Physical commodities trading is buying commodities from producers, transforming the purchased commodities to maximize their value and selling it to consumers getting maximum margin out of these structured trades. How the trade settles and how the quality of a commodity is assessed relies on the physical commodity itself as they are extraordinarily diverse in terms of location (of both producers and consumers) and physical characteristics. For instance, energy, including crude oil is traded with constant demand and refineries are optimized to process particular types of crude oil - light, heavy, sweet sour, and different refineries are optimized differently for derivative products such as Diesel, Petrochemicals. Purchase of energy commodities is a complex process which involves negotiations of contract floating of tenders, shipping arrangements, unloading at ports, transporting to refineries, refinery complexity and most importantly the discounts offered by the sellers. Given the complexity of the possible transformations, and the ever-changing conditions that affect the efficient set of transformations, physical commodities trading is an inherently dynamic, complex, and highly information-intensive task involving information gathering, analysis and the operational capabilities necessary to respond efficiently to this information.

Physical commodities trading requires matching numerous diverse producers and consumers with heterogeneous and highly idiosyncratic preferences directing resources to their highest value uses in response to price signals requiring strong relationships with market players (buyers and sellers of commodities). Physical commodities markets are mostly cyclic, have a seasonal trend and a convenience yield (the consumer wants it now and is willing to pay a higher price for it). Physical commodities traders search producer side and consumer side of the market to find sellers and buyers (bilateral “search” markets), and match them by buying from the former and selling to the latter in bilateral transactions in between adding value by transforming the commodities. Commodities producers are usually not end users and commodities need to be transported from source to destinations creating bottlenecks and an opportunity to make significant margins for traders. Physical traders can also profit through shipping, warehousing, and trade finance of the commodities. Physical commodities trading is also known as the “spot” or “cash” market.

Physical commodities trading is a human-driven business - Humans and relationships are predominant from the very beginning until the end of the trade. Humans will extract coal and assess the quality of it. Humans will test the quality of coal at loading port and discharging port. Human will negotiate premiums and discounts. Human will react against market movements and sometimes refuse to deliver or receive the commodity if prices go against market direction based on market intelligence.

Electronic Exchanges trading commodities futures are not suited to this matching process. They may be an efficient way to transact highly standardized instruments such as plain-vanilla front month contracts in large quantity, but are not well-adapted to predict the downward or upward price movement on commodities such as natural gas resulting from a pipeline explosion or the reaction of oil prices to a news events about an outbreak of war or comments from a Saudi oil minister. Little physical commodities actually change hands with futures trades, which take place on two main exchanges in the US, CME Group and the Intercontinental Exchange. In some commodities such as oil, futures trading has come to dwarf the physical trade, with as much as 13 times the physical amount of oil traded via these purely financial contracts which determines the price of oil. According to data provided by the CME Group, the amount of crude oil futures contracts traded daily on its platform rose in 2022 over 2021 and is nearly double that of a decade ago. For example, Total Energies, the French Oil supermajor may trade 7 million barrels of physical oil a day, but on the same day will electronically trade the equivalent of 31 million barrels of oil futures and options on an electronic exchange.

A blog focused on educating global physical energy commodities participants on evolving financial, regulatory and marketing developments in the Asian commodities markets including use of cryptocurrencies in physical commodities trading. This blog seeks to educate market participants only and does not constitute financial advice.

Showing posts with label Trading. Show all posts

Showing posts with label Trading. Show all posts

Wednesday, 17 August 2022

Monday, 15 August 2022

New paradigm shift in India’s energy trade - evidence in charts

An unprecedented paradigm shift is evolving in the energy commodities trade of India, the world’s third-largest oil consumer after the US and China, and second largest oil importer after China importing over 85 percent of its crude needs. Despite being the second largest coal producer in the world, India is also the world’s second largest coal importer as new power plants designed to use only high grade imported coal (17.6 GW or 8.6% of the 204.9 GW installed power generation capacity) while older power plants import the fuel for blending with domestic coal according to S&P Global. Indian Ministry of Commerce’s Export & Import Data Bank (EIDB) points to crude oil imports worth US$ 122.45 billion and around 173.32 million tons of coal imports worth US$ 30.6 billion in the year 2021-22.

