Energy Security is all about ensuring a more equitable, diverse, and independent energy matrix that can withstand any uncertainties in global oil markets. India’s Ministry of Petroleum is seeking to bring all national refiners – public sector as well as private players – together to scour the global market for the most affordable physical oil grades to safeguard its energy security from future disruptions by diversifying its oil import sources at lower costs. India is already increasing the share of renewables and clean energy and increasing its SPRs. Indian companies have invested over US$ 16 billion in Russia’s oil and gas sector and handle the export of oil from Russia to India. Now, with the threat of US secondary sanctions looming on the horizon, a consortium of buyers can go a long way in working out the logistics to bolster energy security.

On May 16th, 2022 the Czech Ministry of Industry announced plans to launch a new state energy trader to purchase gas through foreign gas upstream producers at better prices as Russia's invasion of Ukraine prompted a re-think on energy security and a drive to cut dependence on Russian supplies and increase the state's influence on gas storage in the country. Utility bills for households and companies have also soared, worsened by the war which has caused energy commodity prices to spike.

Energy Sovereignty on the other hand is substituting fossil fuels imports from problematic countries with other fossil fuels imports from less problematic countries as well as independence from energy imports by boosting domestic energy production including an acceleration of renewable and nuclear developments. Poland, a coal-producing powerhouse, mining 55 million tons of hard coal and 52 million tons of lignite in 2021, rejected cheaper imported Russian and Ukrainian coal which previously accounted for a significant proportion of heating for households. Since Russian imports were banned by Poland in March 2022 shortages led to rising prices forcing the government to subsidize coal for households. The ability to meet most of the domestic demand with Polish coal leaves the country free to push for a cessation of the Russian gas imports achieving a coal-based national energy sovereignty.

A blog focused on educating global physical energy commodities participants on evolving financial, regulatory and marketing developments in the Asian commodities markets including use of cryptocurrencies in physical commodities trading. This blog seeks to educate market participants only and does not constitute financial advice.

Showing posts with label Coal. Show all posts

Showing posts with label Coal. Show all posts

Friday, 9 September 2022

Energy Security vs Energy Sovereignty

Labels:

Coal,

Energy Security,

Energy Sovereignty,

Gas,

Oil

Location:

Czechia

Monday, 15 August 2022

New paradigm shift in India’s energy trade - evidence in charts

An unprecedented paradigm shift is evolving in the energy commodities trade of India, the world’s third-largest oil consumer after the US and China, and second largest oil importer after China importing over 85 percent of its crude needs. Despite being the second largest coal producer in the world, India is also the world’s second largest coal importer as new power plants designed to use only high grade imported coal (17.6 GW or 8.6% of the 204.9 GW installed power generation capacity) while older power plants import the fuel for blending with domestic coal according to S&P Global. Indian Ministry of Commerce’s Export & Import Data Bank (EIDB) points to crude oil imports worth US$ 122.45 billion and around 173.32 million tons of coal imports worth US$ 30.6 billion in the year 2021-22.

