Without price transparency in physical commodities markets with clear and accessible reference commodities prices, physical commodities traders are in a powerful position to profit as they have a virtual information monopoly. Commodities Trading Companies such as Vitol, Trafigura, Glencore, Gunvor, Louis Dreyfus among others trade physical commodities taking advantage of this price opacity, investing in the physical and human capital necessary to transform commodities while simultaneously hedging their physical trades through financial (paper) trading on exchanges thus taking positions in the futures markets and the physical markets. Commodity trading firms do not tend to speculate on the outright direction of commodity prices, but instead aim to profit on the differential between the untransformed and transformed commodity specializing in (1) the production and analysis of information, buyers and sellers active in the market, supply and demand patterns, price structures (over space, time, and form), transformation technologies, and (2) the utilization of this information to optimize transformations in terms of space, time and form. Commodities trading firms attempt to identify the most valuable of these transformations, undertake the transactions necessary to make these transformations and engage in the physical and operational actions necessary to carry them out.

On top of physical trading, Commodity Trading Companies possess prop paper-trading desks. Using market intelligence coming from physical trading desks and ‘classic’ paper trading skills, these companies make profits on swaps, options and futures. They also use these paper trading books to hedge their physical exposure, which subsequently reduce their risk.These companies develop their own strategies and models - quantitative, computer-algorithm-driven or macro-driven similar to the models used in banks or hedge funds for derivatives pricing and market forecasting. They invest in physical commodities fundamental research to get an edge over their competitors and figure out where the market is going. They have on-site associates at origin and destination (offices in exporting and importing countries) to get a flavor of the local market as well as strong middle and back office for physical trading operations. They are highly skilled at managing their risks and know how to create sustainable and win-win relationships with potential buyers and sellers. Due to rising competition and change in business trends, these companies do invest at the source in mines, Exploration and Production (oil), and also transportation infrastructure such as ports. Vitol/Trafigura physically send ships to collect the cargo from the sellers, the miners and the refineries. Some like Glencore own mines (after buying Xstrata). Glencore is now a mining and trading company besides being a Commodities Trading Company. Trafigura is trading with no mining operations. It buys ore, concentrates or even refined outputs, ships them to the buyers. Trafigura model helps even for smaller operations.

Hedge funds on the other hand rarely trade physical form of commodities or take delivery concentrating only on financial or paper trading. Macro-focused hedge funds seek a hedge against an economic slowdown priced in by the market. Unlike many of their equity fund peers, commodities macro managers of the likes of George Soros and Louis Baconare are not dependent on rising markets for their gains. Rather, they look for volatility in commodities markets through 'Asset backed Trading' - a style of commodity trading which is used to seek and exploit market volatility in order to optimise the operational assets, inventory and future produce owned by trading entities. This is their core activity. However more sophisticated funds would also get into taking proprietary positions, market making and offer structured products to their clients. Hedge funds and Investment banks are beginning to exit the financial trading of commodities making daily price swings far greater than in previous years.

Financial trading is becoming an ever more important part of Commodities producers such as International Oil Majors Shell, BP, Total driven by fears that global oil demand could drop in the next few years as climate change concerns reshape society’s—and investors’—attitudes toward fossil fuel producers. The immense scale of the commodities producers' trading units gives them outsize clout. They have massive trading floors that mirror those of Wall Street’s biggest banks. Being a commodities producer gives an inherently bigger advantage with more reliable market information in trading strategy than commodities traders suchas Vitol/Trafigura. This is also the reason why in recent years, Vitol has started looking for refining and storage assets worldwide to control a bigger chunk of the supply chain. BP controls exploration and production as well, so BP obviously has advantage over oil traders who are unable to control costs associated with these projects and an oil company like BP will make more money when the production cost remains stable while prices rise. The problem for a crude oil trader like Vitol is to anticipate the price rise and buy oil from producers at sufficiently lower price to make a profit. Sometimes, the trading strategy for Vitol is so complex that the wafer thin margins made through a trade are actually made through minimizing on transportation costs of the oil instead of the oil price itself. On one occasion in 2016, for example, Shell bought roughly 70% of the cargoes of North Sea crude available for a particular month, triggering wild price gyrations while squeezing out commodities traders who privately complained to Shell. Commodities producers are also moving into the space formerly occupied by the commodities desks of Investment Banks. Shell, for example, in 2016 became the first nonbank to help the Mexican government hedge its exposure to the price of oil. BP's customers now include banks, hedge funds and private equity firms. Exxon is also hiring experienced oil traders to start making bets with the company’s money.

