Investment Banks have commodities units that make money in three major ways:

1. By helping corporations involved in the physical side of the commodities buisness to hedge their exposure to changing commodity prices through instruments such as exchange-traded futures, options and swaps to curb the cost of big run ups in the price of raw materials needed to purchase.

2. The second way was owning physical assets that dealt directly with raw materials - for example refineries and coal mines to running gasoline storage silos.

3. The third and most lucrative way is house trading or prop trading which is done in several ways - from a client flow trade that requires the Investment Bank to take positions the bank otherwise wouldn't have wanted. For example betting that natural gas prices would fall at a time when consensus was for it to go higher. Another form of prop trading is to use internal Bank's capital to take profitable positions. By early 2000s analysts estimate that prop trading accounted for at least a quarter of Goldman's pretax income.

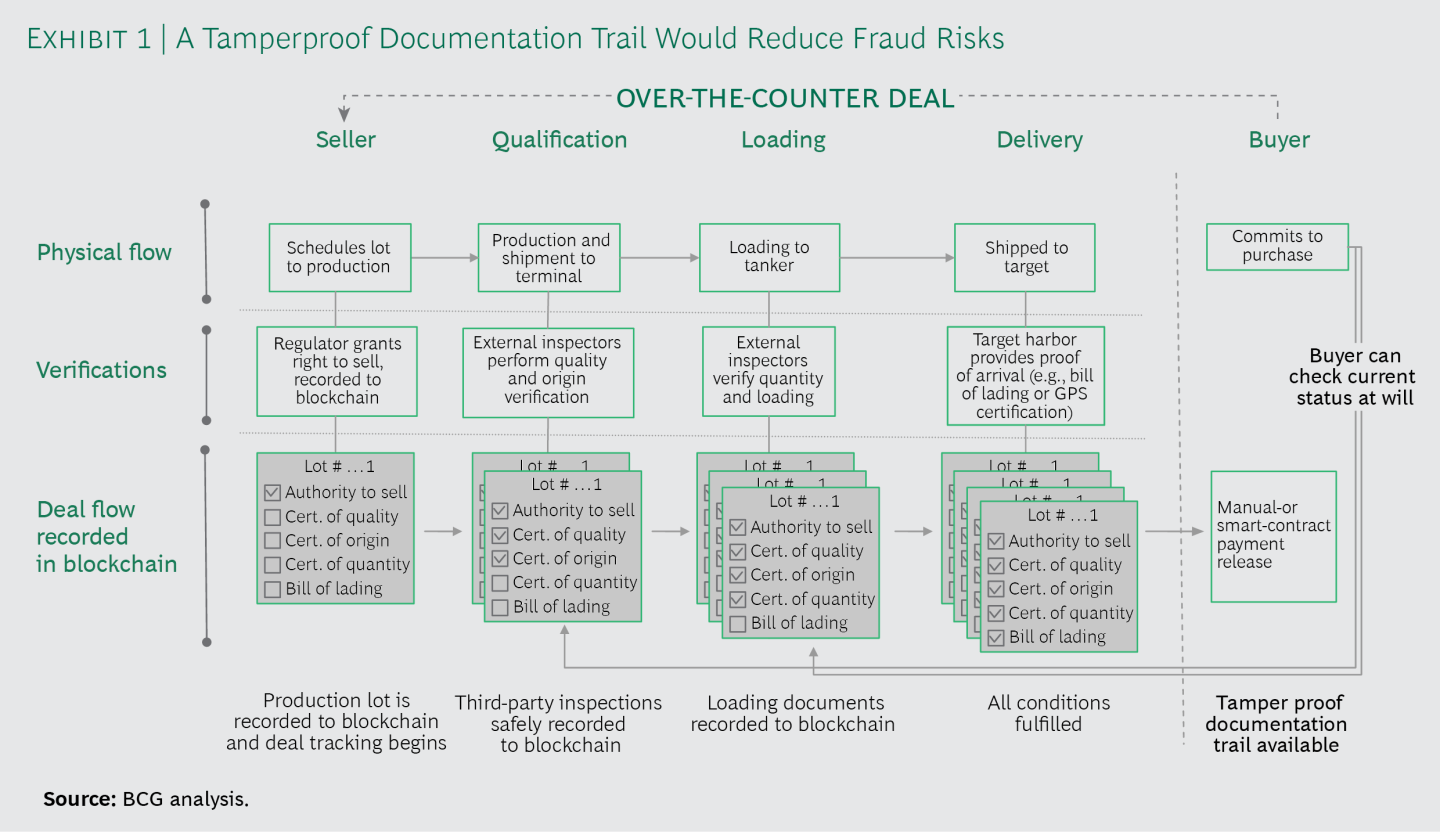

BCG's strategic view on the role of Block Chain in Physical commodities trading illustrated how recording commodities transactions on a blockchain results in greater transparency and fairer prices. This would seriously impact the commodities prop trading of Investment Banks which rely on informal channels such as instant messaging to negotiate deals taking advantage of price information inefficiencies.

