Who would have ever thought that Coal, a much hated and maligned commodity would continue to be a strongly traded commodity in 2022? Indonesia, a leading exporter of thermal coal banned the shipments of coal on New Years Day 2022, causing a surge in coal prices. This follows on a record $158 per tonne in October, though it slipped $68 on Dec. 29 according to Refinitiv and Kpler.

A report published in December 2021 by China's State Grid Corporation outlined China's plans to build as much as 150 gigawatts (GW) of new coal-fired power capacity over the 2021-2025 period, bringing the total to 1,230 GW as the first 1,000-megawatt unit of the Coal powered Shanghaimiao plant, the biggest of its kind was completed. The plant will eventually have four generating units adding to more than half of global coal-fired power generation, a 9% year-on-year increase in 2021, according to a report from International Energy Agency published in December 2021, even as US coal powered plans continue to close.

China (US$16.4 billion - 17.3%), Japan - ($15.95 billion - 16.8%) and India ($15.87 billion - 16.7%) were the biggest importers of coal in 2020 compared to China ($19.6 billion - 12.9%), India - $24.6 billion (16.2%) and Japan (US$25.4 billion - 16.7% of total coal imports) in 2019 as reported by Caixin. These three Asian giants will continue to be major Coal commodities players for at least the next decade.

A blog focused on educating global physical energy commodities participants on evolving financial, regulatory and marketing developments in the Asian commodities markets including use of cryptocurrencies in physical commodities trading. This blog seeks to educate market participants only and does not constitute financial advice.

Monday, 3 January 2022

Friday, 31 December 2021

BCG's strategic view on the role of Block Chain in Physical Commodities trading

Back in 2018, the German electric utilities company e.ON's Thorsten Kuehnel observed that “The potential of blockchain technology lies in disintermediation. This creates true disruption; everything else is incremental innovation or optimization.” BCG, a global consulting firm, along the same lines issued a publication outlining their strategic view on the role of Block Chain in Physical Commodities trading:

