In July 2022, the European Central Bank published a blog on the "key objectives of the digital euro". The blog co-authored by none other than Christine Lagarde, President of the ECB argued that a digital payment ecosystem such as the digital Euro without a strong monetary anchor would create confusion leading to financial instability as "it is crucial that we all still have easy access to central bank money, which is the foundation of our currency".

In January 2022, the Federal Reserve came out with a highly anticipated paper on a digital dollar, taking a step in a process that could lead to Congressional action. This was followed in March 2022 by an Executive Order from the Biden administration placing the “highest urgency” on exploring a US CBDC and asks for an interagency report on all aspects of the future of money in the next 180 days. The Executive Order also advances US participation in cross-border experimentation of wholesale CBDCs.

The ECB is analyzing how financial intermediaries could provide front-end services that build on a digital euro. The analysis expected to completed by October 2023 followed by the development of integrated services as well as carry out testing and possible live experimentation of a digital euro in a phase that could take around three years. Extrapolating this timeline guidance from the ECB, it would be safe to assume that a digital Euro will not be available before 2028 at the very earliest. The ECB is likely to drive large scale adoption of the digital euro once adopted and likely to increase the proposed amount of digital euros in circulation to 1.5 trillion euros to control the negative effects on financial stability.

The Fed also sees commercial banks and nonbank financial companies acting as intermediaries. Banks would issue and manage the digital wallets that people would use for payments and deposits. The US is the furthest behind when it comes to developing CBDCs among the G7 economies, according to the Atlantic Council.

Central bank digital currencies like the digital dollar and the digital euro are expected to be used for payment settlement. CBDCs pose tough competition to cryptocurrencies used for cross-border payment settlements such as Ripple (XRP) and to a limited extent Bitcoin (BTC). The underlying technology for both the digital dollar and the digital euro is based on concepts in cryptography and distributed or decentralized solutions such as DLT.

A blog focused on educating global physical energy commodities participants on evolving financial, regulatory and marketing developments in the Asian commodities markets including use of cryptocurrencies in physical commodities trading. This blog seeks to educate market participants only and does not constitute financial advice.

Thursday 18 August 2022

Wednesday 17 August 2022

Commodities Lectures Series - Physical commodities trading vs. Exchange based commodities futures trading

Physical commodities trading is buying commodities from producers, transforming the purchased commodities to maximize their value and selling it to consumers getting maximum margin out of these structured trades. How the trade settles and how the quality of a commodity is assessed relies on the physical commodity itself as they are extraordinarily diverse in terms of location (of both producers and consumers) and physical characteristics. For instance, energy, including crude oil is traded with constant demand and refineries are optimized to process particular types of crude oil - light, heavy, sweet sour, and different refineries are optimized differently for derivative products such as Diesel, Petrochemicals. Purchase of energy commodities is a complex process which involves negotiations of contract floating of tenders, shipping arrangements, unloading at ports, transporting to refineries, refinery complexity and most importantly the discounts offered by the sellers. Given the complexity of the possible transformations, and the ever-changing conditions that affect the efficient set of transformations, physical commodities trading is an inherently dynamic, complex, and highly information-intensive task involving information gathering, analysis and the operational capabilities necessary to respond efficiently to this information.

Physical commodities trading requires matching numerous diverse producers and consumers with heterogeneous and highly idiosyncratic preferences directing resources to their highest value uses in response to price signals requiring strong relationships with market players (buyers and sellers of commodities). Physical commodities markets are mostly cyclic, have a seasonal trend and a convenience yield (the consumer wants it now and is willing to pay a higher price for it). Physical commodities traders search producer side and consumer side of the market to find sellers and buyers (bilateral “search” markets), and match them by buying from the former and selling to the latter in bilateral transactions in between adding value by transforming the commodities. Commodities producers are usually not end users and commodities need to be transported from source to destinations creating bottlenecks and an opportunity to make significant margins for traders. Physical traders can also profit through shipping, warehousing, and trade finance of the commodities. Physical commodities trading is also known as the “spot” or “cash” market.

Physical commodities trading is a human-driven business - Humans and relationships are predominant from the very beginning until the end of the trade. Humans will extract coal and assess the quality of it. Humans will test the quality of coal at loading port and discharging port. Human will negotiate premiums and discounts. Human will react against market movements and sometimes refuse to deliver or receive the commodity if prices go against market direction based on market intelligence.