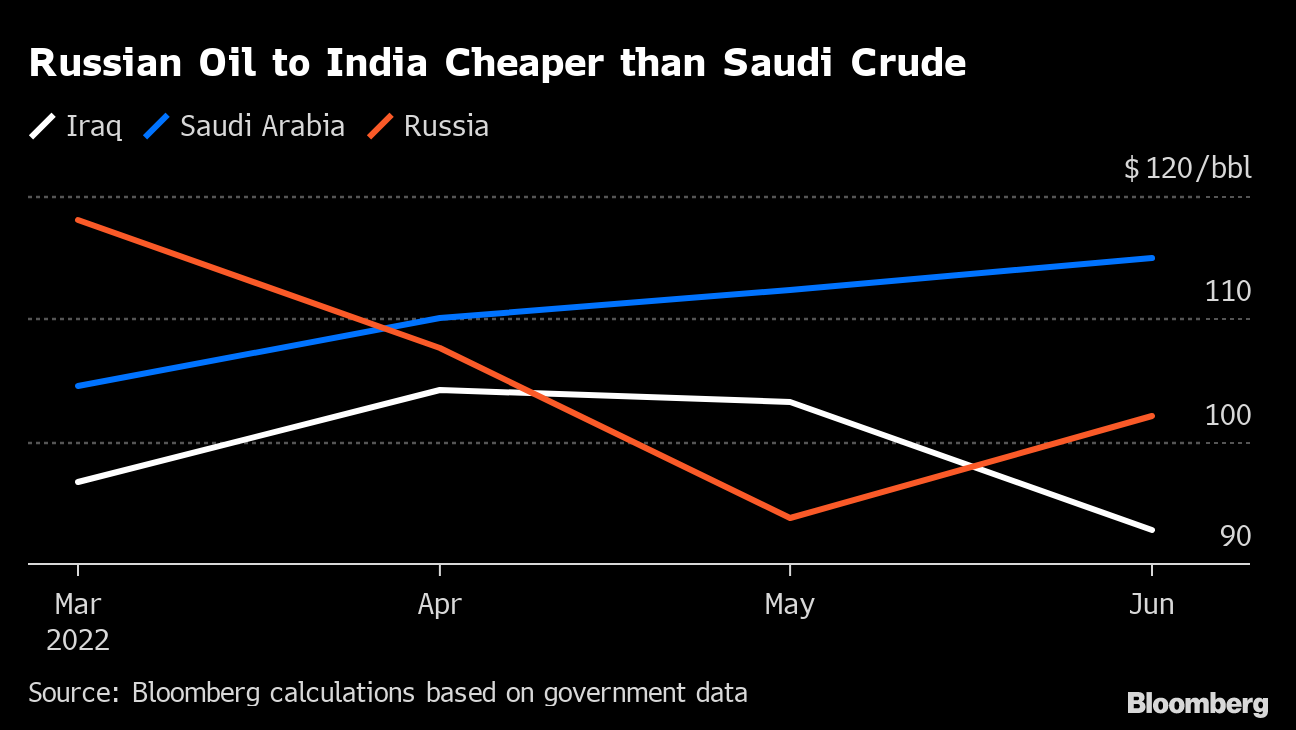

In a new paradigm shift, according to analysis by Bloomberg, Russia surpassed Saudi Arabia as the second-biggest supplier of crude to India in June 2022, ranked just behind Iraq.

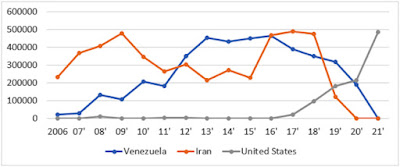

In comparison, India’s imports of U.S. oil and gas commodities which grew from $4.1 billion in 2018 to $5.5 billion in 2020 roughly halved by July 2021 and the US is no longer among India’s top oil suppliers according to the oil ministry’s Petroleum Planning & Analysis Cell.