Real-time settlement provided by Block Chains could eliminate clearing risk with fraudulent or poor quality physical delivery of goods forcing Investment Banks acting as counterparties to release collateral earlier eliminating storage profits as was the case with aluminum storage with Goldman Sachs and The London Metal Exchange.

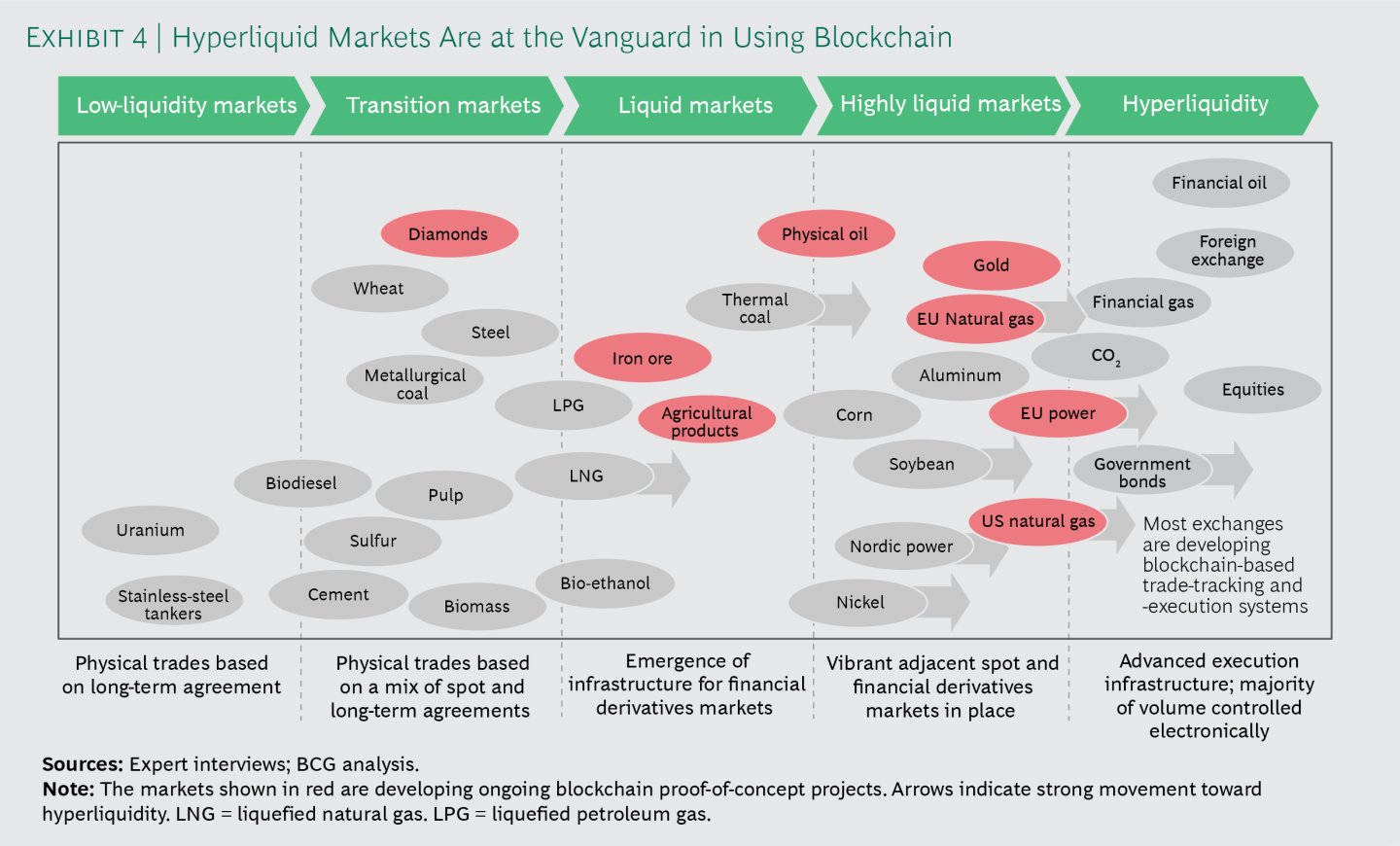

Block Chains can also disintermediate investment banks in commodity markets with low pricing complexity and low degree of diversity in pricing mechanisms such as Power. EnerChain, the world’s first trading tool for large-scale wholesale peer-to-peer energy trading over the blockchain developed by big European gas and power companies consortium achieves exactly this disintermediation through Block chain based trust, security and transparency between the market participants.

These Consortium permissioned blockchains governed by a group of commodtities participants has the most disruptive potential to align market participants towards real-time streamlining of matching, clearing and settlement of trades, asset exchange, standardization and wholesale peer-to-peer trading. In 2019, EnHelix Marketplace, a Block Chain based marketplace to streamline scheduling, nomination, and billing operations for midstream natural gas market participants including cargo brokers, and logistics companies was unveiled at the Gastech energy conference in Singapore. This HyperLedger based distributed ledger streamlines commodities trading with applications supporting every step of the process from pre-trade KYC, trade execution to post-trade risk management with smart contracts making these energy trades faster and more organized for market participants.Consortium blockchains are more decentralized thereby resulting in higher levels of security. That being said, setting up such consortiums around physical commodities trading can be a fraught process as it requires cooperation between all the participants and presents logistical challenges as well as potential antitrust risk.

A blog focused on educating global physical energy commodities participants on evolving financial, regulatory and marketing developments in the Asian commodities markets including use of cryptocurrencies in physical commodities trading. This blog seeks to educate market participants only and does not constitute financial advice.

Showing posts with label Commodities. Show all posts

Showing posts with label Commodities. Show all posts

Friday, 14 January 2022

Thursday, 13 January 2022

Physical commodities may be entering a new supercycle from the beginning of 2022