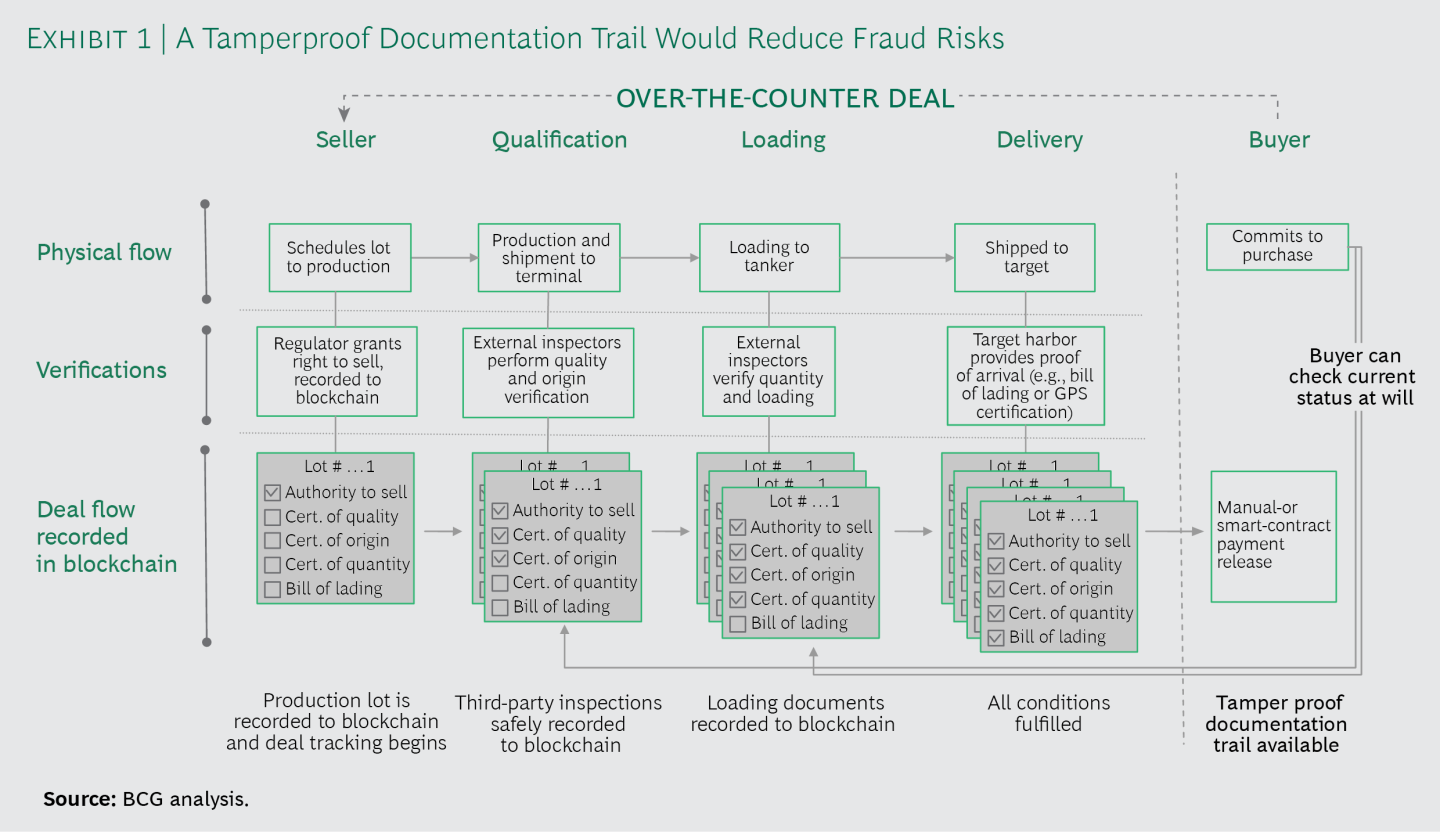

Pricing and Arbitrage According to BCG, Block Chain’s ability to transparently record complicated transactions, track goods, and reduce fraud superficialy make it a natural fit for the commodity business as most trades would have to be recorded accurately in a shared ledger and participants could compare the price of their consignment against other consignments and thereby spot discrepancies. Greater transparency would lead to fairer prices. However, it would impact the profits of traders that rely on pricing inefficiencies to make money. Price-reporting agencies such as Bloomberg and Platts would also need to find new ways to expand their businesses observes BCG.

