Back in 2018, the German electric utilities company e.ON's Thorsten Kuehnel observed that “The potential of blockchain technology lies in disintermediation. This creates true disruption; everything else is incremental innovation or optimization.” BCG, a global consulting firm, along the same lines issued a publication outlining their strategic view on the role of Block Chain in Physical Commodities trading:

Pricing and Arbitrage

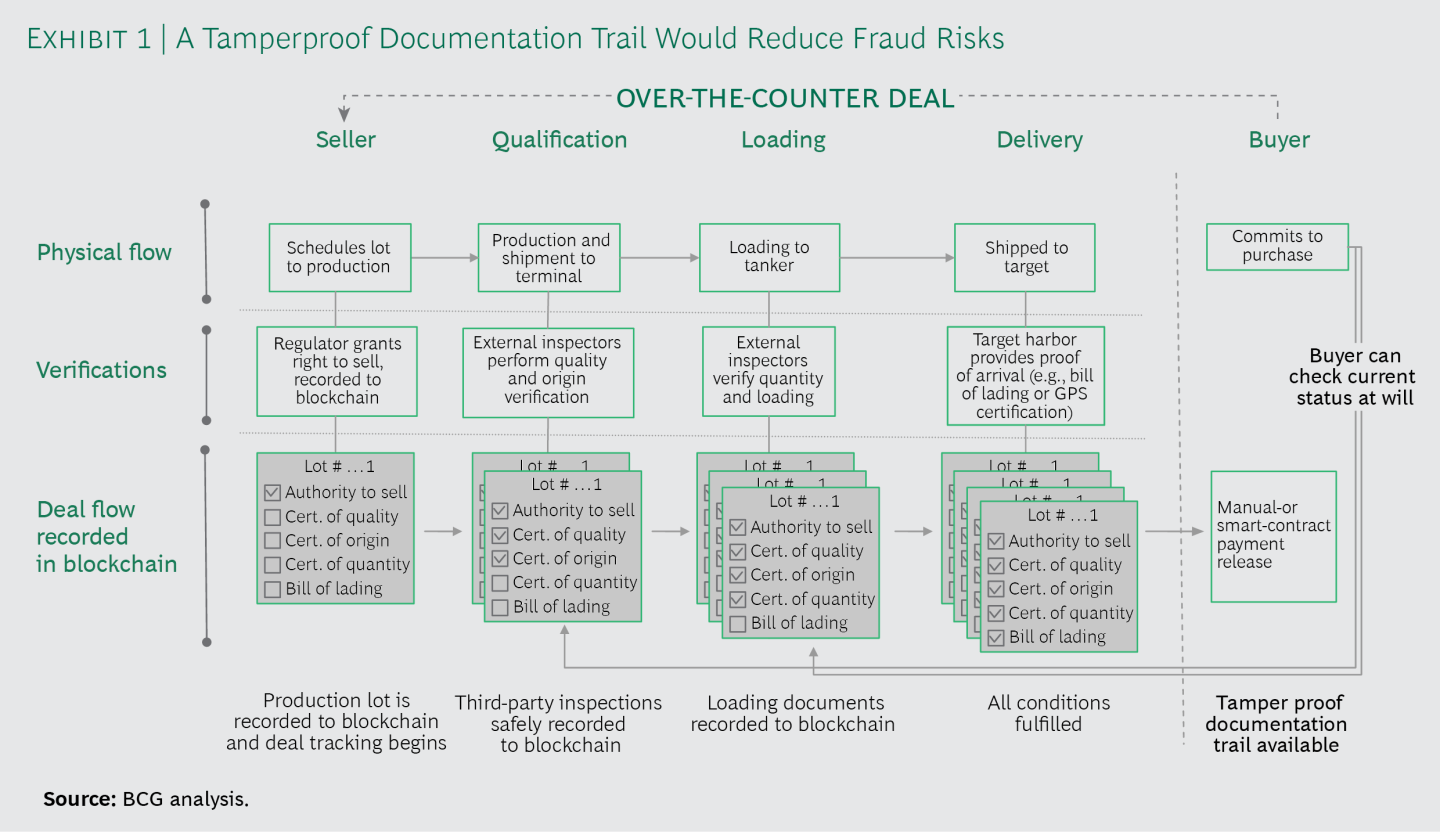

According to BCG, Block Chain’s ability to transparently record complicated transactions, track goods, and reduce fraud superficialy make it a natural fit for the commodity business as most trades would have to be recorded accurately in a shared ledger and participants could compare the price of their consignment against other consignments and thereby spot discrepancies. Greater transparency would lead to