The US Energy Information Administration reported in early January 2022, that while energy prices in the S&P Goldman Sachs Commodity Index (GSCI) ended 2021 59% higher, most other commodity indexes included in the GSCI increased by about 20%. Sharp price increases were largely driven by increased demand from the initial phase of global economic recovery from the COVID-19 pandemic. Goldman Sachs also seems very bullish on commodities even projecting a long supercycle for years to come.

The last time physical commodities were in a supercycle was in the 2000s when commodities were rocketing to their all time highs. This supercycle fizzled to an end at the end of that decade. In October 2012, Goldman Sach's Jeff Currie, then a commodities analyst, now the global head of commodities research observed at the London Metal Exchange meeting that the collective assets under management were the lowest they had been in a decade in commodities focused hedge-funds and the average commodity fund in 2012 was on track to lose close to 3%.

The last time physical commodities were in a supercycle was in the 2000s when commodities were rocketing to their all time highs. This supercycle fizzled to an end at the end of that decade. In October 2012, Goldman Sach's Jeff Currie, then a commodities analyst, now the global head of commodities research observed at the London Metal Exchange meeting that the collective assets under management were the lowest they had been in a decade in commodities focused hedge-funds and the average commodity fund in 2012 was on track to lose close to 3%.

Labels:

Commodities,

Goldman Sachs,

Supercycle,

US EIA

Thursday, 6 January 2022

Increased regulatory scrutiny of Fintech in Commodities Trading may impact Smart Contracts and Cryptocurrencies significantly

Back in October 2018, Brian Quintenz, the commissioner of CFTC, in a speech in Dubai, questioned the use of smart contracts in Commodities Futures Trading within the CFTC’s jurisdiction asking: "is the method by which it is being transacted on the blockchain compliant with CFTC regulations? If the contract is a swap, is it being offered to retail participants? Is it a product that must be traded on an exchange? Does the protocol itself perform exchange-like functions by facilitating trading, thereby potentially implicating registration requirements?". While the commissioner acknowledged that many smart contracts operate entirely outside of the CFTC’s jurisdiction, the open question was “if a smart contract is violative of CFTC regulation, then who is subject to an enforcement action?” The answer, implicitly holds the developers of the blockchain and the general users responsible, as they are typically unable to assess or police the legality of each application of the blockchain.