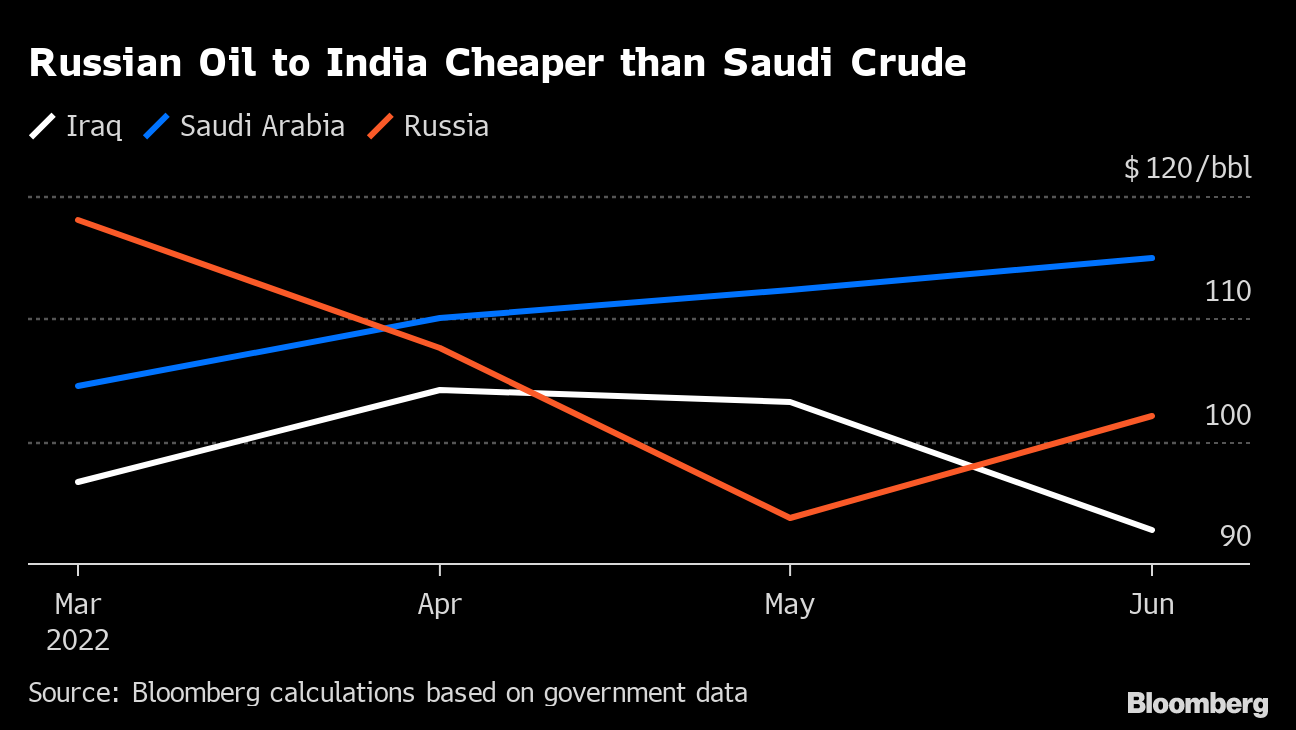

In a new paradigm shift, according to analysis by Bloomberg, Russia surpassed Saudi Arabia as the second-biggest supplier of crude to India in June 2022, ranked just behind Iraq.

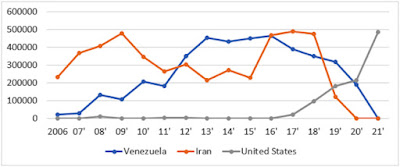

In comparison, India’s imports of U.S. oil and gas commodities which grew from $4.1 billion in 2018 to $5.5 billion in 2020 roughly halved by July 2021 and the US is no longer among India’s top oil suppliers according to the oil ministry’s Petroleum Planning & Analysis Cell.