Electronic Exchanges trading commodities futures are not suited to this matching process. They may be an efficient way to transact highly standardized instruments such as plain-vanilla front month contracts in large quantity, but are not well-adapted to predict the downward or upward price movement on commodities such as natural gas resulting from a pipeline explosion or the reaction of oil prices to a news events about an outbreak of war or comments from a Saudi oil minister. Little physical commodities actually change hands with futures trades, which take place on two main exchanges in the US, CME Group and the Intercontinental Exchange. In some commodities such as oil, futures trading has come to dwarf the physical trade, with as much as 13 times the physical amount of oil traded via these purely financial contracts which determines the price of oil. According to data provided by the CME Group, the amount of crude oil futures contracts traded daily on its platform rose in 2022 over 2021 and is nearly double that of a decade ago. For example, Total Energies, the French Oil supermajor may trade 7 million barrels of physical oil a day, but on the same day will electronically trade the equivalent of 31 million barrels of oil futures and options on an electronic exchange.

Physical commodities trading requires matching numerous diverse producers and consumers with heterogeneous and highly idiosyncratic preferences directing resources to their highest value uses in response to price signals requiring strong relationships with market players (buyers and sellers of commodities). Physical commodities markets are mostly cyclic, have a seasonal trend and a convenience yield (the consumer wants it now and is willing to pay a higher price for it). Physical commodities traders search producer side and consumer side of the market to find sellers and buyers (bilateral “search” markets), and match them by buying from the former and selling to the latter in bilateral transactions in between adding value by transforming the commodities. Commodities producers are usually not end users and commodities need to be transported from source to destinations creating bottlenecks and an opportunity to make significant margins for traders. Physical traders can also profit through shipping, warehousing, and trade finance of the commodities. Physical commodities trading is also known as the “spot” or “cash” market.

Physical commodities trading is a human-driven business - Humans and relationships are predominant from the very beginning until the end of the trade. Humans will extract coal and assess the quality of it. Humans will test the quality of coal at loading port and discharging port. Human will negotiate premiums and discounts. Human will react against market movements and sometimes refuse to deliver or receive the commodity if prices go against market direction based on market intelligence.

Electronic Exchanges trading commodities futures are not suited to this matching process. They may be an efficient way to transact highly standardized instruments such as plain-vanilla front month contracts in large quantity, but are not well-adapted to predict the downward or upward price movement on commodities such as natural gas resulting from a pipeline explosion or the reaction of oil prices to a news events about an outbreak of war or comments from a Saudi oil minister. Little physical commodities actually change hands with futures trades, which take place on two main exchanges in the US, CME Group and the Intercontinental Exchange. In some commodities such as oil, futures trading has come to dwarf the physical trade, with as much as 13 times the physical amount of oil traded via these purely financial contracts which determines the price of oil. According to data provided by the CME Group, the amount of crude oil futures contracts traded daily on its platform rose in 2022 over 2021 and is nearly double that of a decade ago. For example, Total Energies, the French Oil supermajor may trade 7 million barrels of physical oil a day, but on the same day will electronically trade the equivalent of 31 million barrels of oil futures and options on an electronic exchange.

Labels:

Futures,

Oil,

Oil trading,

Physical commodities,

Trading

Location:

New Jersey, USA

Monday 15 August 2022

New paradigm shift in India’s energy trade - evidence in charts

An unprecedented paradigm shift is evolving in the energy commodities trade of India, the world’s third-largest oil consumer after the US and China, and second largest oil importer after China importing over 85 percent of its crude needs. Despite being the second largest coal producer in the world, India is also the world’s second largest coal importer as new power plants designed to use only high grade imported coal (17.6 GW or 8.6% of the 204.9 GW installed power generation capacity) while older power plants import the fuel for blending with domestic coal according to S&P Global. Indian Ministry of Commerce’s Export & Import Data Bank (EIDB) points to crude oil imports worth US$ 122.45 billion and around 173.32 million tons of coal imports worth US$ 30.6 billion in the year 2021-22.