In 2018, the CFTC had issued a primer on understanding smart contracts and their potential use cases.

Similarly, Congressional scrutiny of cryptocurrencies is increasing regulatory pressure on stablecoins and other cryptocurrencies and have the potential to destabilize the global monetary system In an interview with Bloomberg in August 2021, John Paulson predicted that “Cryptocurrencies, regardless of where they’re trading today, will eventually prove to be worthless. Once the exuberance wears off, or liquidity dries up, they will go to zero.”. The selloff in Bitcoin on January 5th, 2022 as the Fed and other central banks pare back on excess-liquidity measures and prime the markets for higher rates in 2022 points to a vindication of Mr. Paulson's pediction. Barron's highlighted the selloff as another sign that Bitcoin is acting more like a tech stock than an inflation-fighting store of value–or digital gold, as its proponents argue.

Similarly, Congressional scrutiny of cryptocurrencies is increasing regulatory pressure on stablecoins and other cryptocurrencies and have the potential to destabilize the global monetary system In an interview with Bloomberg in August 2021, John Paulson predicted that “Cryptocurrencies, regardless of where they’re trading today, will eventually prove to be worthless. Once the exuberance wears off, or liquidity dries up, they will go to zero.”. The selloff in Bitcoin on January 5th, 2022 as the Fed and other central banks pare back on excess-liquidity measures and prime the markets for higher rates in 2022 points to a vindication of Mr. Paulson's pediction. Barron's highlighted the selloff as another sign that Bitcoin is acting more like a tech stock than an inflation-fighting store of value–or digital gold, as its proponents argue.

Labels:

Bitcoin,

CFTC,

Commodities,

Congress,

Regulation,

Trading

Monday, 3 January 2022

Gold imports continue to rise (and shine) in the world's second largest gold consumer market

India imported gold worth $34.6 billion in 2020 against $28.2 billion in 2019 with Swiss gold imports accounting for almost half at $16.3 billion. According to Bloomberg, India's gold imports at 900 tons in 2021, up from 350 tons in 2020 are set to be the highest in six years:

India is the world’s second-biggest gold consumer and imports almost all the metal it consumes with the World Gold Council has estimating that sales in the peak October to December period to be the best in at least a decade. The Securities and Exchange Board of India has allowed setting up Gold Exchanges from 2022 where trading in the form of electronic gold receipts (EGRs) at the excahnge is expected to help with a transparent domestic spot price discovery mechanism. The denomination for trading of EGRs and conversion of an EGR into gold is left to the exchanges but EGR trading will be subject to securities transaction tax and goods and services tax.The Directorate General of Foreign Trade issues license to entitities such as the State Trading Corporation (STC) of India to import gold in the form of 100 gm and 1 Kg bars with 0.995 and 0.999 purity, for Indian traders or jewellery manufacturers.

Coal continues to be surprisingly a strongly traded commodity in Asian Markets

Who would have ever thought that Coal, a much hated and maligned commodity would continue to be a strongly traded commodity in 2022? Indonesia, a leading exporter of thermal coal banned the shipments of coal on New Years Day 2022, causing a surge in coal prices. This follows on a record $158 per tonne in October, though it slipped $68 on Dec. 29 according to Refinitiv and Kpler.

A report published in December 2021 by China's State Grid Corporation outlined China's plans to build as much as 150 gigawatts (GW) of new coal-fired power capacity over the 2021-2025 period, bringing the total to 1,230 GW as the first 1,000-megawatt unit of the Coal powered Shanghaimiao plant, the biggest of its kind was completed. The plant will eventually have four generating units adding to more than half of global coal-fired power generation, a 9% year-on-year increase in 2021, according to a report from International Energy Agency published in December 2021, even as US coal powered plans continue to close.

China (US$16.4 billion - 17.3%), Japan - ($15.95 billion - 16.8%) and India ($15.87 billion - 16.7%) were the biggest importers of coal in 2020 compared to China ($19.6 billion - 12.9%), India - $24.6 billion (16.2%) and Japan (US$25.4 billion - 16.7% of total coal imports) in 2019 as reported by Caixin. These three Asian giants will continue to be major Coal commodities players for at least the next decade.

China (US$16.4 billion - 17.3%), Japan - ($15.95 billion - 16.8%) and India ($15.87 billion - 16.7%) were the biggest importers of coal in 2020 compared to China ($19.6 billion - 12.9%), India - $24.6 billion (16.2%) and Japan (US$25.4 billion - 16.7% of total coal imports) in 2019 as reported by Caixin. These three Asian giants will continue to be major Coal commodities players for at least the next decade.

