An unprecedented paradigm shift is evolving in the energy commodities trade of India, the world’s third-largest oil consumer after the US and China, and second largest oil importer after China importing over 85 percent of its crude needs. Despite being the second largest coal producer in the world, India is also the world’s second largest coal importer as new power plants designed to use only high grade imported coal (17.6 GW or 8.6% of the 204.9 GW installed power generation capacity) while older power plants import the fuel for blending with domestic coal according to S&P Global. Indian Ministry of Commerce’s Export & Import Data Bank (EIDB) points to crude oil imports worth US$ 122.45 billion and around 173.32 million tons of coal imports worth US$ 30.6 billion in the year 2021-22.

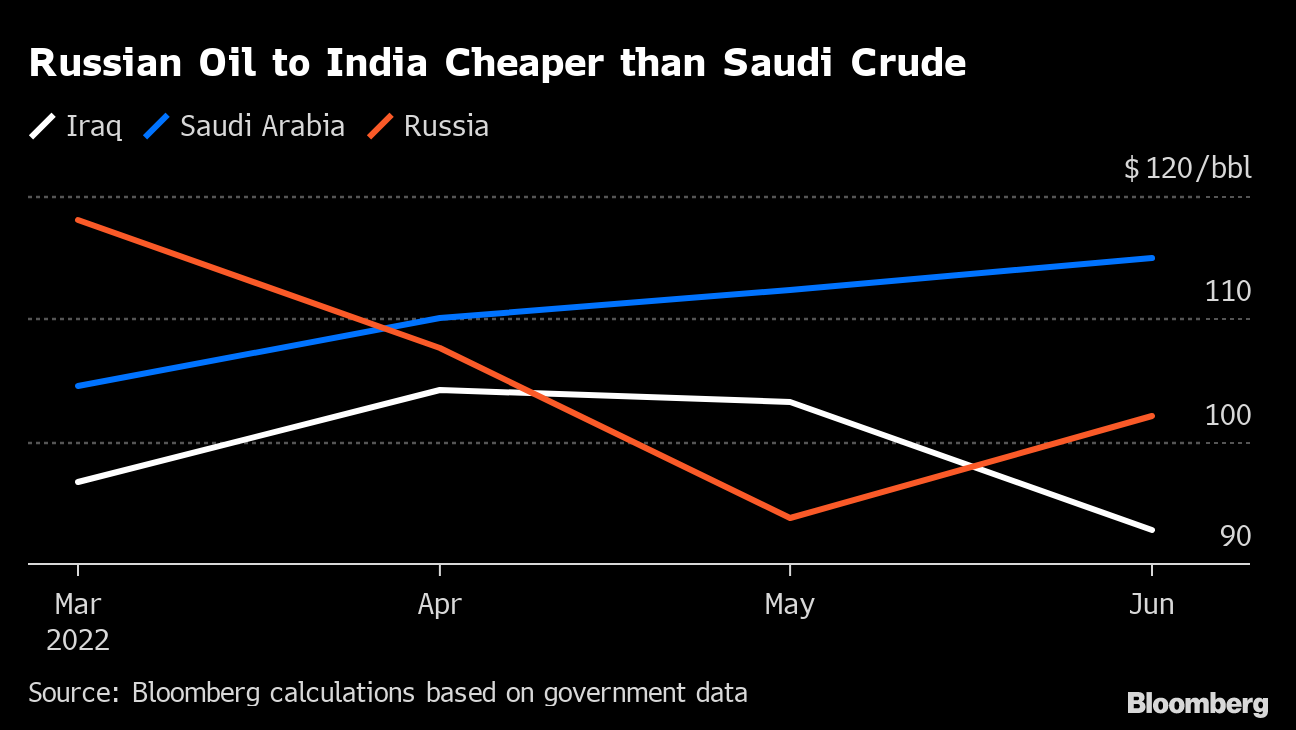

In a new paradigm shift, according to analysis by Bloomberg, Russia surpassed Saudi Arabia as the second-biggest supplier of crude to India in June 2022, ranked just behind Iraq.

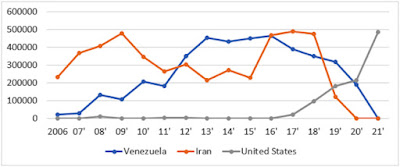

In comparison, India’s imports of U.S. oil and gas commodities which grew from $4.1 billion in 2018 to $5.5 billion in 2020 roughly halved by July 2021 and the US is no longer among India’s top oil suppliers according to the oil ministry’s Petroleum Planning & Analysis Cell.