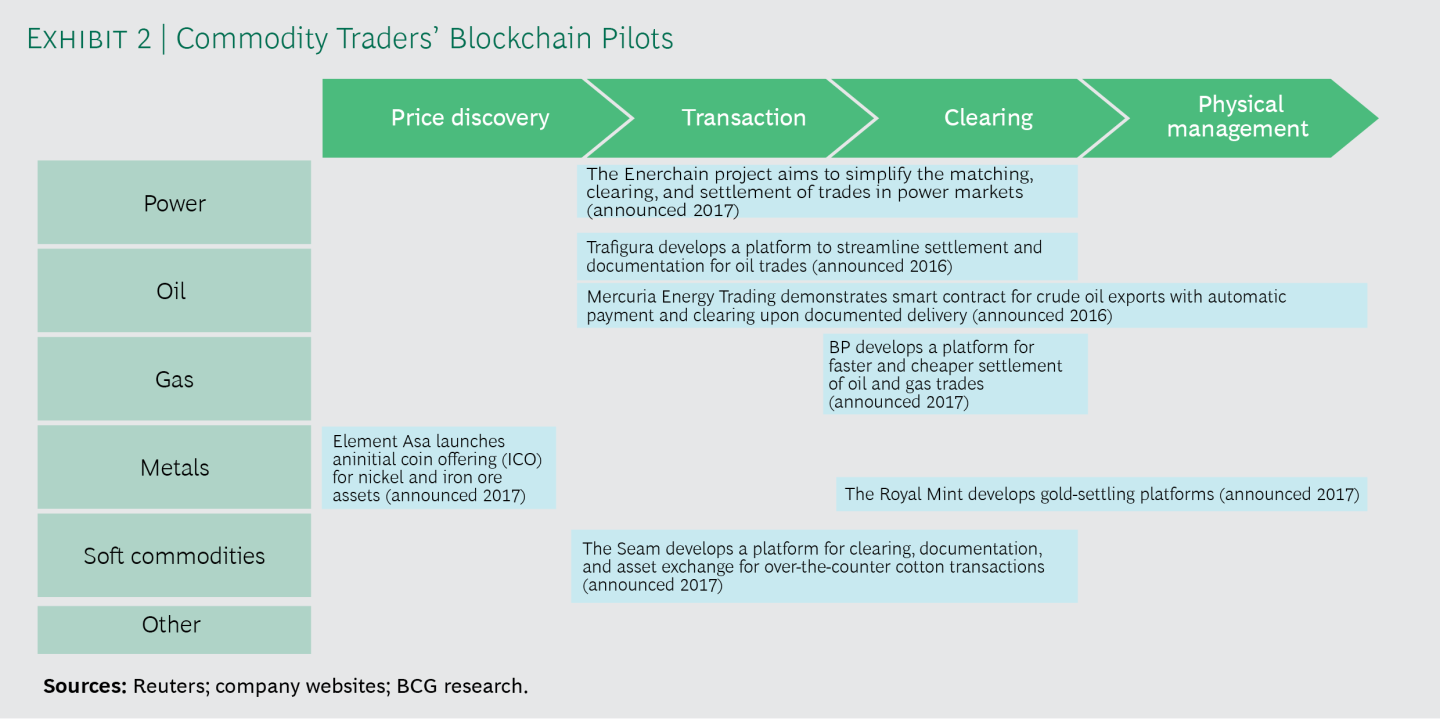

Pilot Block Chain Implementations Cutting post-trade processing costs is another potential use of blockchain in commodity trading, with savings of up to 40% across operations, accounting, settlements and IT, according to blockchain developers. Big energy traders are backing blockchain post-trade projects, like Vakt for oil and OneOffice for gas. Wholesale peer-to-peer trading is another application being developed by big European gas and power companies in the Enerchain project. The partners hope to enable large-scale trading, making the project unique in its focus, size, and disruptive potential.