fairer prices. However, it would impact the profits of traders that rely on pricing inefficiencies to make money. Price-reporting agencies such as Bloomberg and Platts would also need to find new ways to expand their businesses observes BCG.

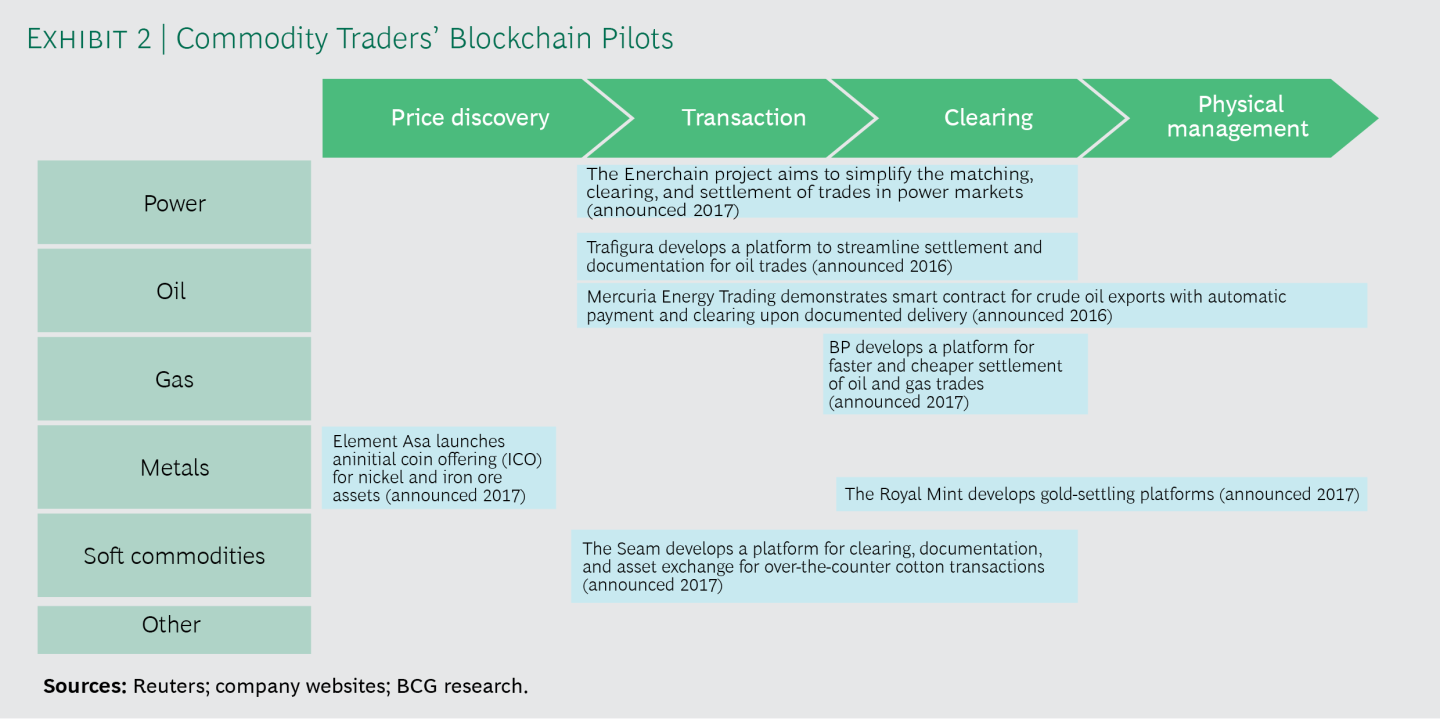

Pilot Block Chain Implementations Cutting post-trade processing costs is another potential use of blockchain in commodity trading, with savings of up to 40% across operations, accounting, settlements and IT, according to blockchain developers. Big energy traders are backing blockchain post-trade projects, like Vakt for oil and OneOffice for gas. Wholesale peer-to-peer trading is another application being developed by big European gas and power companies in the Enerchain project. The partners hope to enable large-scale trading, making the project unique in its focus, size, and disruptive potential.