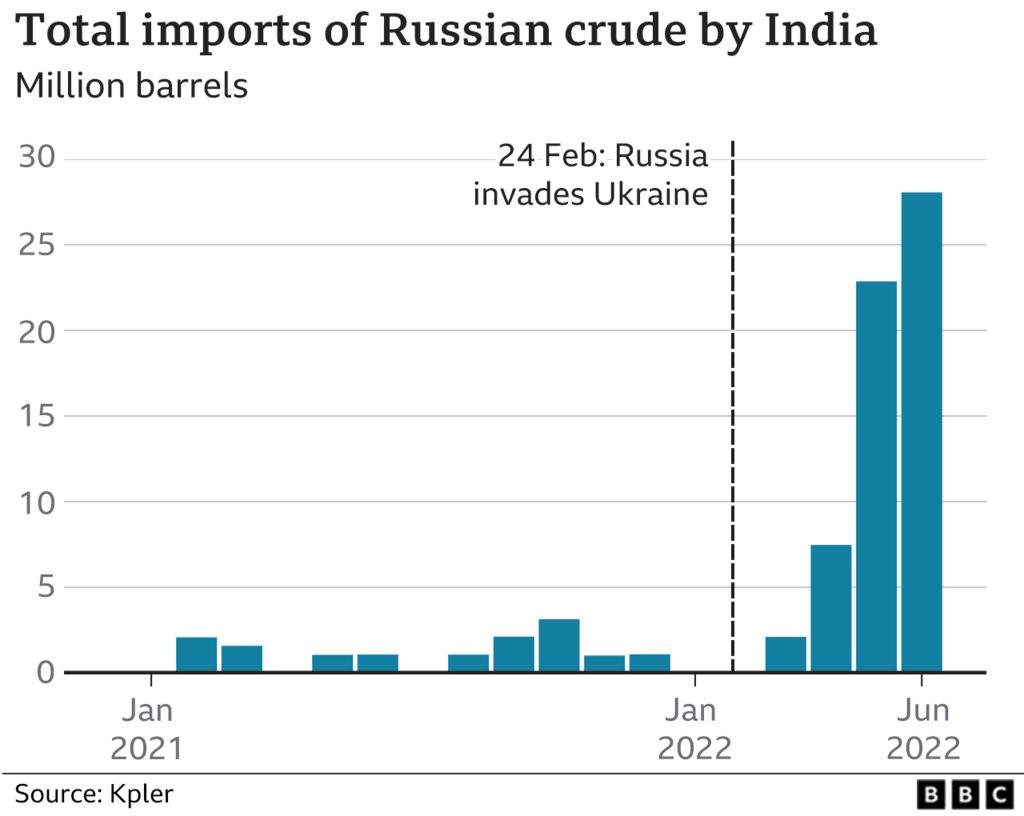

With economic growth expected to rise to 8% this year, Indian state refiners which dominate fuel retailing are in the market for the lowest priced crude that works with their refinery and product configurations via open tenders. The discount of Russian Urals crude to Brent crude was around $30 per barrel with bigger discounts to other medium-sour grades typically sold to India such as Oman and Upper Zakum reflecting the huge risk premium the market requires to transact on Russian cargoes according to Kpler. In 2021, only around 2% of India’s total oil imports (12 million barrels or 33,000 barrels a day on average of Urals crude) came from Russia, according to Kpler.

Urals oil contracts for India rose from nothing in January 2022 to 300,000 barrels a day in March to 700,000 a day in April totaling around 26 million barrels ending June 2022 according to Kpler. The India-bound Russian tankers head into Jamnagar, in the western state of Gujarat, where Reliance Industries has the world’s largest refinery complex, and into the Vadinar refinery of Nayara Energy an affiliate of Rosneft, the Russian state company which alone imports crude oil worth about $1bn every month or 400,000 barrels per day on average.

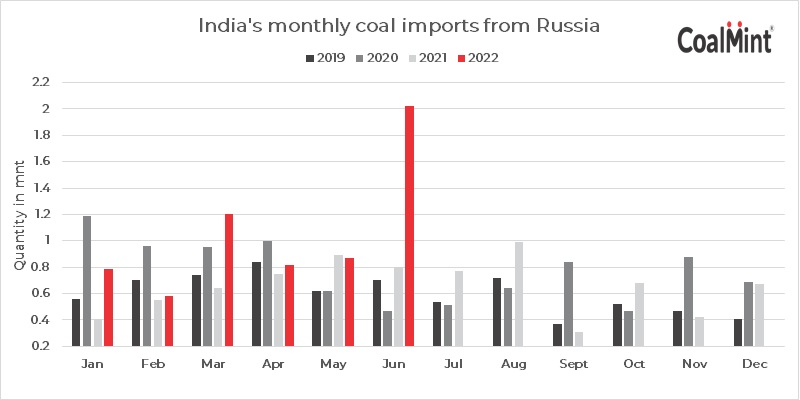

This paradigm shift in India’s energy trade is not limited to oil. Russia became India's third-largest coal supplier in July 2022 after Indonesia and Australia, with imports from Russia jumping 70.3% to a new record of 2.06 million mt, per Coalmint data. In comparison, thermal coal imports from the US fell 52% on the year to 3.4 million mt over the same time. Russian imports to India are expected to rise even higher due to a wider coal shortage during the third quarter of 2022 exacerbated by higher electricity demand. Steep discounts offered by Russian suppliers for thermal coal and Urals crude as global prices trade at near-record highs due to western sanctions are not the only reason for this paradigm shift. India is also exploring alternative payment channels for trade with Russia including allowing payments for energy commodities in the Indian rupee or settling the trade in other Asian currencies furthering this new paradigm.

This paradigm shift in India’s energy trade is not limited to oil. Russia became India's third-largest coal supplier in July 2022 after Indonesia and Australia, with imports from Russia jumping 70.3% to a new record of 2.06 million mt, per Coalmint data. In comparison, thermal coal imports from the US fell 52% on the year to 3.4 million mt over the same time. Russian imports to India are expected to rise even higher due to a wider coal shortage during the third quarter of 2022 exacerbated by higher electricity demand. Steep discounts offered by Russian suppliers for thermal coal and Urals crude as global prices trade at near-record highs due to western sanctions are not the only reason for this paradigm shift. India is also exploring alternative payment channels for trade with Russia including allowing payments for energy commodities in the Indian rupee or settling the trade in other Asian currencies furthering this new paradigm.

Labels:

Coal,

Energy,

India Oil Imports,

Indian rupee,

Physical commodities,

Russia,

Trading

Location:

New Jersey, USA

Thursday, 6 January 2022

Increased regulatory scrutiny of Fintech in Commodities Trading may impact Smart Contracts and Cryptocurrencies significantly

Back in October 2018, Brian Quintenz, the commissioner of CFTC, in a speech in Dubai, questioned the use of smart contracts in Commodities Futures Trading within the CFTC’s jurisdiction asking: "is the method by which it is being transacted on the blockchain compliant with CFTC regulations? If the contract is a swap, is it being offered to retail participants? Is it a product that must be traded on an exchange? Does the protocol itself perform exchange-like functions by facilitating trading, thereby potentially implicating registration requirements?". While the commissioner acknowledged that many smart contracts operate entirely outside of the CFTC’s jurisdiction, the open question was “if a smart contract is violative of CFTC regulation, then who is subject to an enforcement action?” The answer, implicitly holds the developers of the blockchain and the general users responsible, as they are typically unable to assess or police the legality of each application of the blockchain.