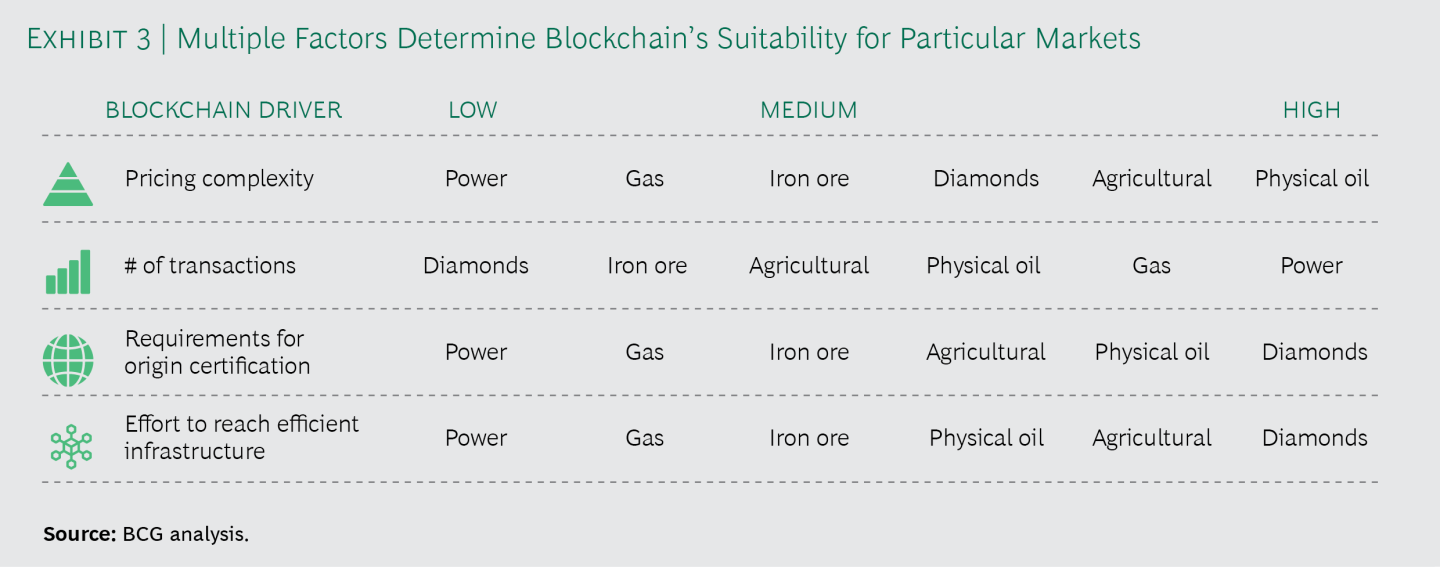

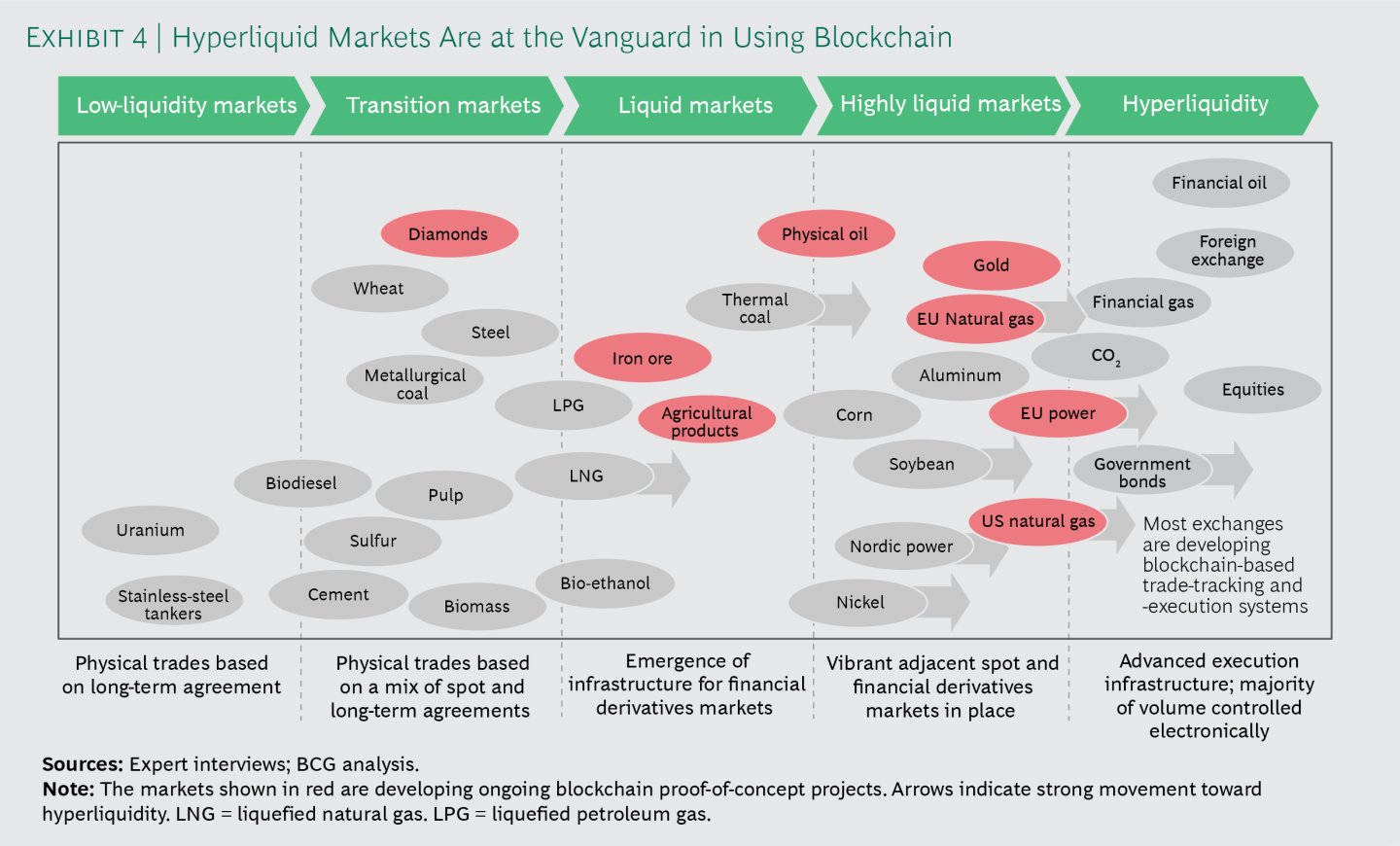

Reality Check BCG examined blockchain’s ability to transform commodity trading in each of the main markets using pricing complexity, particularly how much diversity currently exists in pricing mechanisms and transaction volumes. A more efficient and liquid market, moving commodity trading away from bilateral deals struck directly between two parties to transactions based on electronic platforms that match buyers and sellers may not be far on the horizon.