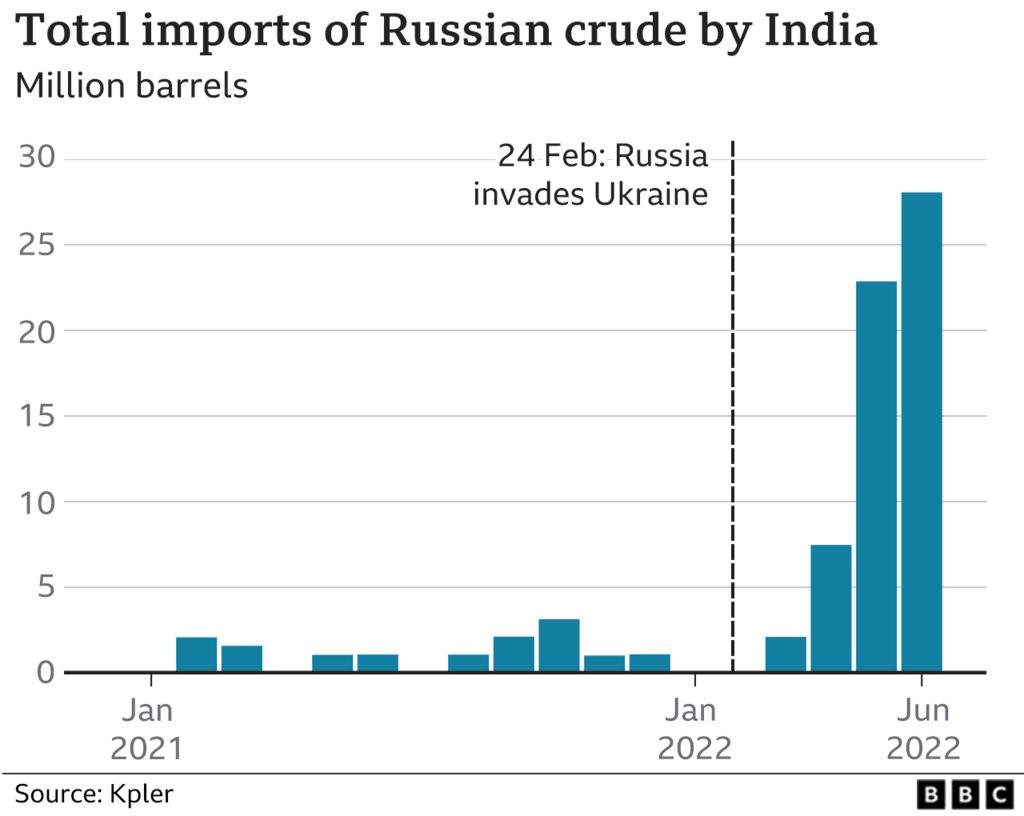

With economic growth expected to rise to 8% this year, Indian state refiners which dominate fuel retailing are in the market for the lowest priced crude that works with their refinery and product configurations via open tenders. The discount of Russian Urals crude to Brent crude was around $30 per barrel with bigger discounts to other medium-sour grades typically sold to India such as Oman and Upper Zakum reflecting the huge risk premium the market requires to transact on Russian cargoes according to Kpler. In 2021, only around 2% of India’s total oil imports (12 million barrels or 33,000 barrels a day on average of Urals crude) came from Russia, according to Kpler.

Urals oil contracts for India rose from nothing in January 2022 to 300,000 barrels a day in March to 700,000 a day in April totaling around 26 million barrels ending June 2022 according to Kpler. The India-bound Russian tankers head into Jamnagar, in the western state of Gujarat, where Reliance Industries has the world’s largest refinery complex, and into the Vadinar refinery of Nayara Energy an affiliate of Rosneft, the Russian state company which alone imports crude oil worth about $1bn every month or 400,000 barrels per day on average.

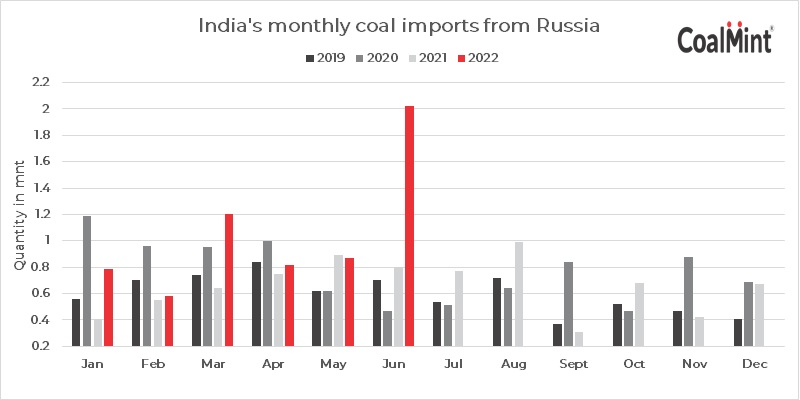

This paradigm shift in India’s energy trade is not limited to oil. Russia became India's third-largest coal supplier in July 2022 after Indonesia and Australia, with imports from Russia jumping 70.3% to a new record of 2.06 million mt, per Coalmint data. In comparison, thermal coal imports from the US fell 52% on the year to 3.4 million mt over the same time. Russian imports to India are expected to rise even higher due to a wider coal shortage during the third quarter of 2022 exacerbated by higher electricity demand.