In 2018, the CFTC had issued a primer on understanding smart contracts and their potential use cases.

Similarly, Congressional scrutiny of cryptocurrencies is increasing regulatory pressure on stablecoins and other cryptocurrencies and have the potential to destabilize the global monetary system In an interview with Bloomberg in August 2021, John Paulson predicted that “Cryptocurrencies, regardless of where they’re trading today, will eventually prove to be worthless. Once the exuberance wears off, or liquidity dries up, they will go to zero.”. The selloff in Bitcoin on January 5th, 2022 as the Fed and other central banks pare back on excess-liquidity measures and prime the markets for higher rates in 2022 points to a vindication of Mr. Paulson's pediction. Barron's highlighted the selloff as another sign that Bitcoin is acting more like a tech stock than an inflation-fighting store of value–or digital gold, as its proponents argue.

Similarly, Congressional scrutiny of cryptocurrencies is increasing regulatory pressure on stablecoins and other cryptocurrencies and have the potential to destabilize the global monetary system In an interview with Bloomberg in August 2021, John Paulson predicted that “Cryptocurrencies, regardless of where they’re trading today, will eventually prove to be worthless. Once the exuberance wears off, or liquidity dries up, they will go to zero.”. The selloff in Bitcoin on January 5th, 2022 as the Fed and other central banks pare back on excess-liquidity measures and prime the markets for higher rates in 2022 points to a vindication of Mr. Paulson's pediction. Barron's highlighted the selloff as another sign that Bitcoin is acting more like a tech stock than an inflation-fighting store of value–or digital gold, as its proponents argue.

Labels:

Bitcoin,

CFTC,

Commodities,

Congress,

Regulation,

Trading

Tuesday, 4 January 2022

Spot Markets in Coal, Electricity and Gold on the horizon in India to coincide with privatized coal mining and gold refining

Spot trading in Coal is on the horizon according to the Securities and Exchange Board of India (SEBI) to coincide with commercial coal mines becoming operational in this decade when 40 per cent of the coal in India will be mined by companies other than State run monopoly Coal India Ltd. India's coal imports have increased largely because of demand from new power plants which are designed to use only high grade imported coal.India imported 215 million tons in 2020-21 mostly from Australia, South Africa and Indonesia. Anil Kumar Jain, India's coal secretary, said in October that the country plans to eliminate imports of thermal coal by 2024.

India’s rush towards renewables is projected to boost trading on the energy spot market to more than quadruple in two years, according to Bloomberg. The share of power under long term contracts is expected to drop between 50 to 60 percent in the next few years.

In a separte report from the World Gold Council (WGC), titled Bullion Trade in India, part of a series of in-depth analyses on India’s bullion market, increasing import of gold doré — a semi-pure alloy of gold and silver — in the last few years has led to a massive expansion of gold refineries in India. The number of refineries rose from 3 in 2012 to 32 in 2020 with a combined refining capacity of 1,200- 1,400 tonnes. Of these, 23 refineries imported doré in 2020 and the top five refineries accounted for more than 70 percent of India’s doré imports.

According to WGC, bullion banking is one of the key pillars to address multiple challenges faced by India’s gold market, such as a lack of quality assurance, the unorganised state of the market and a lack of trust in international markets but with bullion banks like Bank of Nova Scotia exiting their precious metals business and many large bullion dealers (previously clients of the banks) setting up their own refineries, banks’ share of official imports shrank from 40 percent in 2017 to 19 percent in 2020 as the business shifted to refineries.

In a separte report from the World Gold Council (WGC), titled Bullion Trade in India, part of a series of in-depth analyses on India’s bullion market, increasing import of gold doré — a semi-pure alloy of gold and silver — in the last few years has led to a massive expansion of gold refineries in India. The number of refineries rose from 3 in 2012 to 32 in 2020 with a combined refining capacity of 1,200- 1,400 tonnes. Of these, 23 refineries imported doré in 2020 and the top five refineries accounted for more than 70 percent of India’s doré imports.

According to WGC, bullion banking is one of the key pillars to address multiple challenges faced by India’s gold market, such as a lack of quality assurance, the unorganised state of the market and a lack of trust in international markets but with bullion banks like Bank of Nova Scotia exiting their precious metals business and many large bullion dealers (previously clients of the banks) setting up their own refineries, banks’ share of official imports shrank from 40 percent in 2017 to 19 percent in 2020 as the business shifted to refineries.