BCG's concluding recommendationBCG cautions on the complexities and cost of creating new platforms, and recommends collaborative development with partners and regulators to ensure that participants have a clear understanding of the value blockchain can add as well as potential use cases adopting a regional approach, rather than create global solutions.

Pricing and Arbitrage According to BCG, Block Chain’s ability to transparently record complicated transactions, track goods, and reduce fraud superficialy make it a natural fit for the commodity business as most trades would have to be recorded accurately in a shared ledger and participants could compare the price of their consignment against other consignments and thereby spot discrepancies. Greater transparency would lead to fairer prices. However, it would impact the profits of traders that rely on pricing inefficiencies to make money. Price-reporting agencies such as Bloomberg and Platts would also need to find new ways to expand their businesses observes BCG.

Pilot Block Chain Implementations Cutting post-trade processing costs is another potential use of blockchain in commodity trading, with savings of up to 40% across operations, accounting, settlements and IT, according to blockchain developers. Big energy traders are backing blockchain post-trade projects, like Vakt for oil and OneOffice for gas. Wholesale peer-to-peer trading is another application being developed by big European gas and power companies in the Enerchain project. The partners hope to enable large-scale trading, making the project unique in its focus, size, and disruptive potential.

Reality Check BCG examined blockchain’s ability to transform commodity trading in each of the main markets using pricing complexity, particularly how much diversity currently exists in pricing mechanisms and transaction volumes. A more efficient and liquid market, moving commodity trading away from bilateral deals struck directly between two parties to transactions based on electronic platforms that match buyers and sellers may not be far on the horizon.

BCG's concluding recommendationBCG cautions on the complexities and cost of creating new platforms, and recommends collaborative development with partners and regulators to ensure that participants have a clear understanding of the value blockchain can add as well as potential use cases adopting a regional approach, rather than create global solutions.

Labels:

Block Chain,

Boston Consulting Group,

Commodities,

Trading

Thursday, 30 December 2021

Role of Relation Management Informatics in Physical Commodities arbitrage opportunities

The key to success in physical commodities trading is knowing well what you are selling (Commodity), the price (Price Information) and who you are selling to (Relationship Management).

In the age of easy access to futures price information through Bloomberg, Platts and others, producers and consumers have a much better idea of what is "fair price", so traders have to generally pay a higher spot price and sell for a lower spot price than they would have in the past when they took advantage of information mismatch and could make riskless spreads. With the volatility index in commodities being so high, the trader's main edge is a structural edge such as a long term contract to ship a commodity (assets) at a price lower than the spread.

Geographic Arbitrage Traders who have an exceptional knowledge of their counterparties products (Quality) and a healthy network of one on one personal (Relationship), know the different (Geographic) markets, have a deep knowledge of a (Niche) market they understand, have a view of the market (Time) and execute reliably on the physical side (Logistics) would gain this structural edge and protect their market and profit from higher margin without the need to take position (Speculation). Executing offtake agreements on time and minimizing the operational error could be the difference between a profitable and a losing trade.

In the commodity business there is virtually no difference between traders. The traders who focus on helping clients identify issues they don’t even know they have yet and solves their problems are seen as a valuable addition to the client company and not just another trader - the person clients call when issues relating to the trader's expertise unfold. Traders need to build this level of trust, confidence and likability in order to differentiate themselves from the competition.

This level of Relation Management calls for Informatics that deeply embeds the Geographic Arbitrage Trader in understanding the client's industry cycles, pain points, opportunities, and the shifting landscape to ask questions, listen and understand to help offer a better solution. Informatics facilitates the structural edge for a trader to make a move before other market participants see the price opportunity, to move cost efficiently a commodity from one point in the world to another with a deep understanding of opportunity cost, freight market, storage and light processing.

In the age of easy access to futures price information through Bloomberg, Platts and others, producers and consumers have a much better idea of what is "fair price", so traders have to generally pay a higher spot price and sell for a lower spot price than they would have in the past when they took advantage of information mismatch and could make riskless spreads. With the volatility index in commodities being so high, the trader's main edge is a structural edge such as a long term contract to ship a commodity (assets) at a price lower than the spread.

Geographic Arbitrage Traders who have an exceptional knowledge of their counterparties products (Quality) and a healthy network of one on one personal (Relationship), know the different (Geographic) markets, have a deep knowledge of a (Niche) market they understand, have a view of the market (Time) and execute reliably on the physical side (Logistics) would gain this structural edge and protect their market and profit from higher margin without the need to take position (Speculation). Executing offtake agreements on time and minimizing the operational error could be the difference between a profitable and a losing trade.