Steep discounts offered by Russian suppliers for thermal coal and Urals crude as global prices trade at near-record highs due to western sanctions are not the only reason for this paradigm shift. India is also exploring alternative payment channels for trade with Russia including allowing payments for energy commodities in the Indian rupee or settling the trade in other Asian currencies furthering this new paradigm.

A blog focused on educating global physical energy commodities participants on evolving financial, regulatory and marketing developments in the Asian commodities markets including use of cryptocurrencies in physical commodities trading. This blog seeks to educate market participants only and does not constitute financial advice.

Showing posts with label Energy. Show all posts

Showing posts with label Energy. Show all posts

Monday, 15 August 2022

Friday, 14 January 2022

Commodities Lectures Series - Block Chains vs. Investment Banks in physical commodities trading

Investment Banks have commodities units that make money in three major ways:

1. By helping corporations involved in the physical side of the commodities buisness to hedge their exposure to changing commodity prices through instruments such as exchange-traded futures, options and swaps to curb the cost of big run ups in the price of raw materials needed to purchase.

2. The second way was owning physical assets that dealt directly with raw materials - for example refineries and coal mines to running gasoline storage silos.

3. The third and most lucrative way is house trading or prop trading which is done in several ways - from a client flow trade that requires the Investment Bank to take positions the bank otherwise wouldn't have wanted. For example betting that natural gas prices would fall at a time when consensus was for it to go higher. Another form of prop trading is to use internal Bank's capital to take profitable positions. By early 2000s analysts estimate that prop trading accounted for at least a quarter of Goldman's pretax income.

BCG's strategic view on the role of Block Chain in Physical commodities trading illustrated how recording commodities transactions on a blockchain results in greater transparency and fairer prices. This would seriously impact the commodities prop trading of Investment Banks which rely on informal channels such as instant messaging to negotiate deals taking advantage of price information inefficiencies.

Real-time settlement provided by Block Chains could eliminate clearing risk with fraudulent or poor quality physical delivery of goods forcing Investment Banks acting as counterparties to release collateral earlier eliminating storage profits as was the case with aluminum storage with Goldman Sachs and The London Metal Exchange.

Block Chains can also disintermediate investment banks in commodity markets with low pricing complexity and low degree of diversity in pricing mechanisms such as Power. EnerChain, the world’s first trading tool for large-scale wholesale peer-to-peer energy trading over the blockchain developed by big European gas and power companies consortium achieves exactly this disintermediation through Block chain based trust, security and transparency between the market participants.

These Consortium permissioned blockchains governed by a group of commodtities participants has the most disruptive potential to align market participants towards real-time streamlining of matching, clearing and settlement of trades, asset exchange, standardization and wholesale peer-to-peer trading. In 2019, EnHelix Marketplace, a Block Chain based marketplace to streamline scheduling, nomination, and billing operations for midstream natural gas market participants including cargo brokers, and logistics companies was unveiled at the Gastech energy conference in Singapore. This HyperLedger based distributed ledger streamlines commodities trading with applications supporting every step of the process from pre-trade KYC, trade execution to post-trade risk management with smart contracts making these energy trades faster and more organized for market participants.Consortium blockchains are more decentralized thereby resulting in higher levels of security. That being said, setting up such consortiums around physical commodities trading can be a fraught process as it requires cooperation between all the participants and presents logistical challenges as well as potential antitrust risk.

1. By helping corporations involved in the physical side of the commodities buisness to hedge their exposure to changing commodity prices through instruments such as exchange-traded futures, options and swaps to curb the cost of big run ups in the price of raw materials needed to purchase.

2. The second way was owning physical assets that dealt directly with raw materials - for example refineries and coal mines to running gasoline storage silos.

3. The third and most lucrative way is house trading or prop trading which is done in several ways - from a client flow trade that requires the Investment Bank to take positions the bank otherwise wouldn't have wanted. For example betting that natural gas prices would fall at a time when consensus was for it to go higher. Another form of prop trading is to use internal Bank's capital to take profitable positions. By early 2000s analysts estimate that prop trading accounted for at least a quarter of Goldman's pretax income.