A blog focused on educating global physical energy commodities participants on evolving financial, regulatory and marketing developments in the Asian commodities markets including use of cryptocurrencies in physical commodities trading. This blog seeks to educate market participants only and does not constitute financial advice.

Showing posts with label Physical commodities. Show all posts

Showing posts with label Physical commodities. Show all posts

Saturday, 20 August 2022

Commodities Lectures Series - Commodity Trading Companies vs Investment Banks and hedge funds vs - a new competitor - Commodity Producers

Labels:

BP,

Commodities Producers,

Commodities Trading Companies,

Glencore,

Gunvor,

Hedge Funds,

Louis Dreyfus,

Oil,

Oil trading,

Physical commodities,

Shell,

Trafigura,

Vitol

Location:

Czechia

Wednesday, 17 August 2022

Commodities Lectures Series - Physical commodities trading vs. Exchange based commodities futures trading

Physical commodities trading is buying commodities from producers, transforming the purchased commodities to maximize their value and selling it to consumers getting maximum margin out of these structured trades. How the trade settles and how the quality of a commodity is assessed relies on the physical commodity itself as they are extraordinarily diverse in terms of location (of both producers and consumers) and physical characteristics. For instance, energy, including crude oil is traded with constant demand and refineries are optimized to process particular types of crude oil - light, heavy, sweet sour, and different refineries are optimized differently for derivative products such as Diesel, Petrochemicals. Purchase of energy commodities is a complex process which involves negotiations of contract floating of tenders, shipping arrangements, unloading at ports, transporting to refineries, refinery complexity and most importantly the discounts offered by the sellers. Given the complexity of the possible transformations, and the ever-changing conditions that affect the efficient set of transformations, physical commodities trading is an inherently dynamic, complex, and highly information-intensive task involving information gathering, analysis and the operational capabilities necessary to respond efficiently to this information.

Physical commodities trading requires matching numerous diverse producers and consumers with heterogeneous and highly idiosyncratic preferences directing resources to their highest value uses in response to price signals requiring strong relationships with market players (buyers and sellers of commodities). Physical commodities markets are mostly cyclic, have a seasonal trend and a convenience yield (the consumer wants it now and is willing to pay a higher price for it). Physical commodities traders search producer side and consumer side of the market to find sellers and buyers (bilateral “search” markets), and match them by buying from the former and selling to the latter in bilateral transactions in between adding value by transforming the commodities. Commodities producers are usually not end users and commodities need to be transported from source to destinations creating bottlenecks and an opportunity to make significant margins for traders. Physical traders can also profit through shipping, warehousing, and trade finance of the commodities. Physical commodities trading is also known as the “spot” or “cash” market.

Physical commodities trading is a human-driven business - Humans and relationships are predominant from the very beginning until the end of the trade. Humans will extract coal and assess the quality of it. Humans will test the quality of coal at loading port and discharging port. Human will negotiate premiums and discounts. Human will react against market movements and sometimes refuse to deliver or receive the commodity if prices go against market direction based on market intelligence.

Electronic Exchanges trading commodities futures are not suited to this matching process. They may be an efficient way to transact highly standardized instruments such as plain-vanilla front month contracts in large quantity, but are not well-adapted to predict the downward or upward price movement on commodities such as natural gas resulting from a pipeline explosion or the reaction of oil prices to a news events about an outbreak of war or comments from a Saudi oil minister. Little physical commodities actually change hands with futures trades, which take place on two main exchanges in the US, CME Group and the Intercontinental Exchange. In some commodities such as oil, futures trading has come to dwarf the physical trade, with as much as 13 times the physical amount of oil traded via these purely financial contracts which determines the price of oil. According to data provided by the CME Group, the amount of crude oil futures contracts traded daily on its platform rose in 2022 over 2021 and is nearly double that of a decade ago. For example, Total Energies, the French Oil supermajor may trade 7 million barrels of physical oil a day, but on the same day will electronically trade the equivalent of 31 million barrels of oil futures and options on an electronic exchange.