Labels:

China,

Coal,

Commodities,

India,

Japan

Friday, 31 December 2021

BCG's strategic view on the role of Block Chain in Physical Commodities trading

Back in 2018, the German electric utilities company e.ON's Thorsten Kuehnel observed that “The potential of blockchain technology lies in disintermediation. This creates true disruption; everything else is incremental innovation or optimization.” BCG, a global consulting firm, along the same lines issued a publication outlining their strategic view on the role of Block Chain in Physical Commodities trading:

Pricing and Arbitrage According to BCG, Block Chain’s ability to transparently record complicated transactions, track goods, and reduce fraud superficialy make it a natural fit for the commodity business as most trades would have to be recorded accurately in a shared ledger and participants could compare the price of their consignment against other consignments and thereby spot discrepancies. Greater transparency would lead to fairer prices. However, it would impact the profits of traders that rely on pricing inefficiencies to make money. Price-reporting agencies such as Bloomberg and Platts would also need to find new ways to expand their businesses observes BCG.

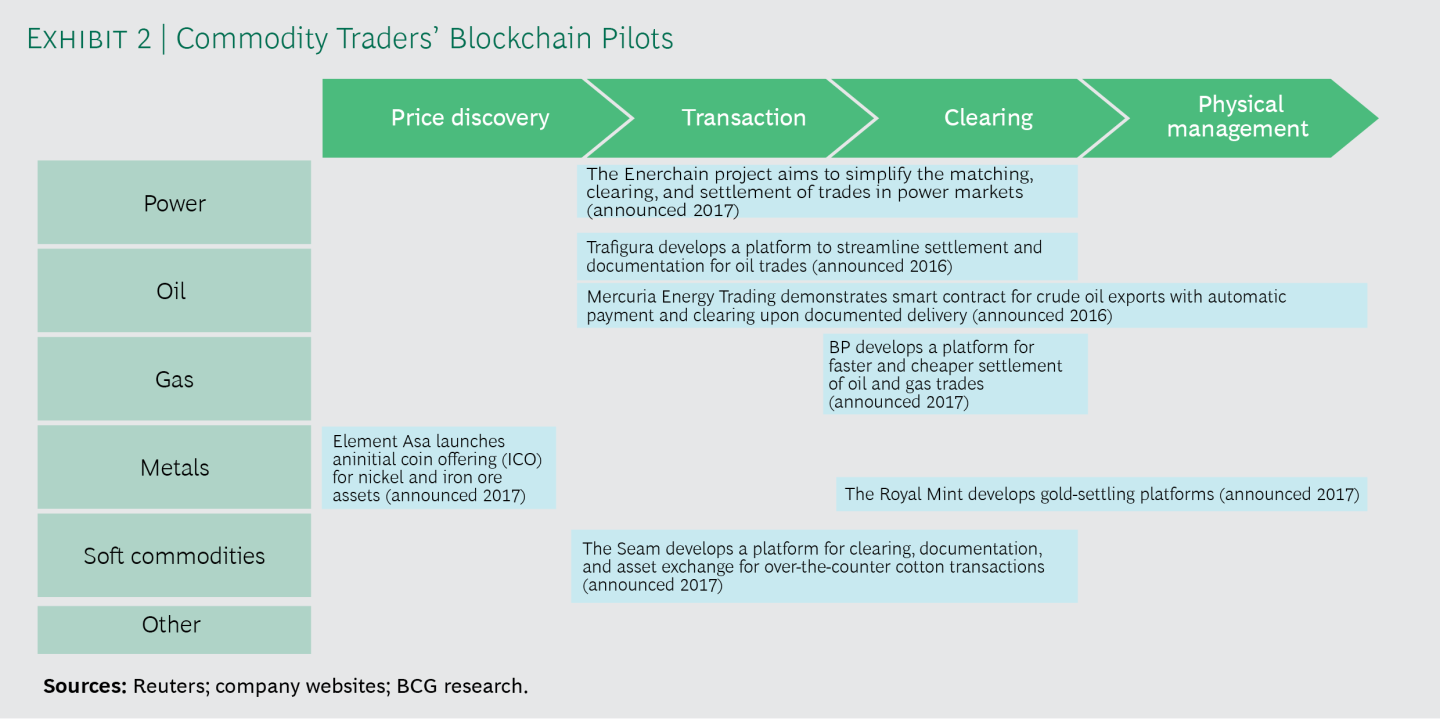

Pilot Block Chain Implementations Cutting post-trade processing costs is another potential use of blockchain in commodity trading, with savings of up to 40% across operations, accounting, settlements and IT, according to blockchain developers. Big energy traders are backing blockchain post-trade projects, like Vakt for oil and OneOffice for gas. Wholesale peer-to-peer trading is another application being developed by big European gas and power companies in the Enerchain project. The partners hope to enable large-scale trading, making the project unique in its focus, size, and disruptive potential.