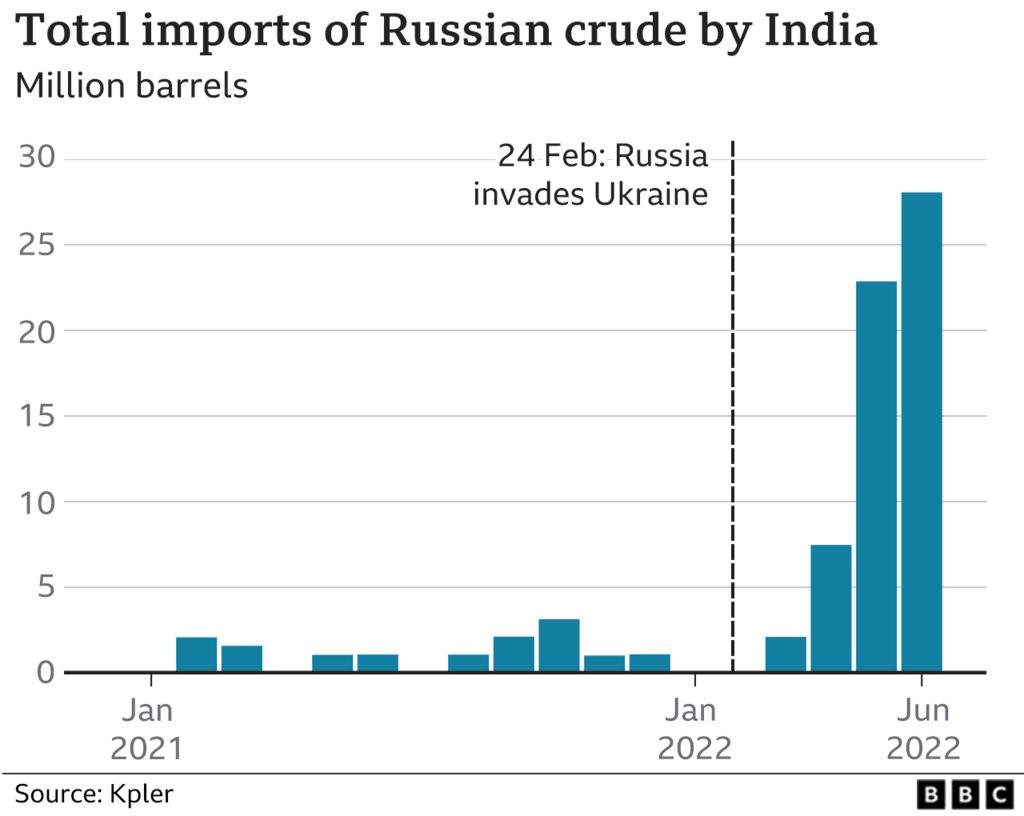

With economic growth expected to rise to 8% this year, Indian state refiners which dominate fuel retailing are in the market for the lowest priced crude that works with their refinery and product configurations via open tenders. The discount of Russian Urals crude to Brent crude was around $30 per barrel with bigger discounts to other medium-sour grades typically sold to India such as Oman and Upper Zakum reflecting the huge risk premium the market requires to transact on Russian cargoes according to Kpler. In 2021, only around 2% of India’s total oil imports (12 million barrels or 33,000 barrels a day on average of Urals crude) came from Russia, according to Kpler.

Urals oil contracts for India rose from nothing in January 2022 to 300,000 barrels a day in March to 700,000 a day in April totaling around 26 million barrels ending June 2022 according to Kpler. The India-bound Russian tankers head into Jamnagar, in the western state of Gujarat, where Reliance Industries has the world’s largest refinery complex, and into the Vadinar refinery of Nayara Energy an affiliate of Rosneft, the Russian state company which alone imports crude oil worth about $1bn every month or 400,000 barrels per day on average.

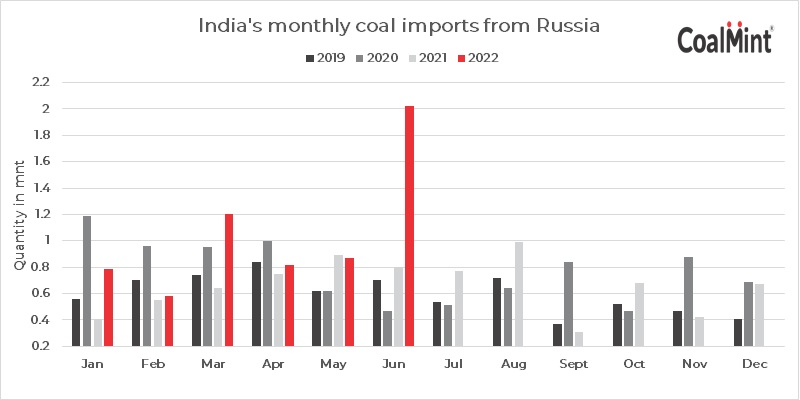

This paradigm shift in India’s energy trade is not limited to oil. Russia became India's third-largest coal supplier in July 2022 after Indonesia and Australia, with imports from Russia jumping 70.3% to a new record of 2.06 million mt, per Coalmint data. In comparison, thermal coal imports from the US fell 52% on the year to 3.4 million mt over the same time. Russian imports to India are expected to rise even higher due to a wider coal shortage during the third quarter of 2022 exacerbated by higher electricity demand. Steep discounts offered by Russian suppliers for thermal coal and Urals crude as global prices trade at near-record highs due to western sanctions are not the only reason for this paradigm shift. India is also exploring alternative payment channels for trade with Russia including allowing payments for energy commodities in the Indian rupee or settling the trade in other Asian currencies furthering this new paradigm.

This paradigm shift in India’s energy trade is not limited to oil. Russia became India's third-largest coal supplier in July 2022 after Indonesia and Australia, with imports from Russia jumping 70.3% to a new record of 2.06 million mt, per Coalmint data. In comparison, thermal coal imports from the US fell 52% on the year to 3.4 million mt over the same time. Russian imports to India are expected to rise even higher due to a wider coal shortage during the third quarter of 2022 exacerbated by higher electricity demand. Steep discounts offered by Russian suppliers for thermal coal and Urals crude as global prices trade at near-record highs due to western sanctions are not the only reason for this paradigm shift. India is also exploring alternative payment channels for trade with Russia including allowing payments for energy commodities in the Indian rupee or settling the trade in other Asian currencies furthering this new paradigm.