Physical commodities trading requires matching numerous diverse producers and consumers with heterogeneous and highly idiosyncratic preferences directing resources to their highest value uses in response to price signals requiring strong relationships with market players (buyers and sellers of commodities). Physical commodities markets are mostly cyclic, have a seasonal trend and a convenience yield (the consumer wants it now and is willing to pay a higher price for it). Physical commodities traders search producer side and consumer side of the market to find sellers and buyers (bilateral “search” markets), and match them by buying from the former and selling to the latter in bilateral transactions in between adding value by transforming the commodities. Commodities producers are usually not end users and commodities need to be transported from source to destinations creating bottlenecks and an opportunity to make significant margins for traders. Physical traders can also profit through shipping, warehousing, and trade finance of the commodities. Physical commodities trading is also known as the “spot” or “cash” market.

Physical commodities trading is a human-driven business - Humans and relationships are predominant from the very beginning until the end of the trade. Humans will extract coal and assess the quality of it. Humans will test the quality of coal at loading port and discharging port. Human will negotiate premiums and discounts. Human will react against market movements and sometimes refuse to deliver or receive the commodity if prices go against market direction based on market intelligence.

Electronic Exchanges trading commodities futures are not suited to this matching process. They may be an efficient way to transact highly standardized instruments such as plain-vanilla front month contracts in large quantity, but are not well-adapted to predict the downward or upward price movement on commodities such as natural gas resulting from a pipeline explosion or the reaction of oil prices to a news events about an outbreak of war or comments from a Saudi oil minister. Little physical commodities actually change hands with futures trades, which take place on two main exchanges in the US, CME Group and the Intercontinental Exchange. In some commodities such as oil, futures trading has come to dwarf the physical trade, with as much as 13 times the physical amount of oil traded via these purely financial contracts which determines the price of oil. According to data provided by the CME Group, the amount of crude oil futures contracts traded daily on its platform rose in 2022 over 2021 and is nearly double that of a decade ago. For example, Total Energies, the French Oil supermajor may trade 7 million barrels of physical oil a day, but on the same day will electronically trade the equivalent of 31 million barrels of oil futures and options on an electronic exchange.

Labels:

Futures,

Oil,

Oil trading,

Physical commodities,

Trading

Location:

New Jersey, USA

Monday, 15 August 2022

New paradigm shift in India’s energy trade - evidence in charts

An unprecedented paradigm shift is evolving in the energy commodities trade of India, the world’s third-largest oil consumer after the US and China, and second largest oil importer after China importing over 85 percent of its crude needs. Despite being the second largest coal producer in the world, India is also the world’s second largest coal importer as new power plants designed to use only high grade imported coal (17.6 GW or 8.6% of the 204.9 GW installed power generation capacity) while older power plants import the fuel for blending with domestic coal according to S&P Global. Indian Ministry of Commerce’s Export & Import Data Bank (EIDB) points to crude oil imports worth US$ 122.45 billion and around 173.32 million tons of coal imports worth US$ 30.6 billion in the year 2021-22.