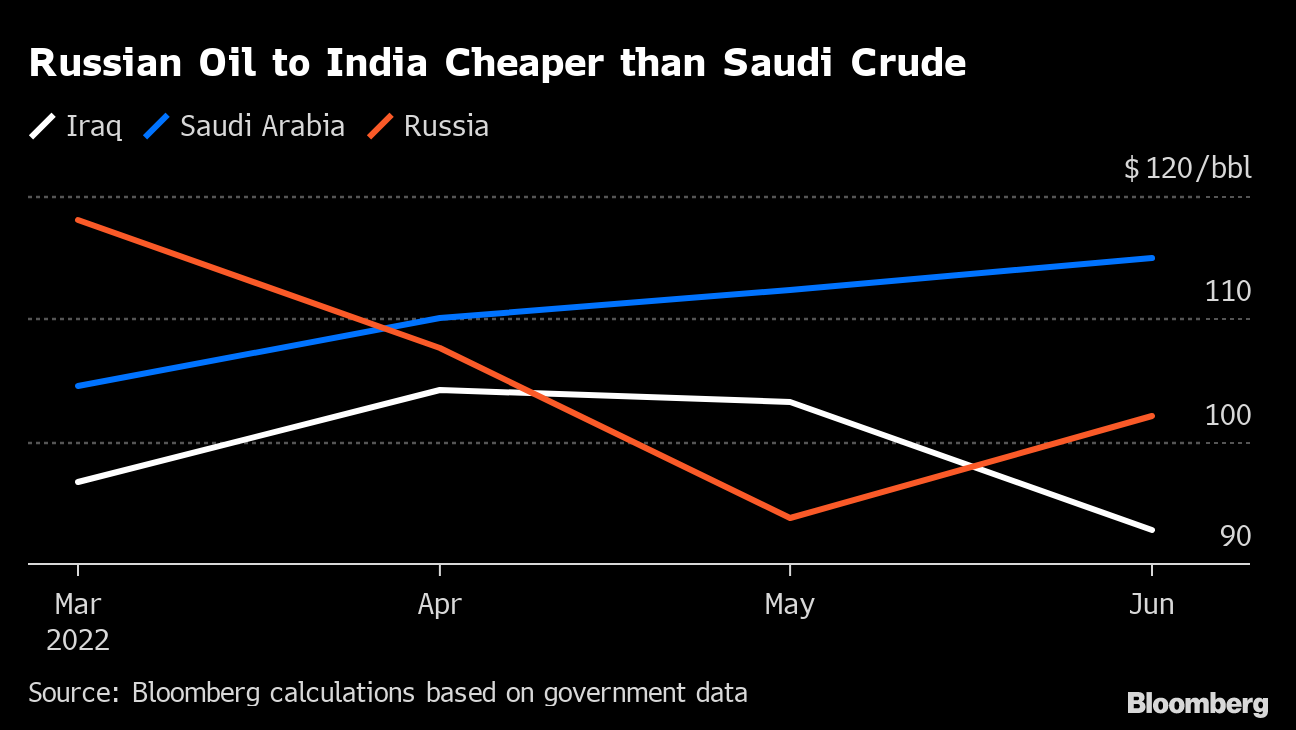

In a new paradigm shift, according to analysis by Bloomberg, Russia surpassed Saudi Arabia as the second-biggest supplier of crude to India in June 2022, ranked just behind Iraq.

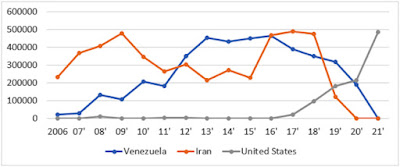

In comparison, India’s imports of U.S. oil and gas commodities which grew from $4.1 billion in 2018 to $5.5 billion in 2020 roughly halved by July 2021 and the US is no longer among India’s top oil suppliers according to the oil ministry’s Petroleum Planning & Analysis Cell.

