmint data. In comparison, thermal coal imports from the US fell 52% on the year to 3.4 million mt over the same time. Russian imports to India are expected to rise even higher due to a wider coal shortage during the third quarter of 2022 exacerbated by higher electricity demand. Steep discounts offered by Russian suppliers for thermal coal and Urals crude as global prices trade at near-record highs due to western sanctions are not the only reason for this paradigm shift. India is also exploring alternative payment channels for trade with Russia including allowing payments for energy commodities in the Indian rupee or settling the trade in other Asian currencies furthering this new paradigm.

Labels:

Coal,

Energy,

India Oil Imports,

Indian rupee,

Physical commodities,

Russia,

Trading

Location:

New Jersey, USA

Sunday, 7 August 2022

Two decoupled energy blocs with India and the Gulf in the middle

Australia’s Strategic Policy Institute opined on the emergence post Russia’s invasion of Ukraine, of two decoupled energy blocs with China and Russia on one side, and Europe, North America, and the Indo-Pacific democracies, on the other side. Prior to Russia’s invasion of Ukraine, in 2020 almost 30% of EU crude oil imports came from Russia and over 40% of natural gas imports came from Russia while more than half of solid fossil fuel (mostly coal) imports originated from Russia (54 %). European nations are now seeking new sources of gas, oil and diesel fuel from the Americas, Africa, the Middle East, and India, as well as an increased focus on local energy production to wean themselves off Russian energy sources.

With Russian oil banned in the United States and Europe, India finds itself in the middle of the two decoupled energy blocs buying Russian crude at substantial discounts, powering its energy-thirsty economy at a lower cost, and refining into products like diesel and jet fuel to sell at better-than-usual margins abroad. Ironically, Europe is eager to buy the same Russian crude after it is refined in India into diesel shipping the fuel to Europe since March 2022, with increased trade flows expected over the coming months. China buys 50% of its oil supplies from the Gulf.

The Strait of Hormuz is the most important chokepoint between the two decoupled energy blocs accounting for about a third of the world’s sea-borne oil (and a fifth of the world’s total oil exports), linking oil and gas Upstream producers in the Middle East with Downstream consumers in Europe, North America, China and Indo-Pacific.

In 2016, according to America’s Energy Information Administration, the waterway carried some 19m barrels of crude and other petroleum products a day. This volume will accelerate through 2030 because of new mega refineries in the Gulf China and India and growing demand in Europe and emerging markets. According to Bloomberg, State-run Qatar Energy’s six new gas-liquefaction plants are set to produce 8 million tons of LNG per year for export to Europe. Morgan Stanley forecasts global LNG consumption to rise by 60% through 2030.

With Russian oil banned in the United States and Europe, India finds itself in the middle of the two decoupled energy blocs buying Russian crude at substantial discounts, powering its energy-thirsty economy at a lower cost, and refining into products like diesel and jet fuel to sell at better-than-usual margins abroad. Ironically, Europe is eager to buy the same Russian crude after it is refined in India into diesel shipping the fuel to Europe since March 2022, with increased trade flows expected over the coming months. China buys 50% of its oil supplies from the Gulf.

The Strait of Hormuz is the most important chokepoint between the two decoupled energy blocs accounting for about a third of the world’s sea-borne oil (and a fifth of the world’s total oil exports), linking oil and gas Upstream producers in the Middle East with Downstream consumers in Europe, North America, China and Indo-Pacific.

In 2016, according to America’s Energy Information Administration, the waterway carried some 19m barrels of crude and other petroleum products a day. This volume will accelerate through 2030 because of new mega refineries in the Gulf China and India and growing demand in Europe and emerging markets. According to Bloomberg, State-run Qatar Energy’s six new gas-liquefaction plants are set to produce 8 million tons of LNG per year for export to Europe. Morgan Stanley forecasts global LNG consumption to rise by 60% through 2030.

Labels:

Downstream,

EU,

European Economy,

Gulf,

India,

Oil trading,

Russia,

Strait of Hormuz,

Upstream

Location:

New Jersey, USA

Saturday, 6 August 2022

The Downstream dilemma - keep investing, or cash in now on what might be refining’s last golden age

In India, several new refineries, petrochemical projects, as well as expansion projects for existing refineries are projected to double India’s refining capacity from the current 5 million barrels per day to 10 million barrels per day by 2030. In the Gulf, four new mega-facilities totaling almost 1.4 million barrels per day are already operational or shortly going live in Jazan, in south-western Saudi Arabia, Al Zour in Kuwait, Karbala in Iraq, Duqm in Oman. Abu Dhabi’s Adnoc Ruwais refinery and Dubai’s Enoc Jebel Ali refinery have raised refining capacity in 2020. Fujairah, Egypt, Iran, Iraq, and Bahrain have also implemented various other refining expansions and upgrades. In Nigeria, a giant new refinery is expected to begin processing in the third quarter of 2022. Saudi Aramco is making new refining investments in Poland and China.