BCG's strategic view on the role of Block Chain in Physical commodities trading illustrated how recording commodities transactions on a blockchain results in greater transparency and fairer prices. This would seriously impact the commodities prop trading of Investment Banks which rely on informal channels such as instant messaging to negotiate deals taking advantage of price information inefficiencies.

Real-time settlement provided by Block Chains could eliminate clearing risk with fraudulent or poor quality physical delivery of goods forcing Investment Banks acting as counterparties to release collateral earlier eliminating storage profits as was the case with aluminum storage with Goldman Sachs and The London Metal Exchange.

Block Chains can also disintermediate investment banks in commodity markets with low pricing complexity and low degree of diversity in pricing mechanisms such as Power. EnerChain, the world’s first trading tool for large-scale wholesale peer-to-peer energy trading over the blockchain developed by big European gas and power companies consortium achieves exactly this disintermediation through Block chain based trust, security and transparency between the market participants.

These Consortium permissioned blockchains governed by a group of commodtities participants has the most disruptive potential to align market participants towards real-time streamlining of matching, clearing and settlement of trades, asset exchange, standardization and wholesale peer-to-peer trading. In 2019, EnHelix Marketplace, a Block Chain based marketplace to streamline scheduling, nomination, and billing operations for midstream natural gas market participants including cargo brokers, and logistics companies was unveiled at the Gastech energy conference in Singapore. This HyperLedger based distributed ledger streamlines commodities trading with applications supporting every step of the process from pre-trade KYC, trade execution to post-trade risk management with smart contracts making these energy trades faster and more organized for market participants.Consortium blockchains are more decentralized thereby resulting in higher levels of security. That being said, setting up such consortiums around physical commodities trading can be a fraught process as it requires cooperation between all the participants and presents logistical challenges as well as potential antitrust risk.

Labels:

Block Chain,

Commodities,

Energy,

Goldman Sachs,

Investment Banks

Tuesday, 4 January 2022

Spot Markets in Coal, Electricity and Gold on the horizon in India to coincide with privatized coal mining and gold refining

Spot trading in Coal is on the horizon according to the Securities and Exchange Board of India (SEBI) to coincide with commercial coal mines becoming operational in this decade when 40 per cent of the coal in India will be mined by companies other than State run monopoly Coal India Ltd. India's coal imports have increased largely because of demand from new power plants which are designed to use only high grade imported coal.India imported 215 million tons in 2020-21 mostly from Australia, South Africa and Indonesia. Anil Kumar Jain, India's coal secretary, said in October that the country plans to eliminate imports of thermal coal by 2024.

India’s rush towards renewables is projected to boost trading on the energy spot market to more than quadruple in two years, according to Bloomberg. The share of power under long term contracts is expected to drop between 50 to 60 percent in the next few years.

In a separte report from the World Gold Council (WGC), titled Bullion Trade in India, part of a series of in-depth analyses on India’s bullion market, increasing import of gold doré — a semi-pure alloy of gold and silver — in the last few years has led to a massive expansion of gold refineries in India. The number of refineries rose from 3 in 2012 to 32 in 2020 with a combined refining capacity of 1,200- 1,400 tonnes. Of these, 23 refineries imported doré in 2020 and the top five refineries accounted for more than 70 percent of India’s doré imports.

According to WGC, bullion banking is one of the key pillars to address multiple challenges faced by India’s gold market, such as a lack of quality assurance, the unorganised state of the market and a lack of trust in international markets but with bullion banks like Bank of Nova Scotia exiting their precious metals business and many large bullion dealers (previously clients of the banks) setting up their own refineries, banks’ share of official imports shrank from 40 percent in 2017 to 19 percent in 2020 as the business shifted to refineries.

In a separte report from the World Gold Council (WGC), titled Bullion Trade in India, part of a series of in-depth analyses on India’s bullion market, increasing import of gold doré — a semi-pure alloy of gold and silver — in the last few years has led to a massive expansion of gold refineries in India. The number of refineries rose from 3 in 2012 to 32 in 2020 with a combined refining capacity of 1,200- 1,400 tonnes. Of these, 23 refineries imported doré in 2020 and the top five refineries accounted for more than 70 percent of India’s doré imports.

According to WGC, bullion banking is one of the key pillars to address multiple challenges faced by India’s gold market, such as a lack of quality assurance, the unorganised state of the market and a lack of trust in international markets but with bullion banks like Bank of Nova Scotia exiting their precious metals business and many large bullion dealers (previously clients of the banks) setting up their own refineries, banks’ share of official imports shrank from 40 percent in 2017 to 19 percent in 2020 as the business shifted to refineries.

Subscribe to:

Comments (Atom)