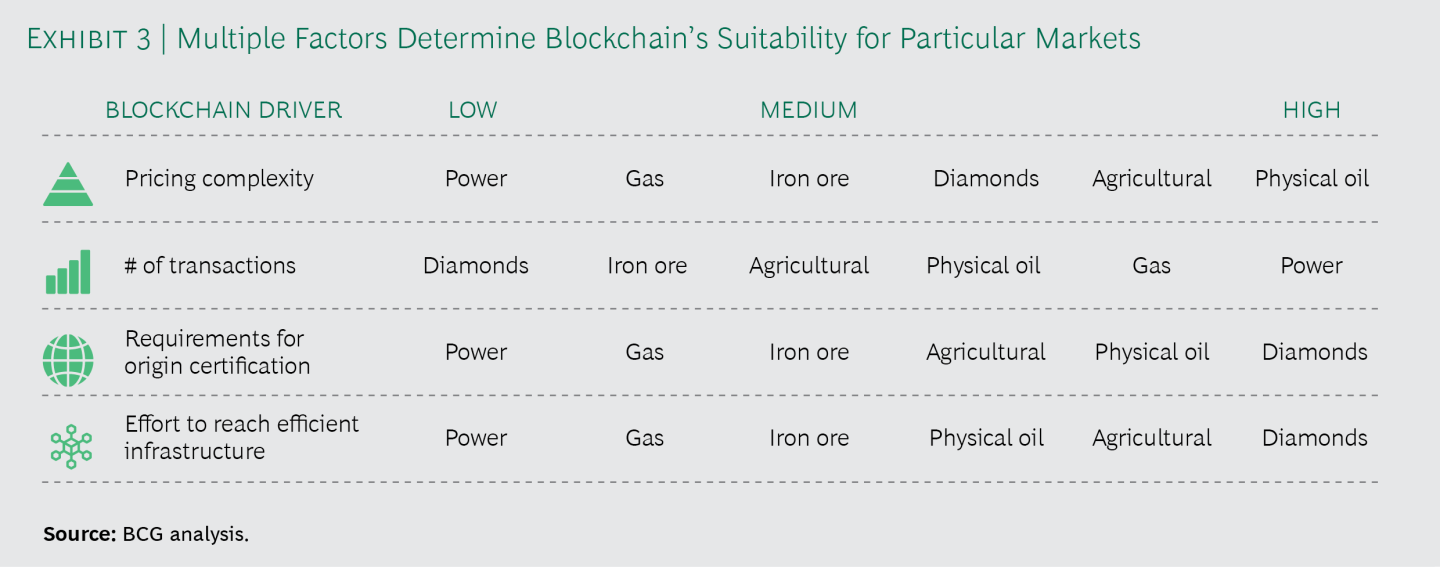

Reality Check BCG examined blockchain’s ability to transform commodity trading in each of the main markets using pricing complexity, particularly how much diversity currently exists in pricing mechanisms and transaction volumes. A more efficient and liquid market, moving commodity trading away from bilateral deals struck directly between two parties to transactions based on electronic platforms that match buyers and sellers may not be far on the horizon.

BCG's concluding recommendationBCG cautions on the complexities and cost of creating new platforms, and recommends collaborative development with partners and regulators to ensure that participants have a clear understanding of the value blockchain can add as well as potential use cases adopting a regional approach, rather than create global solutions.

Pricing and Arbitrage According to BCG, Block Chain’s ability to transparently record complicated transactions, track goods, and reduce fraud superficialy make it a natural fit for the commodity business as most trades would have to be recorded accurately in a shared ledger and participants could compare the price of their consignment against other consignments and thereby spot discrepancies. Greater transparency would lead to fairer prices. However, it would impact the profits of traders that rely on pricing inefficiencies to make money. Price-reporting agencies such as Bloomberg and Platts would also need to find new ways to expand their businesses observes BCG.