Labels:

Coal,

Energy,

India Oil Imports,

Indian rupee,

Physical commodities,

Russia,

Trading

Location:

New Jersey, USA

Tuesday, 4 January 2022

Spot Markets in Coal, Electricity and Gold on the horizon in India to coincide with privatized coal mining and gold refining

Spot trading in Coal is on the horizon according to the Securities and Exchange Board of India (SEBI) to coincide with commercial coal mines becoming operational in this decade when 40 per cent of the coal in India will be mined by companies other than State run monopoly Coal India Ltd. India's coal imports have increased largely because of demand from new power plants which are designed to use only high grade imported coal.India imported 215 million tons in 2020-21 mostly from Australia, South Africa and Indonesia. Anil Kumar Jain, India's coal secretary, said in October that the country plans to eliminate imports of thermal coal by 2024.

India’s rush towards renewables is projected to boost trading on the energy spot market to more than quadruple in two years, according to Bloomberg. The share of power under long term contracts is expected to drop between 50 to 60 percent in the next few years.

In a separte report from the World Gold Council (WGC), titled Bullion Trade in India, part of a series of in-depth analyses on India’s bullion market, increasing import of gold doré — a semi-pure alloy of gold and silver — in the last few years has led to a massive expansion of gold refineries in India. The number of refineries rose from 3 in 2012 to 32 in 2020 with a combined refining capacity of 1,200- 1,400 tonnes. Of these, 23 refineries imported doré in 2020 and the top five refineries accounted for more than 70 percent of India’s doré imports.

According to WGC, bullion banking is one of the key pillars to address multiple challenges faced by India’s gold market, such as a lack of quality assurance, the unorganised state of the market and a lack of trust in international markets but with bullion banks like Bank of Nova Scotia exiting their precious metals business and many large bullion dealers (previously clients of the banks) setting up their own refineries, banks’ share of official imports shrank from 40 percent in 2017 to 19 percent in 2020 as the business shifted to refineries.

In a separte report from the World Gold Council (WGC), titled Bullion Trade in India, part of a series of in-depth analyses on India’s bullion market, increasing import of gold doré — a semi-pure alloy of gold and silver — in the last few years has led to a massive expansion of gold refineries in India. The number of refineries rose from 3 in 2012 to 32 in 2020 with a combined refining capacity of 1,200- 1,400 tonnes. Of these, 23 refineries imported doré in 2020 and the top five refineries accounted for more than 70 percent of India’s doré imports.

According to WGC, bullion banking is one of the key pillars to address multiple challenges faced by India’s gold market, such as a lack of quality assurance, the unorganised state of the market and a lack of trust in international markets but with bullion banks like Bank of Nova Scotia exiting their precious metals business and many large bullion dealers (previously clients of the banks) setting up their own refineries, banks’ share of official imports shrank from 40 percent in 2017 to 19 percent in 2020 as the business shifted to refineries.

Monday, 3 January 2022

Coal continues to be surprisingly a strongly traded commodity in Asian Markets

Who would have ever thought that Coal, a much hated and maligned commodity would continue to be a strongly traded commodity in 2022? Indonesia, a leading exporter of thermal coal banned the shipments of coal on New Years Day 2022, causing a surge in coal prices. This follows on a record $158 per tonne in October, though it slipped $68 on Dec. 29 according to Refinitiv and Kpler.

A report published in December 2021 by China's State Grid Corporation outlined China's plans to build as much as 150 gigawatts (GW) of new coal-fired power capacity over the 2021-2025 period, bringing the total to 1,230 GW as the first 1,000-megawatt unit of the Coal powered Shanghaimiao plant, the biggest of its kind was completed. The plant will eventually have four generating units adding to more than half of global coal-fired power generation, a 9% year-on-year increase in 2021, according to a report from International Energy Agency published in December 2021, even as US coal powered plans continue to close.

China (US$16.4 billion - 17.3%), Japan - ($15.95 billion - 16.8%) and India ($15.87 billion - 16.7%) were the biggest importers of coal in 2020 compared to China ($19.6 billion - 12.9%), India - $24.6 billion (16.2%) and Japan (US$25.4 billion - 16.7% of total coal imports) in 2019 as reported by Caixin. These three Asian giants will continue to be major Coal commodities players for at least the next decade.

China (US$16.4 billion - 17.3%), Japan - ($15.95 billion - 16.8%) and India ($15.87 billion - 16.7%) were the biggest importers of coal in 2020 compared to China ($19.6 billion - 12.9%), India - $24.6 billion (16.2%) and Japan (US$25.4 billion - 16.7% of total coal imports) in 2019 as reported by Caixin. These three Asian giants will continue to be major Coal commodities players for at least the next decade.

Labels:

China,

Coal,

Commodities,

India,

Japan

Subscribe to:

Comments (Atom)