Friday, 31 December 2021

BCG's strategic view on the role of Block Chain in Physical Commodities trading

Back in 2018, the German electric utilities company e.ON's Thorsten Kuehnel observed that “The potential of blockchain technology lies in disintermediation. This creates true disruption; everything else is incremental innovation or optimization.” BCG, a global consulting firm, along the same lines issued a publication outlining their strategic view on the role of Block Chain in Physical Commodities trading:

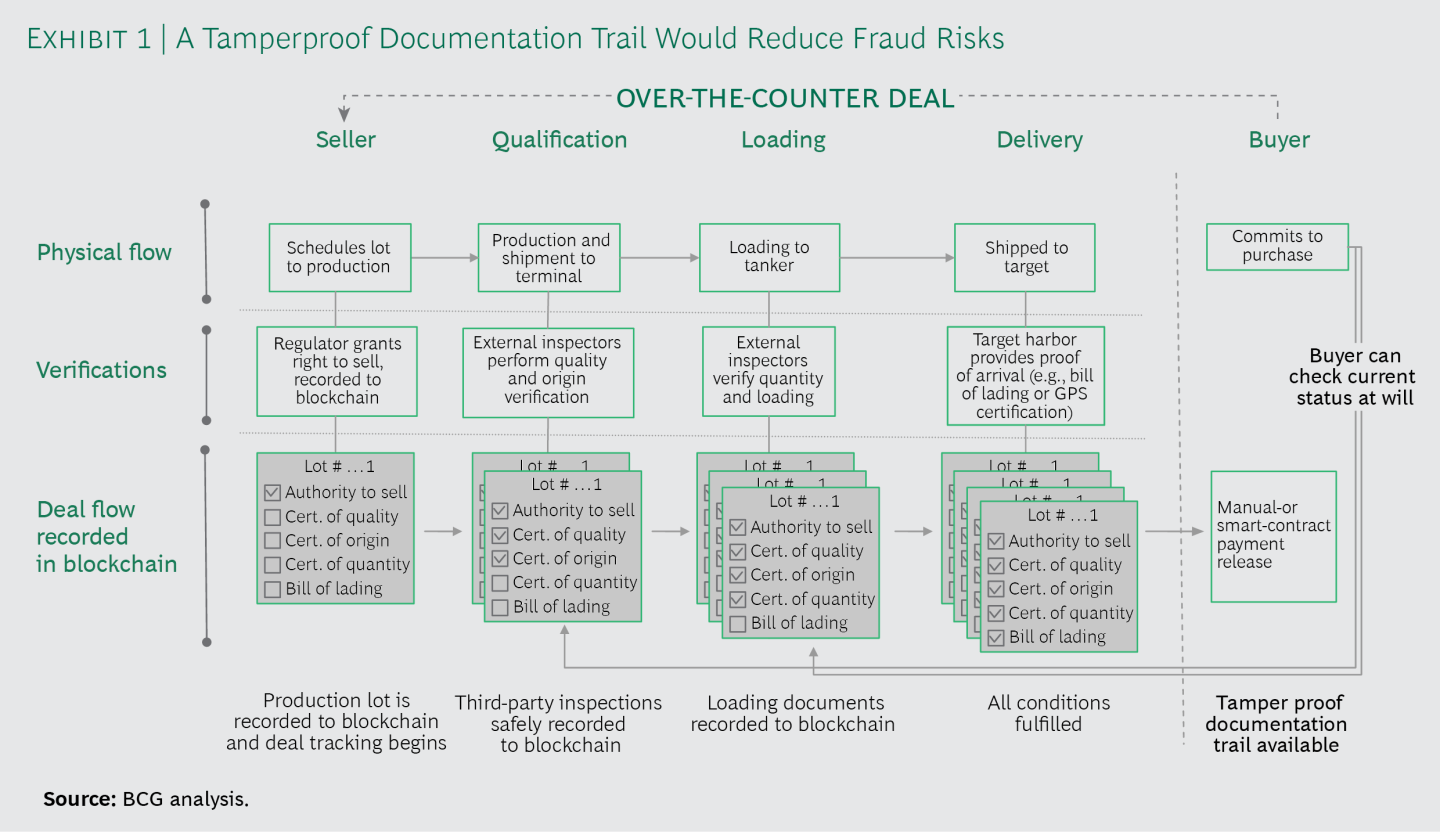

Pricing and Arbitrage According to BCG, Block Chain’s ability to transparently record complicated transactions, track goods, and reduce fraud superficialy make it a natural fit for the commodity business as most trades would have to be recorded accurately in a shared ledger and participants could compare the price of their consignment against other consignments and thereby spot discrepancies. Greater transparency would lead to fairer prices. However, it would impact the profits of traders that rely on pricing inefficiencies to make money. Price-reporting agencies such as Bloomberg and Platts would also need to find new ways to expand their businesses observes BCG.