Pilot Block Chain Implementations Cutting post-trade processing costs is another potential use of blockchain in commodity trading, with savings of up to 40% across operations, accounting, settlements and IT, according to blockchain developers. Big energy traders are backing blockchain post-trade projects, like Vakt for oil and OneOffice for gas. Wholesale peer-to-peer trading is another application being developed by big European gas and power companies in the Enerchain project. The partners hope to enable large-scale trading, making the project unique in its focus, size, and disruptive potential.

Reality Check BCG examined blockchain’s ability to transform commodity trading in each of the main markets using pricing complexity, particularly how much diversity currently exists in pricing mechanisms and transaction volumes. A more efficient and liquid market, moving commodity trading away from bilateral deals struck directly between two parties to transactions based on electronic platforms that match buyers and sellers may not be far on the horizon.

BCG's concluding recommendationBCG cautions on the complexities and cost of creating new platforms, and recommends collaborative development with partners and regulators to ensure that participants have a clear understanding of the value blockchain can add as well as potential use cases adopting a regional approach, rather than create global solutions.

Labels:

Block Chain,

Boston Consulting Group,

Commodities,

Trading

Thursday, 30 December 2021

Role of Relation Management Informatics in Physical Commodities arbitrage opportunities

The key to success in physical commodities trading is knowing well what you are selling (Commodity), the price (Price Information) and who you are selling to (Relationship Management).

In the age of easy access to futures price information through Bloomberg, Platts and others, producers and consumers have a much better idea of what is "fair price", so traders have to generally pay a higher spot price and sell for a lower spot price than they would have in the past when they took advantage of information mismatch and could make riskless spreads. With the volatility index in commodities being so high, the trader's main edge is a structural edge such as a long term contract to ship a commodity (assets) at a price lower than the spread.

Geographic Arbitrage Traders who have an exceptional knowledge of their counterparties products (Quality) and a healthy network of one on one personal (Relationship), know the different (Geographic) markets, have a deep knowledge of a (Niche) market they understand, have a view of the market (Time) and execute reliably on the physical side (Logistics) would gain this structural edge and protect their market and profit from higher margin without the need to take position (Speculation). Executing offtake agreements on time and minimizing the operational error could be the difference between a profitable and a losing trade.

In the commodity business there is virtually no difference between traders. The traders who focus on helping clients identify issues they don’t even know they have yet and solves their problems are seen as a valuable addition to the client company and not just another trader - the person clients call when issues relating to the trader's expertise unfold. Traders need to build this level of trust, confidence and likability in order to differentiate themselves from the competition.

This level of Relation Management calls for Informatics that deeply embeds the Geographic Arbitrage Trader in understanding the client's industry cycles, pain points, opportunities, and the shifting landscape to ask questions, listen and understand to help offer a better solution. Informatics facilitates the structural edge for a trader to make a move before other market participants see the price opportunity, to move cost efficiently a commodity from one point in the world to another with a deep understanding of opportunity cost, freight market, storage and light processing.

In the age of easy access to futures price information through Bloomberg, Platts and others, producers and consumers have a much better idea of what is "fair price", so traders have to generally pay a higher spot price and sell for a lower spot price than they would have in the past when they took advantage of information mismatch and could make riskless spreads. With the volatility index in commodities being so high, the trader's main edge is a structural edge such as a long term contract to ship a commodity (assets) at a price lower than the spread.

Geographic Arbitrage Traders who have an exceptional knowledge of their counterparties products (Quality) and a healthy network of one on one personal (Relationship), know the different (Geographic) markets, have a deep knowledge of a (Niche) market they understand, have a view of the market (Time) and execute reliably on the physical side (Logistics) would gain this structural edge and protect their market and profit from higher margin without the need to take position (Speculation). Executing offtake agreements on time and minimizing the operational error could be the difference between a profitable and a losing trade.

In the commodity business there is virtually no difference between traders. The traders who focus on helping clients identify issues they don’t even know they have yet and solves their problems are seen as a valuable addition to the client company and not just another trader - the person clients call when issues relating to the trader's expertise unfold. Traders need to build this level of trust, confidence and likability in order to differentiate themselves from the competition.