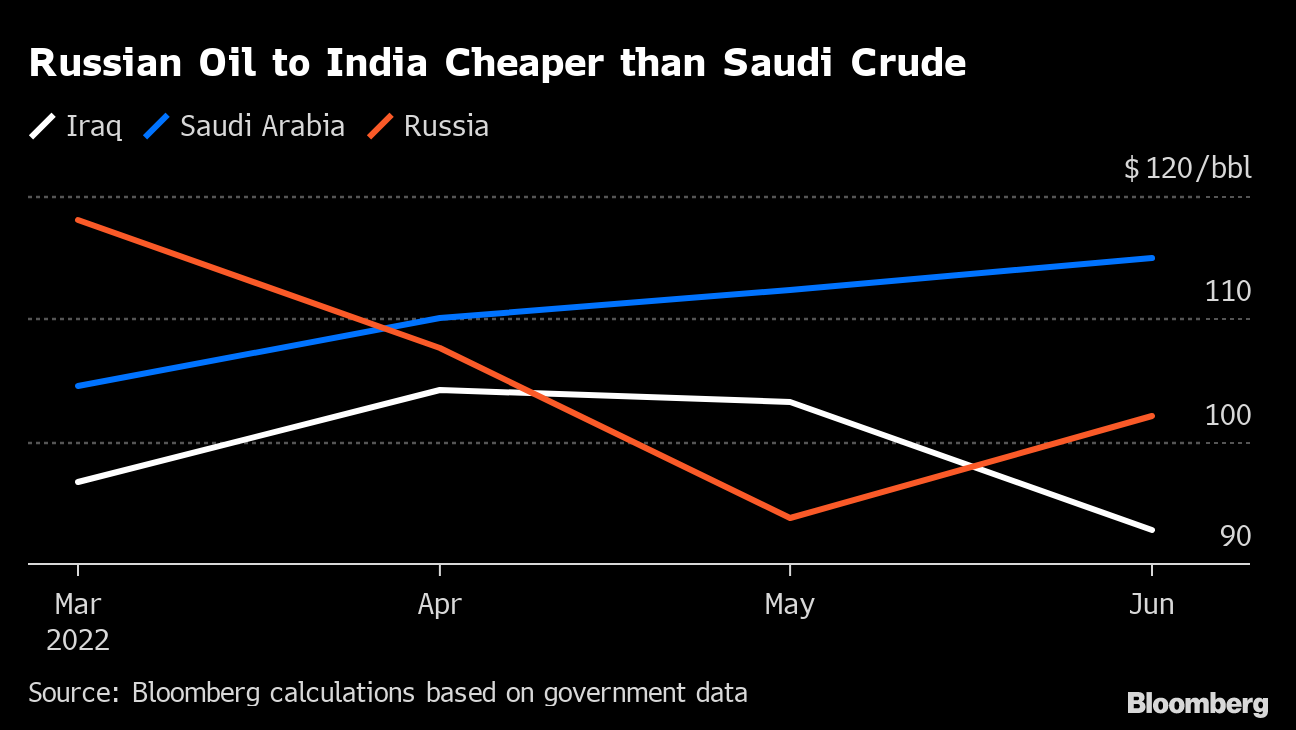

In a new paradigm shift, according to analysis by Bloomberg, Russia surpassed Saudi Arabia as the second-biggest supplier of crude to India in June 2022, ranked just behind Iraq.

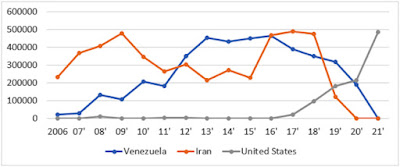

In comparison, India’s imports of U.S. oil and gas commodities which grew from $4.1 billion in 2018 to $5.5 billion in 2020 roughly halved by July 2021 and the US is no longer among India’s top oil suppliers according to the oil ministry’s Petroleum Planning & Analysis Cell.