In the commodity business there is virtually no difference between traders. The traders who focus on helping clients identify issues they don’t even know they have yet and solves their problems are seen as a valuable addition to the client company and not just another trader - the person clients call when issues relating to the trader's expertise unfold. Traders need to build this level of trust, confidence and likability in order to differentiate themselves from the competition.

This level of Relation Management calls for Informatics that deeply embeds the Geographic Arbitrage Trader in understanding the client's industry cycles, pain points, opportunities, and the shifting landscape to ask questions, listen and understand to help offer a better solution. Informatics facilitates the structural edge for a trader to make a move before other market participants see the price opportunity, to move cost efficiently a commodity from one point in the world to another with a deep understanding of opportunity cost, freight market, storage and light processing.

Labels:

Commodities,

Informatics,

Price,

Relationship Management

Wednesday, 29 December 2021

Commodities Lectures Series - Understanding the difference between Sourcing, Origination and Merchandising in commodities trading

Sourcing, Origination and Merchandising have to do with deal flow in a Physical Commodities Trading House.

Sourcing has to do with buying commodities already loaded onto a vessel in a port (Free on Board or FOB). FOB markets are very competitive and timing the purchase is a matter of sheer diligence, network of contacts and often good luck on the part of the Sourcer. Sourcing is very often not a client facing activity but does need extensive networking with carriers and with commodity traders in other geographies. A Sourcer will seek arbitrage opportunities based on their geographic location and the supply/demand in that area (location arbitrage) or time delay between when a particular commodity is bought and the time when it is delivered (time arbitrage) to trade FOB commodities with counterparties.

Origination on the other hand is a strictly client facing activity involving vast knowledge of the trading house's client's markets expanding the trading desk's reach. An Originator engages clients of the trading house and to propose or provide strategic solutions for their particular commodity commercial need through the products and services his trading house provides. Solutions can take the form of mediating a forward delivery of crude to complex, multi year engagement of developing, producing, marketing and selling of an energy producing asset (e.g. natural gas field). Origination often involves purchasing commodities directly from industrial farms, oil drillers or mines, coordinating with other functions of the trading house (trading, structuring, operations, quants, credit, legal, compliance, IT among others) to handle everthing from the logistics to get that commodity from the farm, oil well or mine to a port and shipping it to a client's warehouse, foundry or refinery.

Merchandising is essentially the process of purchasing, transporting and wholesale distributing commodities to end customers over deferred time periods or demand markets. A Merchandiser is often the counterparty from a client's side to an Originator from a trading house. Merchandisers work with Sourcers ad Originators from a trading house in locating, purchasing and customer account management as it relates to a particular commodity. Sourcers and Originators are the supply side of trade, essentially bringing commodities to market where as Merchandising often has to do with demand fulfillment. The full trade cycle can be thought of as Sourcing, Origination and Merchandising.

Origination on the other hand is a strictly client facing activity involving vast knowledge of the trading house's client's markets expanding the trading desk's reach. An Originator engages clients of the trading house and to propose or provide strategic solutions for their particular commodity commercial need through the products and services his trading house provides. Solutions can take the form of mediating a forward delivery of crude to complex, multi year engagement of developing, producing, marketing and selling of an energy producing asset (e.g. natural gas field). Origination often involves purchasing commodities directly from industrial farms, oil drillers or mines, coordinating with other functions of the trading house (trading, structuring, operations, quants, credit, legal, compliance, IT among others) to handle everthing from the logistics to get that commodity from the farm, oil well or mine to a port and shipping it to a client's warehouse, foundry or refinery.

Merchandising is essentially the process of purchasing, transporting and wholesale distributing commodities to end customers over deferred time periods or demand markets. A Merchandiser is often the counterparty from a client's side to an Originator from a trading house. Merchandisers work with Sourcers ad Originators from a trading house in locating, purchasing and customer account management as it relates to a particular commodity. Sourcers and Originators are the supply side of trade, essentially bringing commodities to market where as Merchandising often has to do with demand fulfillment. The full trade cycle can be thought of as Sourcing, Origination and Merchandising.

Labels:

Commodities,

Merchandising,

Origination,

Sourcing,

Trading

Subscribe to:

Comments (Atom)