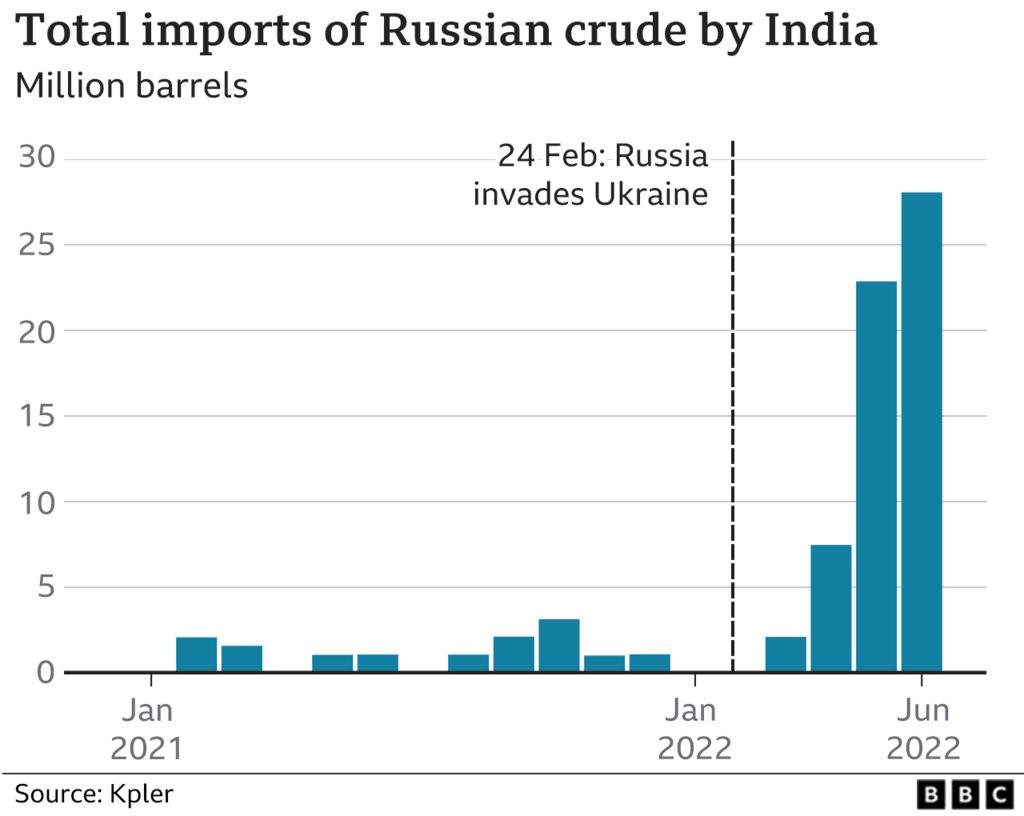

With economic growth expected to rise to 8% this year, Indian state refiners which dominate fuel retailing are in the market for the lowest priced crude that works with their refinery and product configurations via open tenders. The discount of Russian Urals crude to Brent crude was around $30 per barrel with bigger discounts to other medium-sour grades typically sold to India such as Oman and Upper Zakum reflecting the huge risk premium the market requires to transact on Russian cargoes according to Kpler. In 2021, only around 2% of India’s total oil imports (12 million barrels or 33,000 barrels a day on average of Urals crude) came from Russia, according to Kpler.

Urals oil contracts for India rose from nothing in January 2022 to 300,000 barrels a day in March to 700,000 a day in April totaling around 26 million barrels ending June 2022 according to Kpler. The India-bound Russian tankers head into Jamnagar, in the western state of Gujarat, where Reliance Industries has the world’s largest refinery complex, and into the Vadinar refinery of Nayara Energy an affiliate of Rosneft, the Russian state company which alone imports crude oil worth about $1bn every month or 400,000 barrels per day on average.

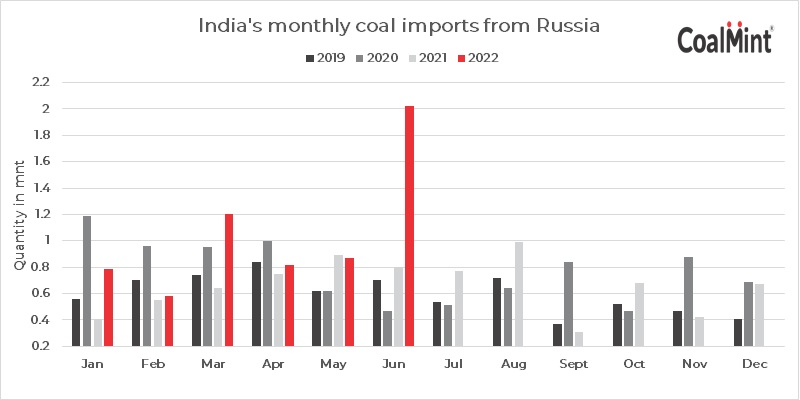

This paradigm shift in India’s energy trade is not limited to oil. Russia became India's third-largest coal supplier in July 2022 after Indonesia and Australia, with imports from Russia jumping 70.3% to a new record of 2.06 million mt, per Coalmint data. In comparison, thermal coal imports from the US fell 52% on the year to 3.4 million mt over the same time. Russian imports to India are expected to rise even higher due to a wider coal shortage during the third quarter of 2022 exacerbated by higher electricity demand. Steep discounts offered by Russian suppliers for thermal coal and Urals crude as global prices trade at near-record highs due to western sanctions are not the only reason for this paradigm shift. India is also exploring alternative payment channels for trade with Russia including allowing payments for energy commodities in the Indian rupee or settling the trade in other Asian currencies furthering this new paradigm.