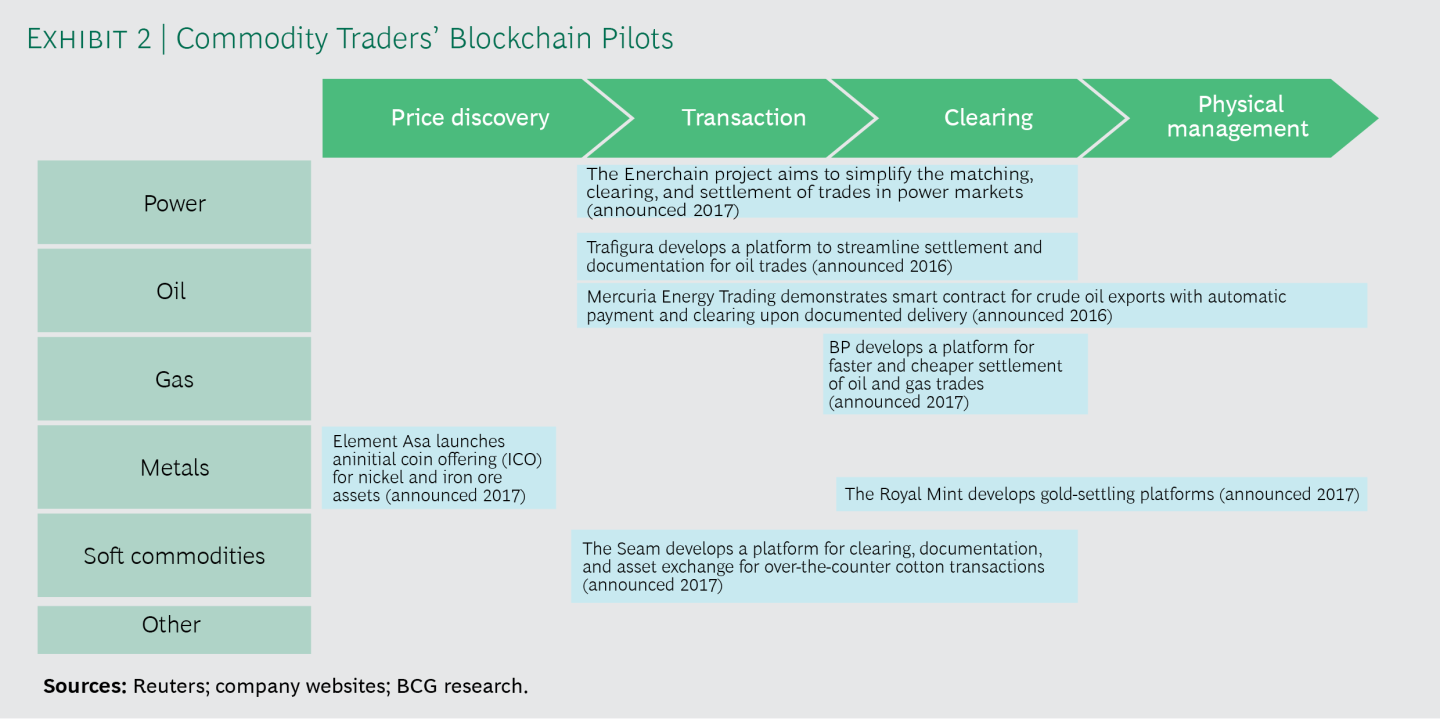

Pilot Block Chain Implementations Cutting post-trade processing costs is another potential use of blockchain in commodity trading, with savings of up to 40% across operations, accounting, settlements and IT, according to blockchain developers. Big energy traders are backing blockchain post-trade projects, like Vakt for oil and OneOffice for gas. Wholesale peer-to-peer trading is another application being developed by big European gas and power companies in the Enerchain project. The partners hope to enable large-scale trading, making the project unique in its focus, size, and disruptive potential.