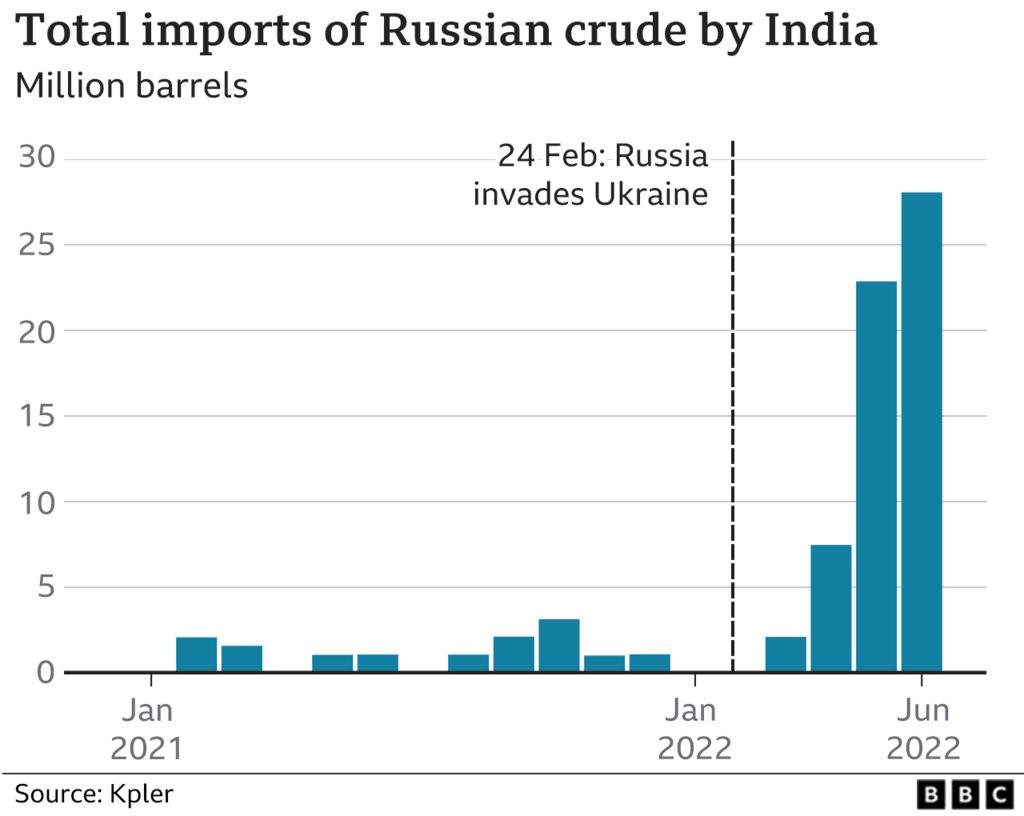

With economic growth expected to rise to 8% this year, Indian state refiners which dominate fuel retailing are in the market for the lowest priced crude that works with their refinery and product configurations via open tenders. The discount of Russian Urals crude to Brent crude was around $30 per barrel with bigger discounts to other medium-sour grades typically sold to India such as Oman and Upper Zakum reflecting the huge risk premium the market requires to transact on Russian cargoes according to Kpler. In 2021, only around 2% of India’s total oil imports (12 million barrels or 33,000 barrels a day on average of Urals crude) came from Russia, according to Kpler.

Urals oil contracts for India rose from nothing in January 2022 to 300,000 barrels a day in March to 700,000 a day in April totaling around 26 million barrels ending June 2022 according to Kpler. The India-bound Russian tankers head into Jamnagar, in the western state of Gujarat, where Reliance Industries has the world’s largest refinery complex, and into the Vadinar refinery of Nayara Energy an affiliate of Rosneft, the Russian state company which alone imports crude oil worth about $1bn every month or 400,000 barrels per day on average.

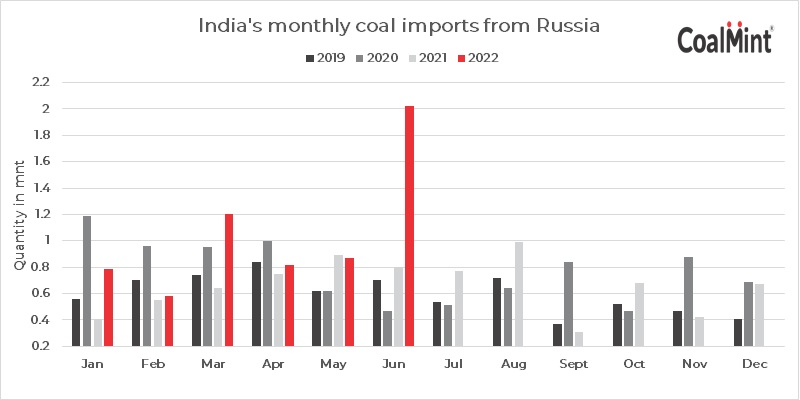

This paradigm shift in India’s energy trade is not limited to oil. Russia became India's third-largest coal supplier in July 2022 after Indonesia and Australia, with imports from Russia jumping 70.3% to a new record of 2.06 million mt, per Coalmint data. In comparison, thermal coal imports from the US fell 52% on the year to 3.4 million mt over the same time. Russian imports to India are expected to rise even higher due to a wider coal shortage during the third quarter of 2022 exacerbated by higher electricity demand. Steep discounts offered by Russian suppliers for thermal coal and Urals crude as global prices trade at near-record highs due to western sanctions are not the only reason for this paradigm shift. India is also exploring alternative payment channels for trade with Russia including allowing payments for energy commodities in the Indian rupee or settling the trade in other Asian currencies furthering this new paradigm.

This paradigm shift in India’s energy trade is not limited to oil. Russia became India's third-largest coal supplier in July 2022 after Indonesia and Australia, with imports from Russia jumping 70.3% to a new record of 2.06 million mt, per Coalmint data. In comparison, thermal coal imports from the US fell 52% on the year to 3.4 million mt over the same time. Russian imports to India are expected to rise even higher due to a wider coal shortage during the third quarter of 2022 exacerbated by higher electricity demand. Steep discounts offered by Russian suppliers for thermal coal and Urals crude as global prices trade at near-record highs due to western sanctions are not the only reason for this paradigm shift. India is also exploring alternative payment channels for trade with Russia including allowing payments for energy commodities in the Indian rupee or settling the trade in other Asian currencies furthering this new paradigm.

Labels:

Coal,

Energy,

India Oil Imports,

Indian rupee,

Physical commodities,

Russia,

Trading

Location:

New Jersey, USA

Subscribe to:

Comments (Atom)