This paradigm shift in India’s energy trade is not limited to oil. Russia became India's third-largest coal supplier in July 2022 after Indonesia and Australia, with imports from Russia jumping 70.3% to a new record of 2.06 million mt, per Coalmint data. In comparison, thermal coal imports from the US fell 52% on the year to 3.4 million mt over the same time. Russian imports to India are expected to rise even higher due to a wider coal shortage during the third quarter of 2022 exacerbated by higher electricity demand. Steep discounts offered by Russian suppliers for thermal coal and Urals crude as global prices trade at near-record highs due to western sanctions are not the only reason for this paradigm shift. India is also exploring alternative payment channels for trade with Russia including allowing payments for energy commodities in the Indian rupee or settling the trade in other Asian currencies furthering this new paradigm.

Labels:

Coal,

Energy,

India Oil Imports,

Indian rupee,

Physical commodities,

Russia,

Trading

Location:

New Jersey, USA

Sunday 7 August 2022

Two decoupled energy blocs with India and the Gulf in the middle

Australia’s Strategic Policy Institute opined on the emergence post Russia’s invasion of Ukraine, of two decoupled energy blocs with China and Russia on one side, and Europe, North America, and the Indo-Pacific democracies, on the other side. Prior to Russia’s invasion of Ukraine, in 2020 almost 30% of EU crude oil imports came from Russia and over 40% of natural gas imports came from Russia while more than half of solid fossil fuel (mostly coal) imports originated from Russia (54 %). European nations are now seeking new sources of gas, oil and diesel fuel from the Americas, Africa, the Middle East, and India, as well as an increased focus on local energy production to wean themselves off Russian energy sources.

With Russian oil banned in the United States and Europe, India finds itself in the middle of the two decoupled energy blocs buying Russian crude at substantial discounts, powering its energy-thirsty economy at a lower cost, and refining into products like diesel and jet fuel to sell at better-than-usual margins abroad. Ironically, Europe is eager to buy the same Russian crude after it is refined in India into diesel shipping the fuel to Europe since March 2022, with increased trade flows expected over the coming months. China buys 50% of its oil supplies from the Gulf.

The Strait of Hormuz is the most important chokepoint between the two decoupled energy blocs accounting for about a third of the world’s sea-borne oil (and a fifth of the world’s total oil exports), linking oil and gas Upstream producers in the Middle East with Downstream consumers in Europe, North America, China and Indo-Pacific.

In 2016, according to America’s Energy Information Administration, the waterway carried some 19m barrels of crude and other petroleum products a day. This volume will accelerate through 2030 because of new mega refineries in the Gulf China and India and growing demand in Europe and emerging markets. According to Bloomberg, State-run Qatar Energy’s six new gas-liquefaction plants are set to produce 8 million tons of LNG per year for export to Europe. Morgan Stanley forecasts global LNG consumption to rise by 60% through 2030.

With Russian oil banned in the United States and Europe, India finds itself in the middle of the two decoupled energy blocs buying Russian crude at substantial discounts, powering its energy-thirsty economy at a lower cost, and refining into products like diesel and jet fuel to sell at better-than-usual margins abroad. Ironically, Europe is eager to buy the same Russian crude after it is refined in India into diesel shipping the fuel to Europe since March 2022, with increased trade flows expected over the coming months. China buys 50% of its oil supplies from the Gulf.

The Strait of Hormuz is the most important chokepoint between the two decoupled energy blocs accounting for about a third of the world’s sea-borne oil (and a fifth of the world’s total oil exports), linking oil and gas Upstream producers in the Middle East with Downstream consumers in Europe, North America, China and Indo-Pacific.

In 2016, according to America’s Energy Information Administration, the waterway carried some 19m barrels of crude and other petroleum products a day. This volume will accelerate through 2030 because of new mega refineries in the Gulf China and India and growing demand in Europe and emerging markets. According to Bloomberg, State-run Qatar Energy’s six new gas-liquefaction plants are set to produce 8 million tons of LNG per year for export to Europe. Morgan Stanley forecasts global LNG consumption to rise by 60% through 2030.

Labels:

Downstream,

EU,

European Economy,

Gulf,

India,

Oil trading,

Russia,

Strait of Hormuz,

Upstream

Location:

New Jersey, USA

Subscribe to:

Posts (Atom)