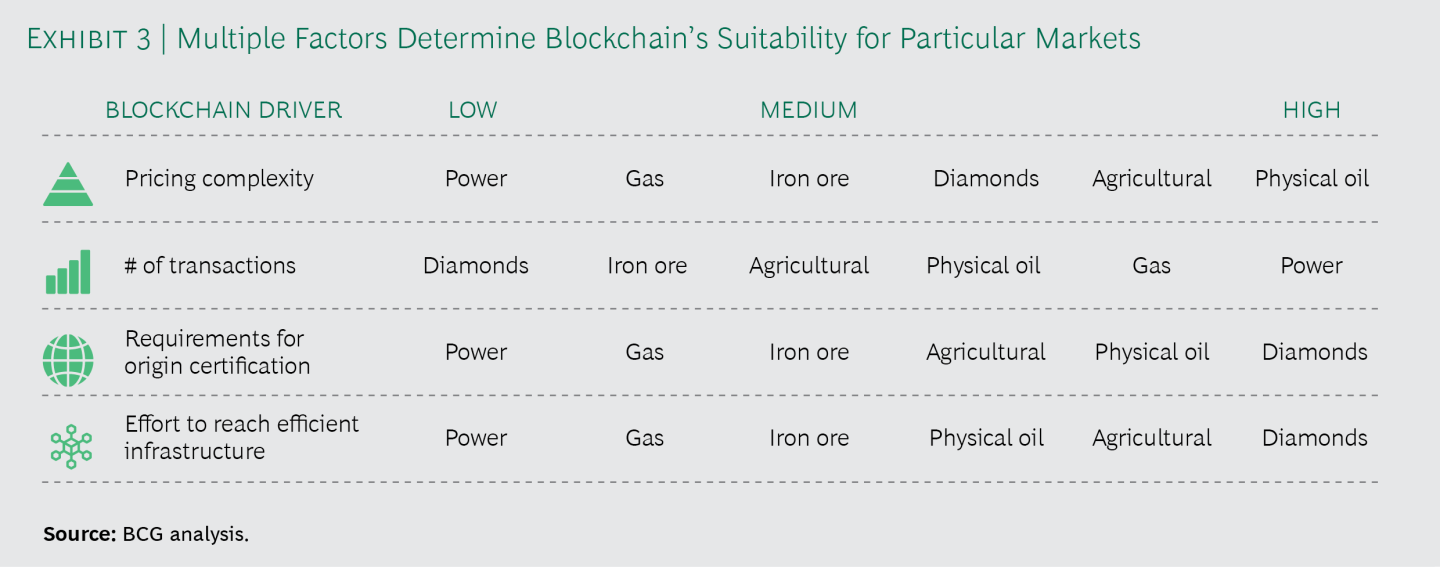

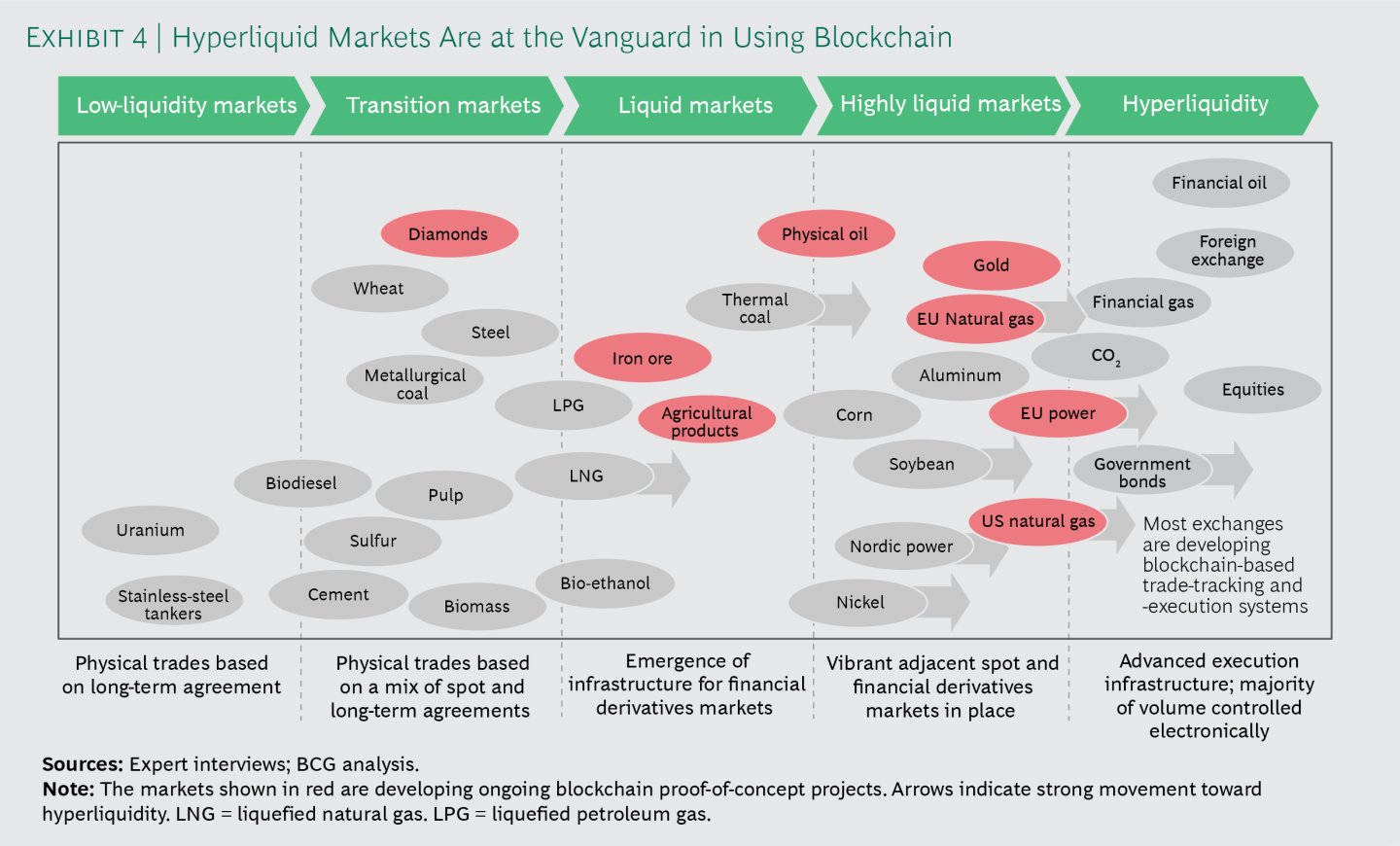

Reality Check BCG examined blockchain’s ability to transform commodity trading in each of the main markets using pricing complexity, particularly how much diversity currently exists in pricing mechanisms and transaction volumes. A more efficient and liquid market, moving commodity trading away from bilateral deals struck directly between two parties to transactions based on electronic platforms that match buyers and sellers may not be far on the horizon.

BCG's concluding recommendationBCG cautions on the complexities and cost of creating new platforms, and recommends collaborative development with partners and regulators to ensure that participants have a clear understanding of the value blockchain can add as well as potential use cases adopting a regional approach, rather than create global solutions.