This level of Relation Management calls for Informatics that deeply embeds the Geographic Arbitrage Trader in understanding the client's industry cycles, pain points, opportunities, and the shifting landscape to ask questions, listen and understand to help offer a better solution. Informatics facilitates the structural edge for a trader to make a move before other market participants see the price opportunity, to move cost efficiently a commodity from one point in the world to another with a deep understanding of opportunity cost, freight market, storage and light processing.

Labels:

Commodities,

Informatics,

Price,

Relationship Management

Wednesday, 29 December 2021

Commodities Lectures Series - Understanding the difference between Sourcing, Origination and Merchandising in commodities trading

Sourcing, Origination and Merchandising have to do with deal flow in a Physical Commodities Trading House.

Sourcing has to do with buying commodities already loaded onto a vessel in a port (Free on Board or FOB). FOB markets are very competitive and timing the purchase is a matter of sheer diligence, network of contacts and often good luck on the part of the Sourcer. Sourcing is very often not a client facing activity but does need extensive networking with carriers and with commodity traders in other geographies. A Sourcer will seek arbitrage opportunities based on their geographic location and the supply/demand in that area (location arbitrage) or time delay between when a particular commodity is bought and the time when it is delivered (time arbitrage) to trade FOB commodities with counterparties.

Origination on the other hand is a strictly client facing activity involving vast knowledge of the trading house's client's markets expanding the trading desk's reach. An Originator engages clients of the trading house and to propose or provide strategic solutions for their particular commodity commercial need through the products and services his trading house provides. Solutions can take the form of mediating a forward delivery of crude to complex, multi year engagement of developing, producing, marketing and selling of an energy producing asset (e.g. natural gas field). Origination often involves purchasing commodities directly from industrial farms, oil drillers or mines, coordinating with other functions of the trading house (trading, structuring, operations, quants, credit, legal, compliance, IT among others) to handle everthing from the logistics to get that commodity from the farm, oil well or mine to a port and shipping it to a client's warehouse, foundry or refinery.

Merchandising is essentially the process of purchasing, transporting and wholesale distributing commodities to end customers over deferred time periods or demand markets. A Merchandiser is often the counterparty from a client's side to an Originator from a trading house. Merchandisers work with Sourcers ad Originators from a trading house in locating, purchasing and customer account management as it relates to a particular commodity. Sourcers and Originators are the supply side of trade, essentially bringing commodities to market where as Merchandising often has to do with demand fulfillment. The full trade cycle can be thought of as Sourcing, Origination and Merchandising.

Origination on the other hand is a strictly client facing activity involving vast knowledge of the trading house's client's markets expanding the trading desk's reach. An Originator engages clients of the trading house and to propose or provide strategic solutions for their particular commodity commercial need through the products and services his trading house provides. Solutions can take the form of mediating a forward delivery of crude to complex, multi year engagement of developing, producing, marketing and selling of an energy producing asset (e.g. natural gas field). Origination often involves purchasing commodities directly from industrial farms, oil drillers or mines, coordinating with other functions of the trading house (trading, structuring, operations, quants, credit, legal, compliance, IT among others) to handle everthing from the logistics to get that commodity from the farm, oil well or mine to a port and shipping it to a client's warehouse, foundry or refinery.

Merchandising is essentially the process of purchasing, transporting and wholesale distributing commodities to end customers over deferred time periods or demand markets. A Merchandiser is often the counterparty from a client's side to an Originator from a trading house. Merchandisers work with Sourcers ad Originators from a trading house in locating, purchasing and customer account management as it relates to a particular commodity. Sourcers and Originators are the supply side of trade, essentially bringing commodities to market where as Merchandising often has to do with demand fulfillment. The full trade cycle can be thought of as Sourcing, Origination and Merchandising.

Labels:

Commodities,

Merchandising,

Origination,

Sourcing,

Trading

Revisiting an old Commodities classic - "Hot Commodities" by Jim Rogers

Over the holidays I re-read Jim Rogers' classic "Hot Commodities" written back in 2004. In this book, Jim had colorfully introduced the world of commodity investing as one of the simplest bases by which investors can value companies, markets, and whole economies. In particular, I re-read his predictions written in 2004 on his recommended hot commodities - oil, gold, lead, sugar and coffee - and on the ffect of China on these commodities. At the close of 2021, I have to take my hat off to Jim for being spot on and nailing every single call. Jim's book is available on amazon.

Labels:

China,

Commodities,

Emerging Markets

Subscribe to:

Comments (Atom)