Reality Check

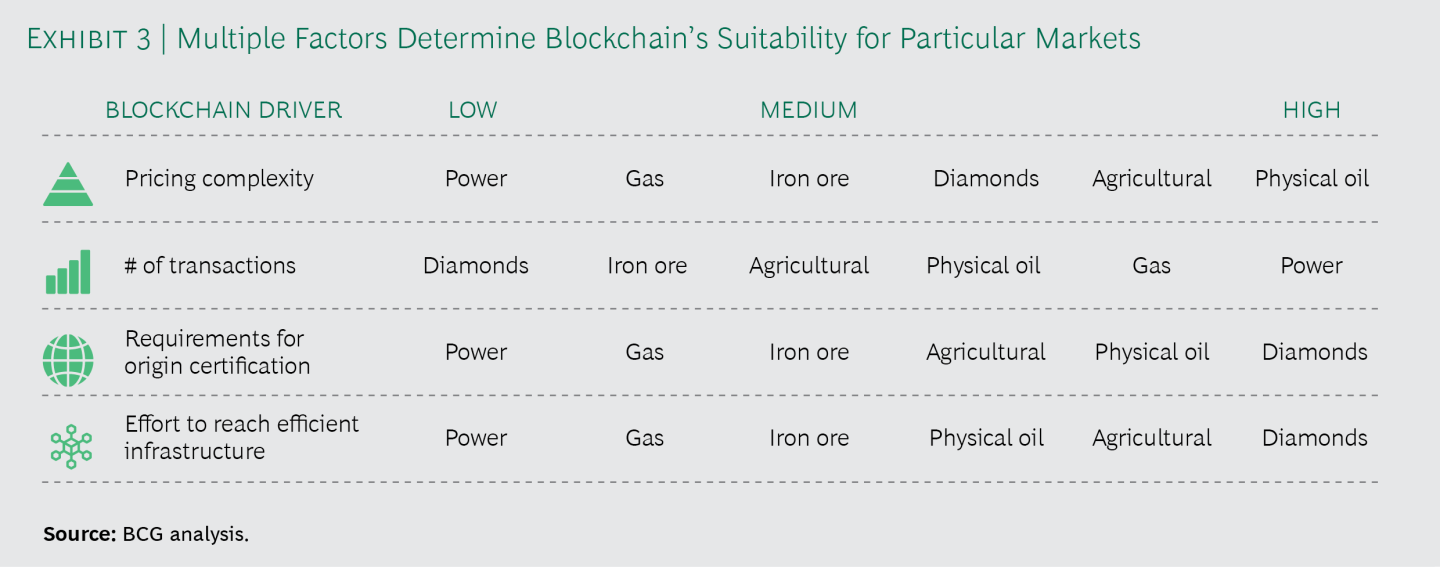

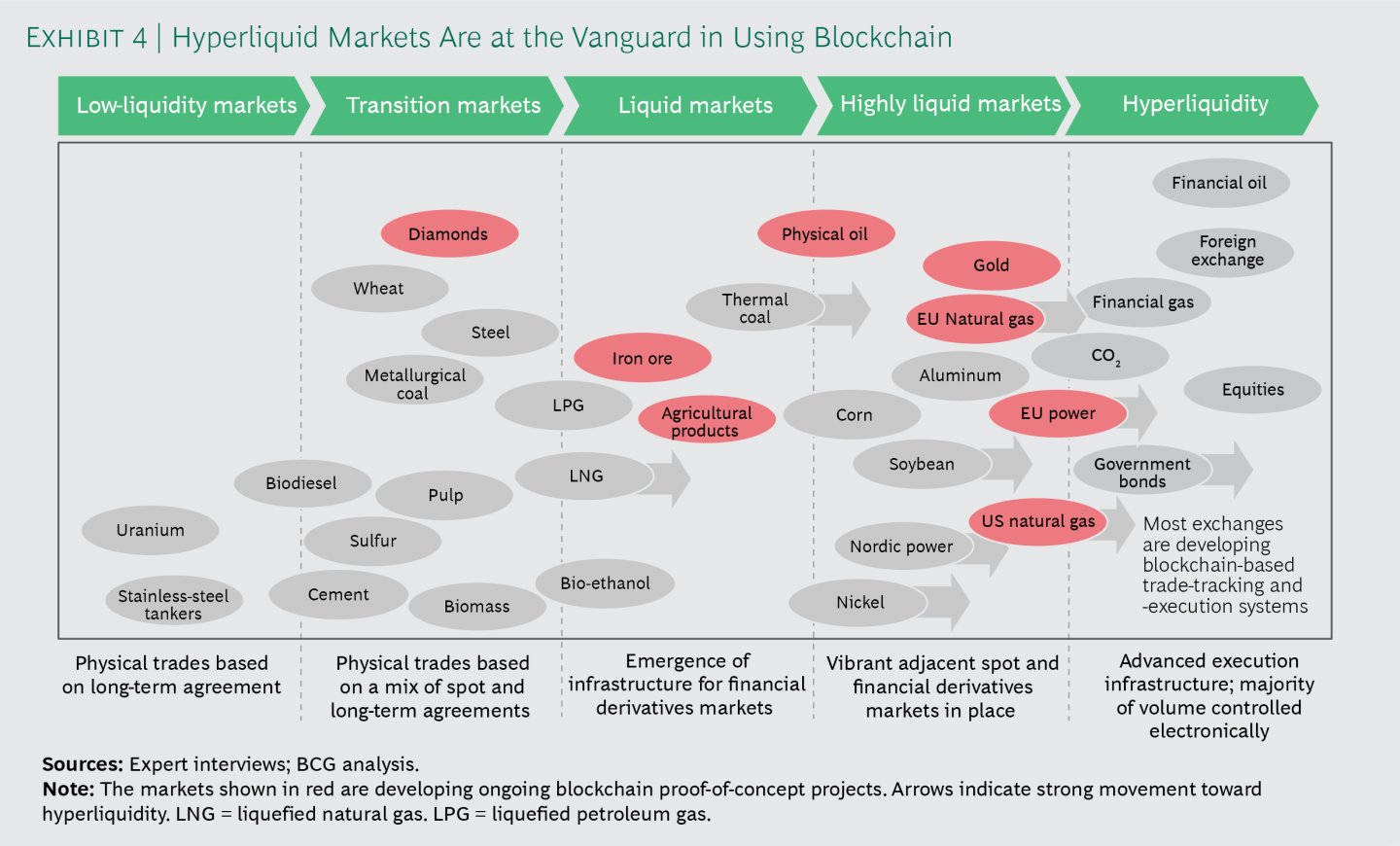

BCG examined blockchain’s ability to transform commodity trading in each of the main markets using pricing complexity, particularly how much diversity currently exists in pricing mechanisms and transaction volumes. A more efficient and liquid market, moving commodity trading away from bilateral deals struck directly between two parties to transactions based on electronic platforms that match buyers and sellers may not be far on the horizon.

BCG's concluding recommendationBCG cautions on the complexities and cost of creating new platforms, and recommends collaborative development with partners and regulators to ensure that participants have a clear understanding of the value blockchain can add as well as potential use cases adopting a regional approach, rather than create global solutions.

A blog focused on educating global physical energy commodities participants on evolving financial, regulatory and marketing developments in the Asian commodities markets including use of cryptocurrencies in physical commodities trading. This blog seeks to educate market participants only and does not constitute financial advice.

Showing posts with label Boston Consulting Group. Show all posts

Showing posts with label Boston Consulting Group. Show all posts

Friday, 31 December 2021

Subscribe to:

Comments (Atom)