Pricing and Arbitrage According to BCG, Block Chain’s ability to transparently record complicated transactions, track goods, and reduce fraud superficialy make it a natural fit for the commodity business as most trades would have to be recorded accurately in a shared ledger and participants could compare the price of their consignment against other consignments and thereby spot discrepancies. Greater transparency would lead to fairer prices. However, it would impact the profits of traders that rely on pricing inefficiencies to make money. Price-reporting agencies such as Bloomberg and Platts would also need to find new ways to expand their businesses observes BCG.

Pilot Block Chain Implementations Cutting post-trade processing costs is another potential use of blockchain in commodity trading, with savings of up to 40% across operations, accounting, settlements and IT, according to blockchain developers. Big energy traders are backing blockchain post-trade projects, like Vakt for oil and OneOffice for gas. Wholesale peer-to-peer trading is another application being developed by big European gas and power companies in the Enerchain project. The partners hope to enable large-scale trading, making the project unique in its focus, size, and disruptive potential.

Reality Check BCG examined blockchain’s ability to transform commodity trading in each of the main markets using pricing complexity, particularly how much diversity currently exists in pricing mechanisms and transaction volumes. A more efficient and liquid market, moving commodity trading away from bilateral deals struck directly between two parties to transactions based on electronic platforms that match buyers and sellers may not be far on the horizon.

BCG's concluding recommendationBCG cautions on the complexities and cost of creating new platforms, and recommends collaborative development with partners and regulators to ensure that participants have a clear understanding of the value blockchain can add as well as potential use cases adopting a regional approach, rather than create global solutions.

Labels:

Block Chain,

Boston Consulting Group,

Commodities,

Trading

Wednesday, 29 December 2021

Commodities Lectures Series - Understanding the difference between Sourcing, Origination and Merchandising in commodities trading

Sourcing, Origination and Merchandising have to do with deal flow in a Physical Commodities Trading House.

Sourcing has to do with buying commodities already loaded onto a vessel in a port (Free on Board or FOB). FOB markets are very competitive and timing the purchase is a matter of sheer diligence, network of contacts and often good luck on the part of the Sourcer. Sourcing is very often not a client facing activity but does need extensive networking with carriers and with commodity traders in other geographies. A Sourcer will seek arbitrage opportunities based on their geographic location and the supply/demand in that area (location arbitrage) or time delay between when a particular commodity is bought and the time when it is delivered (time arbitrage) to trade FOB commodities with counterparties.

Origination on the other hand is a strictly client facing activity involving vast knowledge of the trading house's client's markets expanding the trading desk's reach. An Originator engages clients of the trading house and to propose or provide strategic solutions for their particular commodity commercial need through the products and services his trading house provides. Solutions can take the form of mediating a forward delivery of crude to complex, multi year engagement of developing, producing, marketing and selling of an energy producing asset (e.g. natural gas field). Origination often involves purchasing commodities directly from industrial farms, oil drillers or mines, coordinating with other functions of the trading house (trading, structuring, operations, quants, credit, legal, compliance, IT among others) to handle everthing from the logistics to get that commodity from the farm, oil well or mine to a port and shipping it to a client's warehouse, foundry or refinery.

Merchandising is essentially the process of purchasing, transporting and wholesale distributing commodities to end customers over deferred time periods or demand markets. A Merchandiser is often the counterparty from a client's side to an Originator from a trading house. Merchandisers work with Sourcers ad Originators from a trading house in locating, purchasing and customer account management as it relates to a particular commodity. Sourcers and Originators are the supply side of trade, essentially bringing commodities to market where as Merchandising often has to do with demand fulfillment. The full trade cycle can be thought of as Sourcing, Origination and Merchandising.

Origination on the other hand is a strictly client facing activity involving vast knowledge of the trading house's client's markets expanding the trading desk's reach. An Originator engages clients of the trading house and to propose or provide strategic solutions for their particular commodity commercial need through the products and services his trading house provides. Solutions can take the form of mediating a forward delivery of crude to complex, multi year engagement of developing, producing, marketing and selling of an energy producing asset (e.g. natural gas field). Origination often involves purchasing commodities directly from industrial farms, oil drillers or mines, coordinating with other functions of the trading house (trading, structuring, operations, quants, credit, legal, compliance, IT among others) to handle everthing from the logistics to get that commodity from the farm, oil well or mine to a port and shipping it to a client's warehouse, foundry or refinery.

Merchandising is essentially the process of purchasing, transporting and wholesale distributing commodities to end customers over deferred time periods or demand markets. A Merchandiser is often the counterparty from a client's side to an Originator from a trading house. Merchandisers work with Sourcers ad Originators from a trading house in locating, purchasing and customer account management as it relates to a particular commodity. Sourcers and Originators are the supply side of trade, essentially bringing commodities to market where as Merchandising often has to do with demand fulfillment. The full trade cycle can be thought of as Sourcing, Origination and Merchandising.

Labels:

Commodities,

Merchandising,

Origination,

Sourcing,

Trading

Subscribe to:

Comments (Atom)