This endless demand for refining capacity with economies of scale, maximizing the output of high-value products may be close to a peak due to increasing fuel efficiency, competition from biofuels, rise of electric vehicles and pressures from climate action groups. Current fuel shortages caused by Russia’s invasion of Ukraine may ease but with a projected global economic slump in the last two quarters of 2022 the Great 2022 Downstream boom is bound to come to an end.

These new refineries may be harbingers of refining’s last golden age as among global refining mainstays, oil demand in Europe has been in decline since 2006; in Japan, since 1996. Refineries need constant investment to meet tightening safety and environmental standards, a changing demand mix for fuel, the capital cost of the facility, a host of other expenses and liabilities from unionized workforces, pensions, pollution legacies from less stringent eras as well as carbon prices. Oil majors Shell, BP and TotalEnergies have been selling or closing refineries or converting them to biofuels processing or storage terminals to cash in now on refining’s last golden age.

This endless demand for refining capacity with economies of scale, maximizing the output of high-value products may be close to a peak due to increasing fuel efficiency, competition from biofuels, rise of electric vehicles and pressures from climate action groups. Current fuel shortages caused by Russia’s invasion of Ukraine may ease but with a projected global economic slump in the last two quarters of 2022 the Great 2022 Downstream boom is bound to come to an end.

These new refineries may be harbingers of refining’s last golden age as among global refining mainstays, oil demand in Europe has been in decline since 2006; in Japan, since 1996. Refineries need constant investment to meet tightening safety and environmental standards, a changing demand mix for fuel, the capital cost of the facility, a host of other expenses and liabilities from unionized workforces, pensions, pollution legacies from less stringent eras as well as carbon prices. Oil majors Shell, BP and TotalEnergies have been selling or closing refineries or converting them to biofuels processing or storage terminals to cash in now on refining’s last golden age.

Labels:

Downstream,

Gulf,

India,

Oil,

Refineries,

Refining margins

Location:

New Jersey, USA

Tuesday, 2 August 2022

The Great 2022 Downstream boom

Refiners are enjoying the best of times as of mid-2022: Saudi Aramco’s 1Q22 upstream profit improved 75 per cent on higher crude prices and production but downstream, including refining, gained 130 per cent. In the downstream business, margins in the spread between the input cost of crude oil and the prices of outputs typically hover between $2 and $5 a barrel and frequently go negative.

As of mid-2022, refining margins have soared above $30 a barrel on a global basis and $50 in some locations as China cut its refineries’ export quotas by more than half while diesel stocks in Europe, US and Singapore have drained to multi-year lows. Even though crude prices are, historically speaking, not that high, the squeeze on refined products due to Opec+ production restrictions, sanctions on Russia, Iran and Venezuela, crimp the availability of diesel-rich, medium-gravity crude oils driving end-user prices to records ($176 a barrel for diesel in the UAE in mid-2022).

As of mid-2022, refining margins have soared above $30 a barrel on a global basis and $50 in some locations as China cut its refineries’ export quotas by more than half while diesel stocks in Europe, US and Singapore have drained to multi-year lows. Even though crude prices are, historically speaking, not that high, the squeeze on refined products due to Opec+ production restrictions, sanctions on Russia, Iran and Venezuela, crimp the availability of diesel-rich, medium-gravity crude oils driving end-user prices to records ($176 a barrel for diesel in the UAE in mid-2022).

Labels:

Downstream,

Oil,

Opec+,

Refineries,

Refining margins

Location:

New Jersey, USA

Saturday, 15 January 2022

Gold import duties, smuggling and gold seizures

In February 2021, India's Finance Minister announced cut in import duties on gold from 12.5% to 7.5% albeit effective import duty remained 10.75% after imposition of various cesses, surcharges and a 3% GST.. ThePrint’s Editor-in-Chief Shekhar Gupta explains what the small cut in import duty tells us about the Indian political system’s fatal attraction for bad policy.

On 13 August 2013, the Indian government had raised gold import duty from 6% to 10% which was further raised to 12.5% on 5 July 2019. For taxes and gold import duties over 12.5% gold smuggling becomes a lot more profitable than imports creating a very strong incentive for the grey markets to constantly undermine all reforms to make gold liquid and mainstream according to the World Gold Council. India has had a significant history of seizure of smuggled gold which is directly proportional to the amount smuggled rising from 207% from 2016 to 2020. Nearly 70% of total gold seizures made in 2020-21 were of Myanmar origin. Only about 13% came from the United Arab Emirates.

According to Gupta, in the past, gold was smuggled in large quantities as it funded all of India’s underworld and corruption — bureaucratic corruption, customs corruption, judicial corruption as well as terrorism. “Gold is a sink for black money. One way to clean up gold was to open its imports. Second was to reduce or withdraw all duties so that the margin was taken away. And third was to improve India’s foreign exchange rules” Gupta explained.

On 13 August 2013, the Indian government had raised gold import duty from 6% to 10% which was further raised to 12.5% on 5 July 2019. For taxes and gold import duties over 12.5% gold smuggling becomes a lot more profitable than imports creating a very strong incentive for the grey markets to constantly undermine all reforms to make gold liquid and mainstream according to the World Gold Council. India has had a significant history of seizure of smuggled gold which is directly proportional to the amount smuggled rising from 207% from 2016 to 2020. Nearly 70% of total gold seizures made in 2020-21 were of Myanmar origin. Only about 13% came from the United Arab Emirates.

According to Gupta, in the past, gold was smuggled in large quantities as it funded all of India’s underworld and corruption — bureaucratic corruption, customs corruption, judicial corruption as well as terrorism. “Gold is a sink for black money. One way to clean up gold was to open its imports. Second was to reduce or withdraw all duties so that the margin was taken away. And third was to improve India’s foreign exchange rules” Gupta explained.

Friday, 14 January 2022

Commodities Lectures Series - Block Chains vs. Investment Banks in physical commodities trading

Investment Banks have commodities units that make money in three major ways:

1. By helping corporations involved in the physical side of the commodities buisness to hedge their exposure to changing commodity prices through instruments such as exchange-traded futures, options and swaps to curb the cost of big run ups in the price of raw materials needed to purchase.

2. The second way was owning physical assets that dealt directly with raw materials - for example refineries and coal mines to running gasoline storage silos.

3. The third and most lucrative way is house trading or prop trading which is done in several ways - from a client flow trade that requires the Investment Bank to take positions the bank otherwise wouldn't have wanted. For example betting that natural gas prices would fall at a time when consensus was for it to go higher. Another form of prop trading is to use internal Bank's capital to take profitable positions. By early 2000s analysts estimate that prop trading accounted for at least a quarter of Goldman's pretax income.

BCG's strategic view on the role of Block Chain in Physical commodities trading illustrated how recording commodities transactions on a blockchain results in greater transparency and fairer prices. This would seriously impact the commodities prop trading of Investment Banks which rely on informal channels such as instant messaging to negotiate deals taking advantage of price information inefficiencies.

Real-time settlement provided by Block Chains could eliminate clearing risk with fraudulent or poor quality physical delivery of goods forcing Investment Banks acting as counterparties to release collateral earlier eliminating storage profits as was the case with aluminum storage with Goldman Sachs and The London Metal Exchange.

Block Chains can also disintermediate investment banks in commodity markets with low pricing complexity and low degree of diversity in pricing mechanisms such as Power. EnerChain, the world’s first trading tool for large-scale wholesale peer-to-peer energy trading over the blockchain developed by big European gas and power companies consortium achieves exactly this disintermediation through Block chain based trust, security and transparency between the market participants.

These Consortium permissioned blockchains governed by a group of commodtities participants has the most disruptive potential to align market participants towards real-time streamlining of matching, clearing and settlement of trades, asset exchange, standardization and wholesale peer-to-peer trading. In 2019, EnHelix Marketplace, a Block Chain based marketplace to streamline scheduling, nomination, and billing operations for midstream natural gas market participants including cargo brokers, and logistics companies was unveiled at the Gastech energy conference in Singapore. This HyperLedger based distributed ledger streamlines commodities trading with applications supporting every step of the process from pre-trade KYC, trade execution to post-trade risk management with smart contracts making these energy trades faster and more organized for market participants.Consortium blockchains are more decentralized thereby resulting in higher levels of security. That being said, setting up such consortiums around physical commodities trading can be a fraught process as it requires cooperation between all the participants and presents logistical challenges as well as potential antitrust risk.

1. By helping corporations involved in the physical side of the commodities buisness to hedge their exposure to changing commodity prices through instruments such as exchange-traded futures, options and swaps to curb the cost of big run ups in the price of raw materials needed to purchase.

2. The second way was owning physical assets that dealt directly with raw materials - for example refineries and coal mines to running gasoline storage silos.